What if you could cover your family’s needs with one health insurance policy? A family health insurance does exactly that - it covers all your family members. Why is it necessary to cover your family members? After all, most health insurance plans are to protect you during your old age.

Well, covering your family members is an act of reassurance. During emergencies, you do not have to worry about liquidating your assets. Instead, you can choose to find the best resources for your family.

Getting a family health insurance policy saves you both time and money during financial problems. It can also be extended to include new members of the family. Find yourself a plan that can adequately cover your entire family.

Family health insurance plans cover your whole family under a single policy. This type of health insurance serves as a financial cushion for your loved ones. Family health insurance policies secure your family’s needs and cover more than one person.

6 Benefits of Buying the Best Family Health Insurance Policy

A family health insurance plan helps you recover some expenses, including Covid-19. Thus buying a family insurance plan is a necessity.

Choosing a health insurance plan that covers your entire family can take care of the expense. It is also a wise income instrument. A family floater health insurance plan takes care of your medical needs. It also ensures that every member of the family is well protected.

Here are six reasons why you should opt for health insurance policies that cover your family:

1. Covid-19 health insurance for the entire family

Covid-19 protection does exist in family health insurance plans. With it, you can ensure the best treatment for your family through compensation. Moreover, it helps you during emergencies and can be added as a clause to your existing family floater.

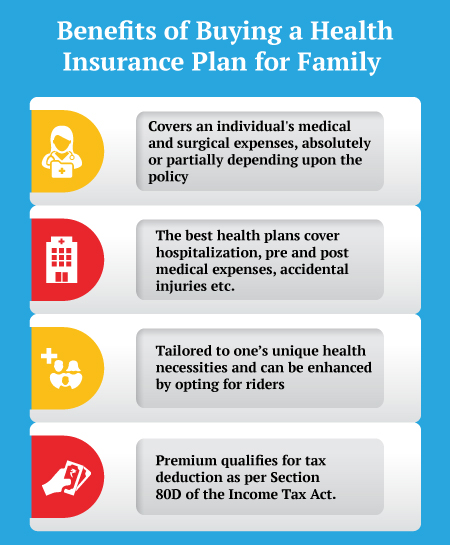

2. Covers medical expenses

One of the most important functions of family health insurance is medical expenses. With rising rates of medicines and treatments, it is better to have insurance cover. Moreover, the cover is adjusted for inflation.

3. Budget-friendly premiums

The affordable pricing of family health insurance plans makes them more accessible to the masses. You can choose a plan according to your budget and calculate the premium online.

4. Add-ons for greater benefits

Family health insurance plans come with additional benefits. The plan can be upgraded to include maternity cover, newborn baby cover, and more.

5. Tax benefits with health insurance plans

Section 80D of the Income Tax Act states that health insurance covers are exempted from taxation. This is a great advantage of health insurance plans. It helps you with both savings and wealth creation.

6. Health insurance for new members

Expecting parents can also cover their newborns. Newborns are often prone to illnesses which make a health insurance plan necessary.

Read why new parents should buy a life insurance plan.

Six Things to Consider While Buying the Best Family Health Insurance Plan

Any step towards getting a health insurance plan involves self-assessment. You need to keep track of your current financial situation.

1. Coverage

Your premiums depend on the kind of coverage you want for your family. This includes skimming through the clauses of the policy. Premiums are based on your needs. They seek to provide you maximum benefits. For instance, if you are an expecting parent, you will need to include the new member in the plan.

2. Price point

Family health insurance plans are flexible. They are tailored to suit the Indian market and have a range of low-premium policies. Find a plan which suits you best, and stick to it.

3. Family plans instead of individual plans

The pandemic has taught us that nobody is immune to deadly viruses. Therefore, you need a plan that can cover your entire family. Instead of adding just your parents to the list, include your children too. More members mean that you save more money in the long run.

4. Renewability

Find a plan which offers lifetime renewability as opposed to limited renewability. This is because most of us require a health insurance plan for the later years of our life.

5. Good claim settlement ratio

Claim settlement ratio is nothing but the number of claims settled by an insurance company. The insurance provider must have a good ratio, so you know that they will deliver their promise.

6. Online premium calculators

You can check your premium online before choosing to invest your money. This helps you plan for your health insurance premium in advance and allows you to achieve your financial goals.

Buy the Best Health Insurance Plan Online

For a paperless, fast, and convenient transaction, buy Health First Plan by Canara HSBC Life Insurance. With unprecedented lockdowns, getting your family insured as fast as possible is best. Family health insurance plans cannot be ignored in a post-Covid world. Without a comprehensive cover, you can be prone to medical expenses. A health insurance plan that covers your entire family will be crucial in the coming years. It will help you prepare for medical emergencies and cope with the economic downturn. Thus, getting a family health insurance plan is pivotal to a financially secure future.

Recent Blogs

Popular Searches

- Family Health Insurance Plan

- What is Health Insurance?

- Health Insurance For Parents

- Health Insurance Tax Benefit Under 80-D

- Health Insurance Facts

- Difference Between Life and Health Insurance

- Difference Between Life and Health Insurance

- Incurred Claim Ratio

- What is Copay in Health Insurance?

- What is Cashless Treatment?

- Accidental Cover in Saral Jeevan Bima

- Accidental Cover in Saral Jeevan Bima

- Tips to Buy Health Insurance

- Short Term Health Insurance Plan

- When Should You Buy Health Insurance?