In your professional life, you may have aspired to achieve various goals. You work hard and earn and make sure your life is worthwhile. You look to fulfil all the goals you thought of and see your family members achieve their investment goals too.

But life is uncertain. What if you were the only earner and lose your life suddenly. In such a case, your family would get into a financial crisis. All that they have thought comes to a halt.

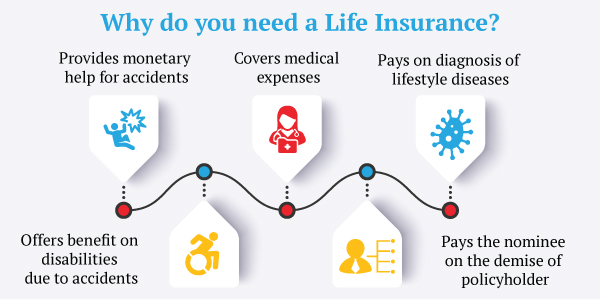

To make sure that the goals and dreams of your family members are achieved, life insurance is necessary.

What is a Life Insurance Policy?

Life insurance covers your life and provides financial assistance to your family members after you are not there with them. The policy will provide you with lump sum money to your dependents in the event of your death.

In return for this coverage, you are required to pay small amounts regularly known as premiums. Without payment of premiums, your policy cannot be active.

Life insurance includes various products such as ULIPs, Savings plans, Term plans, etc.

Canara HSBC Life Insurance offers the best in the market life insurance products. Some of the products are given below:

1. Invest 4G

This plan offers you the benefit of both insurance and investment in a single product. Under this, you can invest in funds such as equity, debt, or even a mix according to your preference and risk-taking abilities.

Death Benefit

In case of your death, your nominees will get higher of the following:

- Sum Assured (-) partial withdrawals if any, in the preceding two years

- Fund Value at the time of death

- 105% of all premiums paid till the date of death.

Maturity Benefit

If you do not die during the policy then you are entitled to receive maturity benefit. This is the fund value at the time of the policy maturity.

2. Guaranteed Savings Plan

Guaranteed Savings Plan provides you life cover as well as builds a habit to save.

This plan includes guaranteed benefits payable at the time of maturity. This means that you will receive a predictable amount. Your principal is safe.

Both these plans are eligible for:

- Tax-benefits u/s 80C and 10(10)D

- Premium protection option

What is a Health Insurance?

Health insurance proposes to cover full or part of your expenses that arise from illnesses in exchange for regular premium payments.

As the medical costs are rising with each passing year, the importance of having a health insurance plan for you and your family cannot be neglected.

There are two types of health insurance

- Mediclaim

- Critical Illness plan

For example, Health First Plan from Canara HSBC Life Insurance offers the following benefits.

a) All in one health plan which covers critical diseases such as cancer, heart diseases, etc.

b) Includes option to increase existing cover during the policy term.

c) All the future premiums will be waived off at the first stage only if you are diagnosed with certain diseases.

d) Your premiums can be returned on maturity

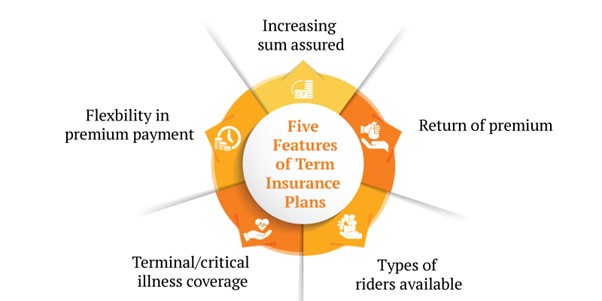

What is a Term Insurance?

Term insurance is a type of life insurance that offers you life coverage for a specific period or a ‘term’. It is the simplest and most affordable form of insurance.

a) The term for which you can take a policy can range from 5-30 years.

b) You select the term for your choice and pay the premiums during the term

c) If you die during your policy term, your family will get the sum assured agreed by you at the time of purchase.

d) However, if you survive the policy term, you are not liable to receive any benefit on maturity.

e) Some plans such as iSelect Smart360 Term Plan from Canara HSBC life insurance offers you a return of premium option. You will get the sum you have paid towards premiums back if you survive the policy term.

Also Read - 5 Year Term Insurance Plan

Difference Between Term Insurance & Life Insurance

Though life insurance and term insurance work towards the same purpose, both the policies have certain differences as well.

1. The primary difference lies in the duration of plans. A term plan offers you protection for a specific duration only.

On the other hand, Life insurance can give you coverage for a longer time. Plans such as Invest 4G provide you coverage up to 100 years if you opt for the century option.

2. Term insurance offers you death benefits. Life insurance provides you with death benefits as well as maturity benefits. However, the term insurance’s death benefit is significantly higher.

3. Premiums of term insurance are much lower than the premium of life insurance plans.

4. The maturity benefit of life insurance is free from taxes.

Life Insurance vs Health Insurance vs Term Insurance

Here are the differences between these 3 most popular types of insurances.

| BASIS | LIFE INSURANCE | HEALTH INSURANCE | TERM INSURANCE |

|---|---|---|---|

| Meaning | Type of insurance that provides for life | Type of insurance which covers expenses that arise from hospitalization | Insurance that provides life coverage till the term chosen. |

| Plan Duration | Plans range from 5-30 years. Certain plans offer coverage up to 100 years. | Shorter duration. Ranges from 5-10 years | Ranges from 5-40 years. |

| Cash Value | These policies build a cash value | No cash value | No cash value |

| Premiums | Premiums are higher as compared to term insurance. | Premiums are moderate. They increase with age. | Premiums are affordable |

| Death benefit | The death benefit is provided to the family in case you die during the policy. | Health insurance includes no death benefit. | Yes, the death benefit is provided to your family if you die within the policy term. |

| Maturity Benefit | Maturity benefit is received after the policy term is over provided the premiums are paid. | Provides cover for medical emergencies (hospitalization expenses) till the policy is active. | No benefit on maturity. Return of premiums available in some plans |

| Bonuses | Bonus added for long term and regular investors | Sum assured increment may happen for claim-free years | NA |

| Tax benefits on premiums paid | Tax deductions available u/s 80C and 10(10)D on the death benefit | Tax deductions available u/s 80D | Tax deductions available u/s 80C and 10(10)D on the death benefit |

| Tax benefits on the maturity value | Tax deductions available u/s 10(10)D in case of ULIP plans bought on/after 1 Feb 2021. | No such benefit is available | No such benefit is available |

Thus, you should use the life insurance plans for specific life goals like retirement, child’s education etc. On the other hand health and term insurance plans should protect your family’s future financially.

Life Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs

Popular Searches

- Term Life Insurance

- Whole Life Insurance

- Critical Illness Insurance

- Accidental Death Benefit Rider

- Compare Life Insurance Quotes

- Best Life Insurance Companies In India

- Factors Affecting Life Insurance Premiums

- Insurance For Tax Savings

- Life Insurance For Children

- Life Insurance Rider

- Life Insurance Plans

- Types of Life Insurance

- Term Life Insurance Tax Benefit

- What is Insurance?

- Life Insurance Premium