What is ULIP | Unit Linked Insurance Plan |

Any investment journey must start with the basic premise of what one's goal is. Financial planning involves taking stock of one's risk profile, investment horizon, and financial goals. Your financial goals could include everything from buying your dream home to securing the best possible education for your children. After weighing these factors, the next step would be to consider which product to invest in. One such investment option is a Unit Linked Insurance Plan or ULIP.

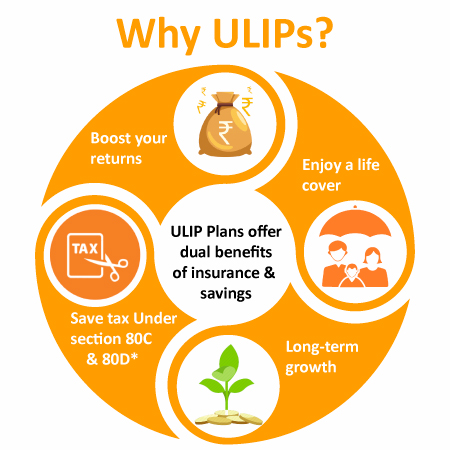

When you opt for a ULIP plan, you get the dual benefits of both insurance and investment, which is why it has turned out to be a feasible option for many investors. You get the benefits of investing in a mutual fund, while also getting insurance cover. When you invest in a ULIP, the insurance firm invests part of the money into shares or bonds, and the remaining is used to provide insurance cover. You can also make changes to your portfolio, switching between debt and equity. This flexibility is another advantage of investing in ULIPs.

ULIP - A popular choice for the young and not-so-young alike

ULIPs are a popular option among millennials who may have started thinking seriously about investments. They may be looking at specific goals like higher education for their children or a dream home. Millennials, who are part of the experience economy, value experiences like travel and would prefer to save up for a big international trip. ULIPs offer them that option because of the lock-in period, the sense of discipline and flexibility in terms of switching between funds for greater returns.

Accident and Accident Disability Benefit Rider

An Accident and Accident Disability Benefit (ADDB) rider offers an extra cover in the event of disability because of an accident. Some insurers offer it for a temporary disability as well. Some even offer waiver of premium as the policyholder might not have a proper income due to disability and paying premiums becomes difficult. If this benefit is not available, you can even go for a separate waiver of premium rider.

So, what exactly is a ‘good’ time to invest in a ULIP plan?

Like with mutual fund investments, any time is a good time to invest in a unit-linked insurance plan. ULIPs help tide over market volatility, so you can invest in them when the markets are down or when they are on the upswing. The earlier you start, the better it is, as you will be able to make use of the power of compounding. Compounding is all about reinvesting your income constantly so that your wealth grows. The longer the timeframe over which you invest, the better position you will be in to reap the benefits.

A ULIP plan should be used for long-term investment so ideally, you would need to start early and stay invested over the long-term. ULIPs have a lock-in period of five years, so they encourage focus and discipline in your investment journey.

A good time to invest in ULIPs is when you have a steady income and don't have too many commitments, and work towards your goals, whatever they may be. You can even alter your premium allocation annually, and don't have to stick to the same amount each year you are invested in. Based on your risk profile, you could choose from a variety of funds with varying exposures to equity. If you seek higher returns, you may need to choose a fund with higher exposure to equity. Also, if you are a salaried professional, and a mid-level executive at that, you can benefit from the tax-saving options for ULIP premiums and maturity amount under Section 80 C and Section 10D of the IT Act.

Investors planning for their retirement fund may also opt for a ULIP plan. One of the benefits includes sum assured or fund value, whichever is higher in the unfortunate event of the policy holder's death, thereby ensuring financial security for the family. As the goal is reaching completion, you could switch to a safer or low-risk investment in place of the equity-heavy option at the beginning or middle of the policy term.

You can consider Canara HSBC Life Insurance's Invest 4G Plan that offers the option of choosing from seven different funds and four portfolio strategies. Besides, it comes with benefits like partial withdrawal in case you need to meet some urgent financial commitments.

Summing up

To conclude, whether you are a new investor in the early stages of your working life or you are planning a retirement fund apart from insurance cover, ULIP is a good option for you. There is no particularly ‘good’ time to start a ULIP. The time is now and the earlier you start the greater your chances are of fulfilling your financial goals. Just remember that any investment decision you make needs to be aligned with your risk profile and your expectations rather than market conditions. A ULIP helps you tide over weak market conditions as you can rebalance your asset allocation and can also fetch you considerable returns over the long-term.

ULIP Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling ULIP insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Don't Just Survive, Thrive

- 3 Plan Options

- Life cover + Guaranteed benefits

- Total Premiums at maturity

- Early income from 2nd policy year

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs