Sabse Pehle Life Insurance Campaign : What You Should Know

Life is unpredictable and while there is no crystal ball in which we could see what the future holds for us, we can at least make rational choices to make our future safe and secure. Remember, one needs to be prepared for the worst as problems usually come unannounced. Thus, to reduce sudden financial burden on your family, it makes sense to buy a life insurance policy. Life insurance is a powerful safety cover that helps your family meet their financial goals even when you are not around. In fact, it is one of the most preferred investment options to achieve one's life goals.

However, there's lack of awareness about life insurance products in the Indian market today. This is mainly because people are not fully aware of the utility of these policy products. Thus, in order to drive awareness among individuals, Life Insurance Council has decided to launch 'Sabse Pehle life insurance' campaign to turn things around for the better.

What is sabse pehle life insurance campaign?

In order to create awareness, Life Insurance Council of India has now come up with this new and innovative campaign at mass level to make Indian population understand the importance of life insurance. The goal of this campaign is to make Indians more aware of the benefits of having a life insurance coverage. To support this initiative, all the 24 insurance companies have joined in hands to raise awareness about the significance of life insurance.

The campaign shows how we could take necessary precautions to safeguard ourselves in our day-to-day routine. Similarly, we should take a life insurance cover to protect our future financial needs. Their aim is to reach maximum population with this provocative campaign and encourage people to buy an adequate life insurance product.

Moreover, to successfully spread the word across the country, this campaign is going to use both traditional and digital platforms. In addition to this, this campaign is all set to be featured in other major Indian languages such as Bengali, Malayalam, Kannada, Telugu, Tamil, etc. which will help in reaching out to people at a broader level.

What is the need to consider life insurance first?

To secure your family's financial future, it is important to buy a life insurance policy. That's why 'sabse pehle life insurance' campaign needs everyone's attention. The sole purpose of this campaign is to develop the need of financial planning at a sub-conscious level. Besides, here's why you need to consider life insurance first -

- Protection against uncertainties and worries - Life insurance also offers complete protection against the risks and worries that are associated with the financial needs of the family. Life is very uncertain. In case you meet with an accident that makes you disabled or you get diagnosed with an illness that requires a lot of money, then you can always count on life insurance as this will cover your medical expenses and will offer regular income for a period of time when you are unable to work.

- To fulfil short term and long term necessities - This is yet another important factor that shows why is it important to buy a life insurance plan. A life insurance policy helps in taking care of your short and long term financial goals. Not just the long term goals like your child's marriage or education but also short term expenses like buying a car or bike require a safety net of life insurance coverage.

- To get complete peace of mind - Nobody can predict the future but having a life insurance policy prepares you for any uncertainty. If you want to live a peaceful and tension-free life, then think sabse pehle life insurance.

- Reducing debts - Many people take loans to meet several requirements such as family marriage, buying a house, car, bike, etc. But, what if the sole breadwinner of the family dies? The burden of all these debts will hit the dependent family members. Therefore, to save the financially unsecure dependents from this trauma, you must buy a life insurance policy. With life insurance, all your financial liabilities are well taken care of and the family runs smoothly even when you are not around. Hence, sabse pehle life insurance.

What are the benefits of buying a life insurance?

Financial planning plays an important role in ensuring a safe and better tomorrow. And making life insurance a part of your financial plan will help in safeguarding the future of your loved ones. Here're some of benefits of buying a life insurance policy -

- Tax Benefits - Life insurance is also considered as an important tax saving tool. As per section 80C of the Income Tax Act, you are not liable to pay tax on the premiums paid towards your policy.

- Cost-effective - It's always advisable to buy a life insurance policy when you are young. Because the younger you are, the cheaper will be the policy.

- Helps to fulfil your long-term financial goals - If you want to achieve long-term financial goals such as child's marriage, buying a home, child's higher education, planning your retirement, etc., in life, then opt for life insurance as it keeps you invested for a longer period.

- Looking after your family in your absence - This is one of the most important benefits of life insurance that you need to look at.

- Plans your retirement goals - A life insurance policy ensures that you have a steady income even after your retirement. All you have to do is to put some money in a life insurance product and enjoy a tension-free retirement life.

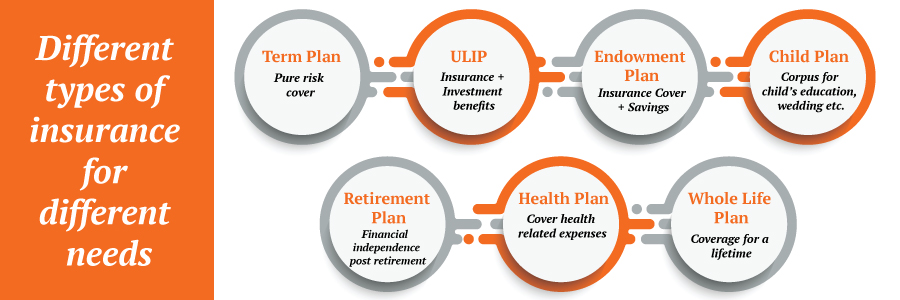

What are the different types of life insurance policies?

Life insurance comes in different forms as per the goals and requirements of a person. From child's education to retirement goals, life insurance has got a range of policies to cater to your several needs. Listed below are the types of life insurance policies -

- Child insurance plan - If you want to fulfill your child's future financial goals such as higher education, entrepreneurship, or marriage, then opt for child insurance plan.

- Retirement plan - It helps the policyholder to build a financial cushion for future so that they live a tension-free retirement life.

- Health insurance plan - It offers coverage against medical expenses that are incurred by the insured person when he/she gets hospitalized because of being injured or ill.

- Unit linked insurance plan - Investment cum insurance plan. An amount of the premium is used as insurance while the remaining is invested in funds such as debts, equities, etc.

- Term insurance plan - Term Insurance provides financial cover to the dependents of the family member in case of his/her death. It offers higher coverage at affordable premium rates.

- Whole life policy - As the name suggests, whole life insurance policy offers coverage against death for the entire life of the policyholder.

- Endowment policy - This is an insurance-cum-savings plan. Here the amount of premium is kept as a life cover while remaining amount is invested by the insurer.

What is the main objective of sabse pehle life insurance campaign?

The primary objective of sabse pehle life insurance campaign is to make individuals understand the importance of life insurance and the need to prioritize it in their lives. In India, very few people are aware of the need of life insurance. Mentioned below are the reasons for the same -

- Life insurance is a necessity, but most people consider life insurance as an investment option

- For some, life insurance is just a tax saving option

- Unlike vehicle insurance, it is not mandatory to have life insurance. Thus, not everyone takes it seriously.

CONCLUSION -

Is your family's financial security your first priority? If yes, then think Sabse Pehle Life Insurance. Because, when you add life insurance in your financial plan, then you can make sure that your family is financially secure throughout their lives while you are there for them and even while you aren't.

Life Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs

Popular Searches

- Term Life Insurance

- Whole Life Insurance

- Critical Illness Insurance

- Accidental Death Benefit Rider

- Compare Life Insurance Quotes

- Best Life Insurance Companies In India

- Factors Affecting Life Insurance Premiums

- Insurance For Tax Savings

- Life Insurance For Children

- Life Insurance Rider

- Life Insurance Plans

- Types of Life Insurance

- Term Life Insurance Tax Benefit

- What is Insurance?

- Life Insurance Premium