If you are employed and hard at work right now, one of the following two thoughts is a reality for you – First, you need that much money and then I say bye-bye to this job, and second, retirement? Who wants to retire? This is amazing!

Irrespective of your thoughts, there will be a day, when you’d want to call it quits and would like to set off on your journey. Or just chill and enjoy the fruits of your decades of labour. And to do any of these you will need your retirement funds. And what better than a comprehensive savings plan to save for all your life goals post retirement?

Retirement & the Key to Happiness

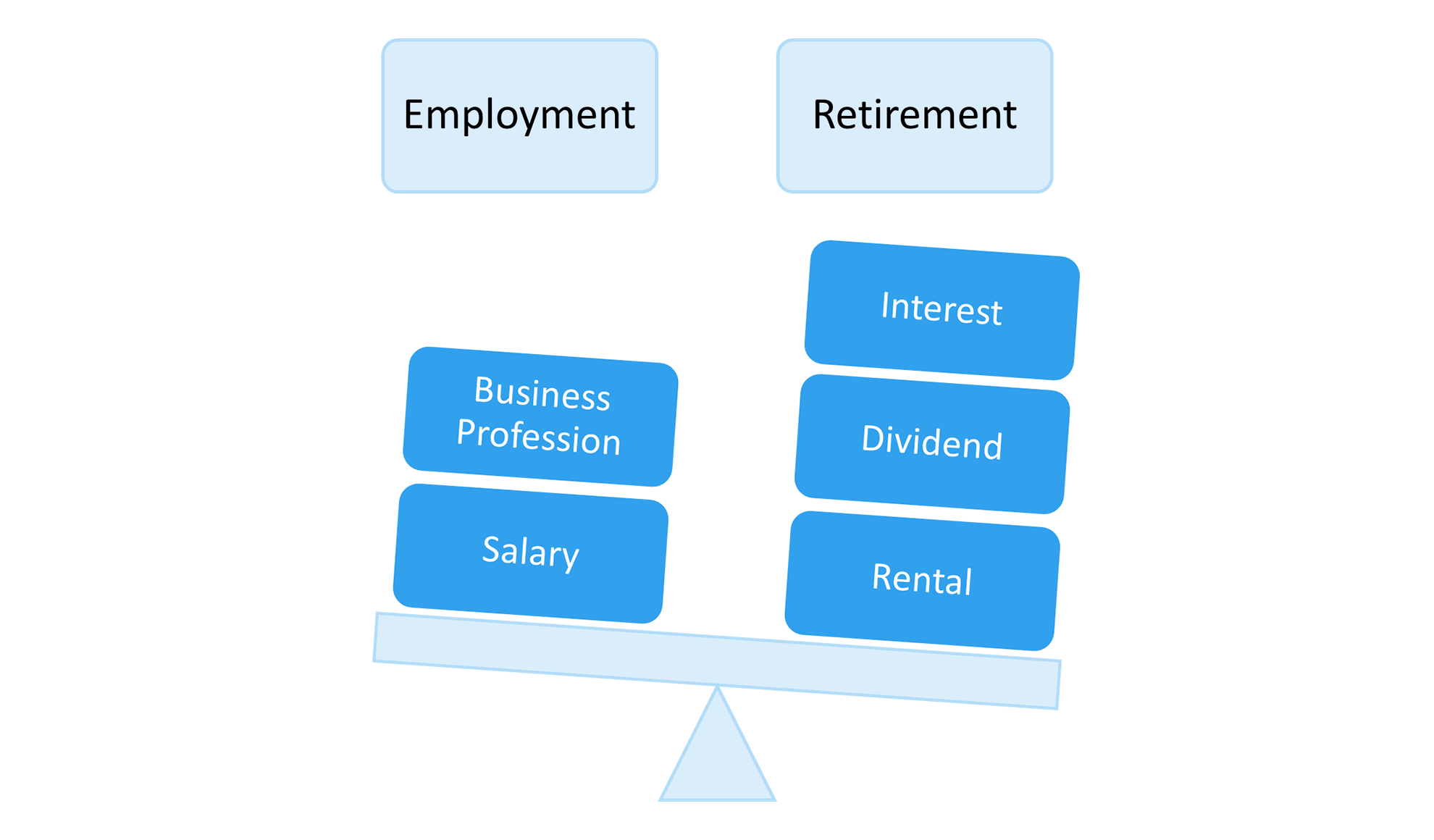

Retirement is often taken as a point of no employment. However, in more modern terms it could simply mean that you no longer need to work to run your household and living expenses.

The key to happiness after retirement is the healthy body, mind and bank balance. While you will work on the body and mind, money definitely will make it easier. In other words, when your investment assets are generating enough income for you to live happily, that’s when you can call yourself retired.

Thus, for a happy retirement one of the key ingredients is: Income from your assets outweighs the salary/professional income

How do you achieve this Key?

Like all great things in life, a retirement with the key to happiness takes time, effort and discipline to build; i.e. retirement planning. In reality, this process is almost boring and without excitement, except when you start enjoying the fruits.

So, here are the boring steps of achieving this key, and believe it boring is better:

Step 1: Plan for Your Retirement

The first step, as always for any big goal, is to plan for it. In this step you need to arrive at the following:

- Where do you stand?

Your current age, income, expenses, savings, etc.

- How far is your retirement goal?

At what age you wish to or will retire

- How much do you expect to spend monthly after retirement?

Your monthly household budget and lifestyle expenses. Here you also figure out if you have any post-retirement financial goals.

- How long do you expect your retirement period to last?

This is simply ‘life-expectancy – retirement age’. Retire too early and your assets will need to last longer.

Based on your expected monthly expenses and post-retirement financial goals, you estimate your retirement corpus. This is your retirement goal.

For example, if you wish to spend equivalent to Rs. 1 lakh at the age of 60, and you are 30 years old right now, you will need between Rs. 5 to 6 crores* of retirement corpus. (*Assuming an inflation rate of 5% p.a. and rate of interest of 8% p.a. on savings post-retirement.)

Step 2: Estimate Your Monthly Savings Need

You can save at the frequency you are comfortable with, though the monthly mode of saving is considered more convenient. Especially if you are salaried, you should stick to the monthly mode. Also, remember to keep it as boring as possible, and automate the investment.

But first, we need to figure out how much to save every month. So, here’s a simple formula for you to figure out. If you save 10% of your current income and can get 8% p.a. rate of return on your investment, you can replicate your current income in the next 30 years.

Reverse this and you get, if you save Rs. 10,000 a month at 8% p.a. for the next 30 years, you can receive Rs. 1 lakh per month as income from the accumulated corpus.

Similarly, if you need to retire in 20 years you need to increase the savings ratio. Increasing your retirement savings to 25% can help you achieve the goal in 20 years. Ideally, if you are 30 years of age and have zero retirement assets, you need to start investing 10-15% of your current income towards retirement.

Don’t worry about falling short though, as your income grows, you can increase the amount you invest accordingly.

Step 3: Select an Investment Instrument

Whether you retire early, don’t retire at all, or just want to replicate your income as early as possible, you want to do it tax-free as far as possible. There are very few such long-term investments which allow you to invest as much as you need and provide tax-free maturity value.

Unit Linked Investment Plans are one such investment. Apart from their tax-efficiency, the following features make ULIPs the perfect retirement investment plans:

- Multiple asset options – Equity, debt and liquid funds. Switching between funds does not attract tax in ULIPs

- Wealth boosters and bonus unit allocation for long term investors (does not affect tax status)

- Automated portfolio management options for risk and return management

- Tax-free partial withdrawals any time after the first five years of the policy

- Life cover, so that spouse doesn’t lose the retirement goal without you

- Completely online - Buy, manage and liquidate online.

Canara HSBC Life’s Invest 4G plan is one such plan offering all of these features and more.

Few Precautions While Using ULIPs for Retirement Plan

Retirement is a long-term goal, and one of the caveats of retirement investing is to ‘increase your investment with your income growth.’ However, the ULIP plan will lose its tax-free status the moment you invest more than 10% of the life cover in any financial year.

Thus, while investing in the plan you should try to get a life cover which is more than 10 times of your current annual investment in the plan.

For example, considering you want to invest Rs. 20,000 a month in a ULIP plan for your retirement, which amounts to Rs. 2.4 lakhs a year.

Usually, you would get a life cover of Rs. 24 lakhs (10x2.4) with this ULIP plan. But this would mean, you cannot invest anything more than Rs. 2.4 lakh in the plan for the next 20-30 years. But, since it is a retirement goal, you will have to invest increasing amounts each year.

Thus, instead of 10 times, you opt for a life cover which is 15 times of your current investment; i.e. Rs 36 lakhs. This will ensure you can keep up the investments with your income growth.

Healthy Body, Mind & Bank Balance

And while you take the boring path towards better bank balance post-retirement, don’t forget about the body and mind too. After all, you will need them to enjoy the exciting benefits of meticulous retirement plan.

Life Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs

Popular Searches

- Term Life Insurance

- Whole Life Insurance

- Critical Illness Insurance

- Accidental Death Benefit Rider

- Compare Life Insurance Quotes

- Best Life Insurance Companies In India

- Factors Affecting Life Insurance Premiums

- Insurance For Tax Savings

- Life Insurance For Children

- Life Insurance Rider

- Life Insurance Plans

- Types of Life Insurance

- Term Life Insurance Tax Benefit

- What is Insurance?

- Life Insurance Premium