Life is full of uncertainties. In the journey of life, you may come across some unplanned turns. The best way to face unexpected events in life is to be prepared for them in some way. When you are prepared, the impact lessens since you have resources to handle the situation.

One such unexpected situation that you may come across is health emergencies. In a health emergency, you have to:

a) Arrange a large sum of money

b) Arrange money in a short time

c) Use your health insurance plan

Different Types of Health Emergencies

Health emergencies are of multiple types depending on the cause. For example, the following three are most common types of health emergencies:

a) An illness which needs hospitalization and treatment

b) Accidental injuries disabling the bodily functions temporarily c) Life-threatening diseases with unpredictable growth and treatment results

The first kind of health emergencies may need you to be hospitalized and will include the cost of hospital care as well as medicines and surgeries.

Accidental injuries may require only monitoring and in severe cases emergency surgeries. For the time of recovery you will need to stay home and away from work for a while.

Both accidental and normal hospital emergencies are covered by your Health insurance. Health policy will either reimburse part of your bills or simply offer a cashless treatment benefit. However the life-threatening emergencies may cost a lot more than the other two.

The treatment cost of life-threatening health emergencies is higher than other two emergencies. For example, the cost of open-heart surgery can be somewhere between Rs 1.75 lakh to Rs 4.25 lakh in a private hospital in India. Cancer is another health emergency that can break you financially if you are not prepared for it. Depending on the type of cancer one has, the cost of treatment can range from Rs 1.75 lakhs to Rs 5.5 lakhs.

Learn when is the right time to buy a health insurance plan.

How To Prepare For Life-Threatening Health Emergencies?

Your entire emergency planning is to handle such emergencies only, and it has three important parts to it:

a) Emergency Funds

b) Health & Life Insurnce plans

c) Line of Credit like bank credit cards etc.

While emergency funds can take care of your family’s important needs and household expenses while you recover, the insurance will take care of the medical costs. However, in the case of critical illnesses, your Health and emergency funds will not suffice.

Critical health insurance plans can help you tackle such medical emergencies better. Here’s why:

a) Defined benefit on diagnosis

b) Amount covers all needs and you are free to use it for treatment and other expenses

c) Provision for long-term regular income for family

What Does a Health Insurance Plan Cover?

Health insurance cover is a good option to deal with basic health-related issues. If you have one, you should know its benefits and limitations. Health insurance offers you specified financial protection against health-related expenses. In general, a health covers the following:

1) The cost of hospitalization that includes room charges, oxygen cylinders, tests, etc.

2) Day Care treatment cost, when you don't need to be hospitalized and released in less than 24 hours

3) Consultation and doctor fee

Health insurance will cover a part of the cost of treatment. For example, if you spent Rs. 10,000 on a treatment for a covered diease

Critical Illnesses & Treatment Costs

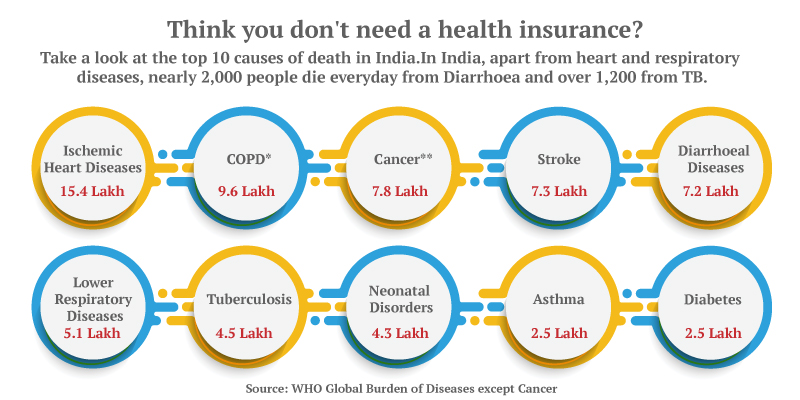

Critical illnesses such as heart diseases, kidney ailments, stroke, etc can come unannounced anytime. The approximate cost of treatment for some of the critical illnesses are as below:

1) Angioplasty: The angioplasty with a single stent can cost you between Rs 40,000 and Rs 2.5 lakhs, depending on the city you take treatment and the type of hospital you get treated.

2) Kidney transplant: The cost of a kidney transplant for both the donor and patient can be as high as Rs 7 lakhs.

3) Stroke: The cost of treatment in case of a stroke can go up to Rs 10 lakhs. It can vary a bit depending on the hospital and the technology used.

These numbers should give you an idea where the need stands compared to the normal Health cover.

How Will a Critical Health Insurance Work?

It provides you with a lump-sum amount in case of covered life-threatening disease. Health First plan is one such critical health insurance plan where you get the following two cover options:

- Major critical illness plan

- Specific Critical Illness covers for Cancer and Heart

The Major Critical Illness covers 26 pre-defined critical diseases in advanced stage. Before the insurance cover starts working for you, you need to select the plans:

1. The Health First Plan’s Major Critical Cover comes with two cover options

A. Level major critical illness cover

B. Increasing Cover (preferable to keep up with the inflation)

2. Return of Premium Option: Critical health insurance is a pure protection plan. Meaning, if there is no claim until the maturity, the policy simply expires without anything in return. If you choose this option you can practically ensure a free of cost protection in case the policy happily expires.

3. Regular Income Option: You can also choose the Monthly Income Benefit option that will give you 1% of the initial sum assured every month for 5 years after you are diagnosed with a disease. This benefit will be important for your family if your income is affected due to the illness.

Once you have the policy in force, here’s how both covers will work to protect your family financially in case you are diagnosed with a covered illness:

(Assuming you select an increasing cover option and regular income benefit under both the plans)

| Major Critical Illness | Specific Cover for Cancer or Heart Ailments | |

| Cost of the Cover | A nominal annual premium is payable for a large cover amount. e.g. Approx Rs. 320 p.m. for a 30-year coverage of Rs. 20 lakhs for a 30 year old male | A nominal annual premium is payable for a large cover amount. e.g. Approx Rs. 689 p.m. for a 30-year coverage of Rs. 20 lakhs heart cover for a 30 year old male & approx. Rs. 373 for cancer cover. |

| Keeping Up with Inflation | The cover will continue to increase at 10% of the initial sum assured every year, until either: - A claim is filed on the policy - The total sum assured reached 150% of the base sum assured | The cover will continue to increase at 10% of the initial sum assured every year, until either: - A claim is filed on the policy - The total sum assured reached 150% of the base sum assured |

| Minor Conditions | No claim is payable if you are diagnosed with a minor condition for a covered terminal disease. | The plan will pay a 25% of the applicable sum assured on diagnosis of a covered minor condition |

| Premium Waiver | Not Applicable | In case of a claim for a minor condition the policy continues without the need of extra premiums. Growth of sum assured will also stop. |

| Major Condition | 100% of the sum assured applicable for the claim year is paid to the family or policyholder | 75% in case of a previos minor claim or 100% of sum assured as applicable for the in case of no previous claims is paid to the policyholder or family |

| Regular Income | 1% of the initial sum assured is paid to the family for 60 months | 1% of the initial sum assured is paid to the family for 60 months |

is another plan you can select. It is a term insurance plan that gives you some benefits of health insurance. You get a sum-assured, in case you or any family member is diagnosed with a terminal illness.

How to Choose the Best Critical Health Insurance?

If you are looking for the best health insurance plans, look for the below features:

1) Cover early stages: You need money for treatment as soon as you are diagnosed with the disease. The best health insurance plan is one that gives a lump-sum amount as soon as you are diagnosed with a critical illness.

2) Provides regular income for the family: If the bread-earner in the family is diagnosed with a critical illness, the situation gets tougher for the family. So you have to ensure your health insurance plan gives you a monthly income when you are diagnosed with a critical illness and the regular income stops.

3) Premium waiver on diagnosis: The health insurance plan should waive off the premium once the insured person is diagnosed with a disease. It is all the more important if the person is the only one earning in the family.

4) Increasing cover option: Your medical expenses and treatment costs are going to increase with time. To keep pace with healthcare inflation, the health insurance plan should increase the sum assured every year.

5) Return of Premium Option: Return of premium option is an attractive feature for those who like to keep every penny accounted for in their purse. It also helps to add a little more to your kitty at the time of retirement.

Click Here to use Power of Compounding Calculator

Recent Blogs

Popular Searches

- Family Health Insurance Plan

- What is Health Insurance?

- Health Insurance For Parents

- Health Insurance Tax Benefit Under 80-D

- Health Insurance Facts

- Difference Between Life and Health Insurance

- Difference Between Life and Health Insurance

- Incurred Claim Ratio

- What is Copay in Health Insurance?

- What is Cashless Treatment?

- Accidental Cover in Saral Jeevan Bima

- Accidental Cover in Saral Jeevan Bima

- Tips to Buy Health Insurance

- Short Term Health Insurance Plan

- When Should You Buy Health Insurance?