The importance of saving and investing money is no news to anyone. Everyone knows investing to be one of the cornerstones of responsible financial practices. Investing money helps increase the value of money as compared to it sitting stagnant in a bank account, earning minimal interest. This is key for establishing long term financial security and staying ahead of any curve balls life may throw at you.

Another cornerstone of responsible financial practices is buying insurance to protect you against financial emergencies and unforeseen expenses. Insurance has the potential to help you and your family.

What is a ULIP?

There exists a way to both - provide a safety net to your family and also generate wealth by investing. It's called ULIP or Unit Linked Insurance Plan. A unit linked insurance plan is a combined insurance plan where a part of the monthly premium paid by the insurance policyholder goes towards the payment for the insurance, and the rest is invested, just like it would have been in a mutual fund.

ULIPs have options for investment in either equity or debt, and policyholders can take their pick based on their appetite for risk. Equity funds can favour investors with aggressive mindsets, while debt funds are more suitable for conservative investors.

Short term gains

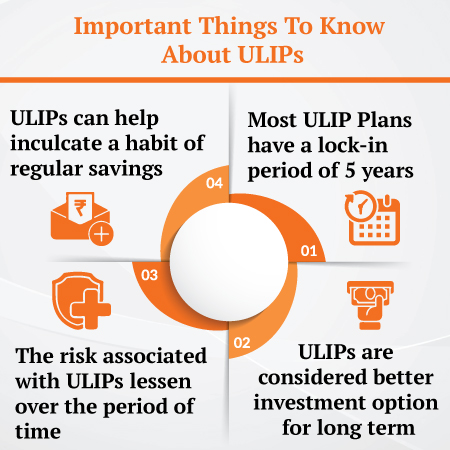

What short-term means to one, might not be the same for the other. Most unit linked insurance plans come with five year lock in periods, meaning one cannot get the money back before then. One may discontinue, but repayment will take place only after five years have passed. Additionally, surrendering a policy early comes with certain charges, making it highly detrimental to your intention of saving money and generating wealth. While the returns of the investment component are dependent on the market, these charges may be avoided by not discontinuing the policy before five years have elapsed.

Also Read - Short Term Investments

Keeping this in mind, if short term to you looks like five years, then sure, ULIP can help you achieve your short term goals by helping preserve your money and letting it grow over the course of five years.

Also Read - Investment Options for 5 Years?

ULIPs over the long term

Unit linked insurance plans, when compared to other insurance products, almost always outperform them. This is mainly because of the equity factor. Unlike other insurance policies,ULIPs invest the investment part of the premium you paid in different funds, diversifying risk and maximising gains.

ULIPs are also flexible, and in the long run, they allow you to switch between investment options. You can choose to switch based on your appetite for risk and the state and direction of the market

ULIPs also provide investors with a tax benefit of 1.5 lakh rupees. Over the years, the sum adds up and ends up being a substantial amount, so in the long term, not only does the insurance and investment component help generate wealth, the tax saving component also helps preserve wealth!

Factoring these three things in, one can safely say that unit linked insurance plans, for the long term, are the best investment plans as they help save money, provide life cover, and also generate wealth by investing your money.

Is ULIP the best investment plan for you?

- Unit linked insurance plans cut down the number of things one has to juggle. Instead of having to keep an eye on and be mindful of a separate life insurance plan and an investment plan, this acts as a monthly investment added to your insurance premium.

- It helps save money and generate wealth over time

- You have the option of switching between portfolios

If all of these seem like the right reasons to you, you should consider investing in the Canara HSBC Life Insurance Invest 4G plan. It is a unit linked insurance plan that allows you to:

- Choose from seven different funds and four different portfolio strategies

- Improve wealth generation through loyalty additions and wealth boosters

- Switch between fund options to take a direction you feel comfortable with

- Withdraw money partially, so you can deal with any financial needs that may arise

All of these convenient features come together to make it a great experience for you, free from worry, and hence the plan is also called the zero worry plan. So, go ahead and invest in the best investment plan that provides you with life cover and allows you to generate wealth at the same time.

ULIP Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling ULIP insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Don't Just Survive, Thrive

- 3 Plan Options

- Life cover + Guaranteed benefits

- Total Premiums at maturity

- Early income from 2nd policy year

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs