Becoming a parent is similar to entering an entirely new lifestyle and is even considered among the most life-changing events that many people experience. Your responsibilities suddenly double up. Therefore, when embarking on this new adventure, preparation is key and financial preparation starts with wise investments in plans like Unit-linked insurance plans and other saving instruments. As parents we want to provide the best for our children but the rising costs are making it increasingly difficult to keep up with the financial requirements of raising and educating children. These days, more and more parents are realizing the need for advanced financial planning to provide the best for their children. Apart from education and regular lifestyle expenses, marriage is another major financial goal in India among new-parents. When seen as a whole, this comes in as a significant amount that most people are not financially ready to bear. Fortunately, you can increase your financial readiness by investing and saving towards this goal.

Saving for Your Child’s Secure Future

For parents, saving for their child’s future is one of the most important financial goals, which is why it should be planned and carried out with utmost care and thorough research. These aren’t ad-hoc expenses and should not be tackled in that manner. The several options available often leave parents in a fix as to how they should invest in favour of their children’s bright future. It is never too early to start investing in your child’s future as you never know what plans your child has for himself once he / she grows up. While most people are aware of the fact that they would require a considerably large corpus for funding their education, several of them find it difficult to approximate the costs they would have to incur. For instance, if you expect your child to take up specialization overseas, you will have to take that cost into consideration. Besides, you will also have to consider the rate of education inflation (which is around 5%) in the US and the foreign exchange rate movement in the US dollar and Indian rupee. While it might not be possible for you to save exactly the amount required, every little bit proves helpful when the time comes.

ULIPs are popular for their dual benefits of investments and life cover. They are long term investment plans that help your money grow and you build a corpus by the time your policy reaches maturity. This is one important reason why ULIP-based child plans are one of the most sought after investment products in the market. The biggest advantage of Unit-linked child insurance plans is that they offer the waiver of premium benefit wherein the future premiums are funded by the insurance company in case of sudden death of the parent of the child.

You can start by investing within 60 to 90 days of your child’s birth so that you can accumulate a significant sum that may not be possible for you to arrange in later stages of life. It is a great idea to start with investing in Unit Linked Child Plans that allow you to expand your savings horizons by switching between high-risk and medium risk funds and gradually moving towards low-risk funds to have safer funds ready before the maturity term. Under unit-linked insurance plans for children, the dependents can receive a lump sum amount on death of the parent along with regular monthly installments to meet their everyday expenses.

Investing in Mutual Funds

Saving for your child's education means you most probably have time until your child turns 18. So, considering your investment objective, your mutual fund can have one of the three features - a long time horizon, a high rate target and no need for immediate cash flows. There's a wide variety of mutual funds and your pick should be based on how much corpus you will need, your appetite for risk, and your need for returns, in addition to your term.

You may choose between debt funds, equity funds and balanced funds. While debt funds invest in fixed-income products like bonds, corporate securities and government treasuries, equity funds invest in stocks, so the expected returns are higher but with more risk. Debt funds are safer but yield better returns at a slower rate, compared to equity. The third kind, balanced funds divide your money between debt and equities. The fund manager aims to maximize your returns, while minimizing the risks involved.

What should you choose?

Unit-linked insurance plans and mutual funds have different tax implications and evaluating the tax implications of your investments before making a decision is important. You can opt to invest a lump sum or a fixed amount through a Systematic Investment Plan. As a parent who is responsible for your child’s secure future, it is vital that you adopt a well-planned investment strategy by choosing between short, medium, and long-term funds as and when required.

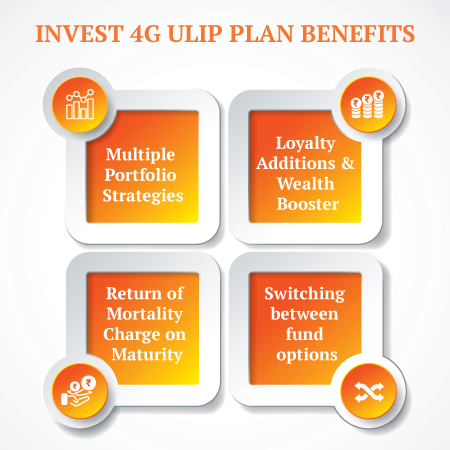

The Invest 4G Unit Linked plan by Canara HSBC Life Insurance is a prominent plan that parents may choose to invest in for a fruitful return. Besides, the Smart Junior plan also provides guaranteed payouts during the last 5 years of policy which can be aligned to child's educational milestones. Both of these plans are ideal for parents who wish to make a provision for academic expenses of their children in advance.

ULIP Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling ULIP insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Don't Just Survive, Thrive

- 3 Plan Options

- Life cover + Guaranteed benefits

- Total Premiums at maturity

- Early income from 2nd policy year

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs