As time goes, our life changes and we play different roles for different people. Apart from emotional investment, these changing life-stages also demand financial investment of the right kind. Children’s education, marriage, your own house, planning for retirement, setting up a contingency fund to meet medical expenses are all major commitments we make to the ones we love. A well-structured and well-thought monthly savings plan can help you meet all your commitments without much hassle.

1) Start Early

– It is highly recommended that you start saving money as early as you can so that you have enough funds ready to fulfill all your planned as well as unplanned commitments. If you have just started earning, it is the best time to instill a financial discipline in your lives, by investing in a savings plan.

2) Set Goals

– It becomes easier to plan your savings when you are clear about your goals in life, goals for yourself and your family. It’s a good idea to make a checklist of all the things that you want to do and the age you think you would want to achieve it by. Once done, you can plan your finances for long and short-terms accordingly.

3) Live on a Budget

– Living on a set budget is a habit not everyone can establish, but those who do are always happier. Fix an amount that you will save, ideally 10-15% of your earning, every month. Hence, you will have to maintain a strict budget for your regular lifestyle, and save a portion of your money as soon as you receive it.

4) Invest Wisely

- When you have decided your financial goals, you will have an estimate of how much money you would want by the time you reach your first milestone. So, you have that time in hand to build up your savings corpus. Then, you need to choose your investments wisely and pick a savings plan that helps you meet your goals. For instance, Invest 4G by Canara HSBC Life Insurance is ideal for long-term savings, offering flexible wealth growing options.

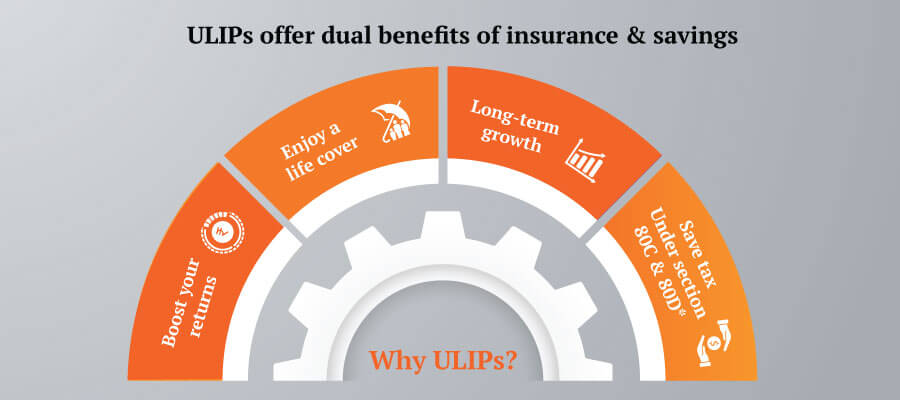

A great option that can help you meet your financial goals is a unit-linked insurance plan (ULIP), which offers the dual benefits of savings along with a life cover to ensure your family is financially secure too. Here are the reasons, you must consider a ULIP:

- Convenient Premium Payment Options – Unit linked insurance plans offer options to choose between yearly, half-yearly & monthly premium installments.

- Partial Withdrawal Facility – After the lock in period, ULIPs allow partial withdrawal of funds subject to nominal charges. If needed, you can also choose to make a full withdrawal before maturity by paying applicable surrender charges.

- Switching Funds For Better Returns – Unlike other plans, ULIP gives you the flexibility to easily switch between equity and debt markets and capitalize on the best opportunities, for better returns. Your policy may allow a certain number of free switches per year.

- Long Term Investment Benefits – ULIP payments, being smaller monthly/ yearly amounts, are much easier to be invested in for a longer period of time. Paired with the option of choosing your funds, longer terms fetch you better returns.

- Add-Ons and Loyalty Bonuses – ULIPs can get you bonuses on making regular payments, such as the Invest 4G by Canara HSBC Life Insurance, that gives extra units to the policy holders in forms of wealth boosters and loyalty additions.

- Tax Benefits – With ULIPs as your investment option, you can earn tax benefits under section 80C & 10(10D) of the Income Tax Act, 1961.

After you have it all in place, you should take stock of your savings and investments at least once every year. Track the performance of your portfolio so that you can assess the returns and switch in case they don’t meet your expectations.

ULIP Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling ULIP insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Don't Just Survive, Thrive

- 3 Plan Options

- Life cover + Guaranteed benefits

- Total Premiums at maturity

- Early income from 2nd policy year

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs