About 440 million millennials in India form 34% of our population and 46% of our workforce. Ours is the largest millennial population in the world. They are currently driving the consumer economy with their product and service purchases. But do millennials save and invest?

Yes, they do. One-third of working millennials put their money only in risk-free investments. They take lesser risks than their older counterparts do in terms of their hard-earned savings. This generation is bringing about a change in the economy. In this scenario, a ULIP would be a safe enough investment plan for youngsters that still takes them one step further from fixed-income savings instruments. Here's an Indian millennial's guide to ULIPs

What is a ULIP?

A Unit Linked Insurance Plan is a unique plan that is part-insurance and part-investment. Your monthly premium payment is partly used for a life cover. The other part is invested in funds selected as per your risk appetite and your financial goals. Since it takes time to accumulate a large corpus of savings, this is a good way to discipline yourself into saving regularly.

Who should invest in ULIPs?

Specific goals

As a young, ambitious individual, you must have a lot of goals for your future like buying a house, a vehicle, your wedding, higher education, etc. A ULIP plan is a good option for you if you wish to remain invested for a long period of time for fulfilling these goals.

Different risk appetites

ULIPs are flexible in terms of choosing and switching investments. The portion of equity in your investment can vary from 0% to 100%. As compared to instruments like fixed deposits, ULIP offer advantages like life insurance cover, guaranteed bonus and better returns.

Keeping track of markets

A ULIP requires you to keep track of markets so as to check how your fund is performing, and decide how to switch allocations. If you are ready to stay updated, ULIPs are for you.

What's the best way to buy and manage a ULIP?

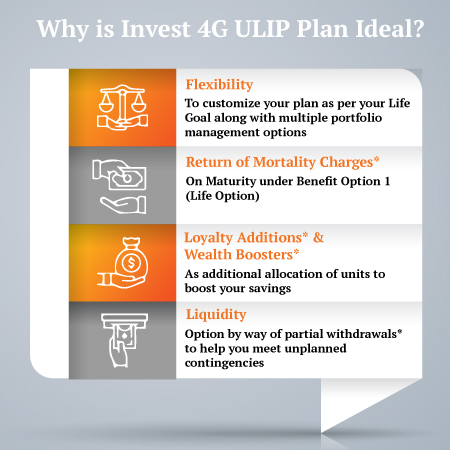

The best way to buy a ULIP for tech-savvy youngsters is online. You can conveniently pay your premiums online as well. You can easily keep track of market movements and switch your investments, manage your funds- all online. A great option that you can check out is the Canara HSBC Invest 4G plan. It offers advantages like partial withdrawals for meeting emergency expenses, and return of mortality charge upon maturity.

What are the charges for a ULIP?

There are various charges for a ULIP which get deducted from your premium. The number and amount of charges depends on who your insurer is. These include administrative charges, fund management charges, surrender charges, mortality charges, partial withdrawal charges, switching charges, etc.

What are the tax benefits of a ULIP ?

In an age when they have just started paying taxes and are learning how to save them, a ULIP is a great investment plan for youngsters. Premiums are tax-deductible upto a limit of Rs.1.5 lakh under Section 80C, while maturity amount is exempt under Section 10(10D) of the Income Tax Act. Moreover, ULIPs are one of the few instruments to be exempt from the Long Term Capital Gains (LTCG) tax.

What are the other benefits of a ULIP?

- ULIPs are the ideal investment plan for youngsters because they offer flexibility in payment of premium i.e. monthly, quarterly, semi annually, etc.

- They offer you the power of better returns through compounding, which means that profits are reinvested for greater profits in the future.

- They offer the flexibility to switch between equity to debt to balanced funds at almost any given time based on the performance of your funds

- They have a 5-year lock-in period, but the actual benefit of ULIPs is derived when you stay invested for a really long period. It inculcates the habit of saving and persisting to save.

- Investing in a ULIP at the very beginning of your career would help you realise your dreams at an earlier stage in your life. That dream vacation in your 30s might actually be possible with a good investment plan.

For your first ULIP, you might want to consider the Invest 4G plan from the Canara HSBC. It offers excellent advantages like 7 different funds and 4 portfolio strategies. You can also boost your savings through Loyalty Additions and Wealth Boosters.

ULIP Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling ULIP insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Don't Just Survive, Thrive

- 3 Plan Options

- Life cover + Guaranteed benefits

- Total Premiums at maturity

- Early income from 2nd policy year

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs