One of the main goals of financial planning in life is to have a safe and comfortable retirement without depending on anyone else. Having a guaranteed income even after one’s career years are over can ensure that the standard of living that you are used to is not taken away. To ensure such a steady inflow of cash, it is highly advised that you sign up for saving plans with guaranteed income, many of which are now available in the Indian market.

Why should you buy Saving Plans with Guaranteed Income?

Many investors who are pre-retirees often rely on stocks or other investments that have fluctuating market values to safeguard their retirement. To prevent getting lost in a sea of uncertainties as your retirement age comes closer, it is useful to diversify your financial portfolio with investments that are low in risk and high in returns. This is where income annuities or insurance policies that double as fixed-income saving plans come into the picture.

Aside from the possibility that you may outlive your savings, such saving plans with guaranteed income can benefit you in other ways:

1. Reduction of Risk of Returns

People who are nearing retirement are understandably reluctant to take up investments that are high in terms of risk. It is always recommended to direct your income towards ventures like life insurance so that people who are dependent on you for livelihood are taken care of in the unfortunate event of your demise.

If you invest in savings plans with guaranteed income, the safety of you, your partner, and your family is pretty much assured because the loss of your professional income will not be felt as sorely. Such savings plans are also far removed from the volatility of the market, so you do not have to worry about the rising and falling figures of stocks for the safety of your retirement.

2. Financial Stability

Even though retirement is something people look forward to, the idea of not being well-off during the last few years of your life can be quite taxing for many professionals. While many people rely on their offsprings or extended family to take care of them, having a stable income of one’s own is the most comfortable way of living because you can always support your family in their times of need.

Learn which insurance is best to get guaranteed monthly income after retirement.

A fixed paycheck that is cashed into your account regularly will give you the psychological support you need as your medical expenses and prescription bills grow larger. Especially considering how there is a higher chance of medical contingencies once you near your death, a fixed income can be highly beneficial for your mental health.

3. Provides a Retirement Corpus

Savings plans with guaranteed income after retirement allows you to continue saving long after the peak of your career. Considering how some of these income plans allow you to defer taxes unless you withdraw funds, savings is made a whole lot easier.

Many savings plans also offer you the option to withdraw the assured sum in parts as a monthly income or as a lump sum amount, which is beneficial if your family has any urgent financial needs that require immediate attention, like a child’s marriage or education.

4. Easier to Budget your Retirement

It is far easier to plan out the specifics of your retirement when you know you will have a steady influx of cash on a regular basis. The comforts of a retirement house, as well as coverage for your spouse, can both be taken care of if you have a guaranteed income plan.

Learn 8 reasons to buy a guaranteed income plan.

5. Diversification of your Financial Portfolio

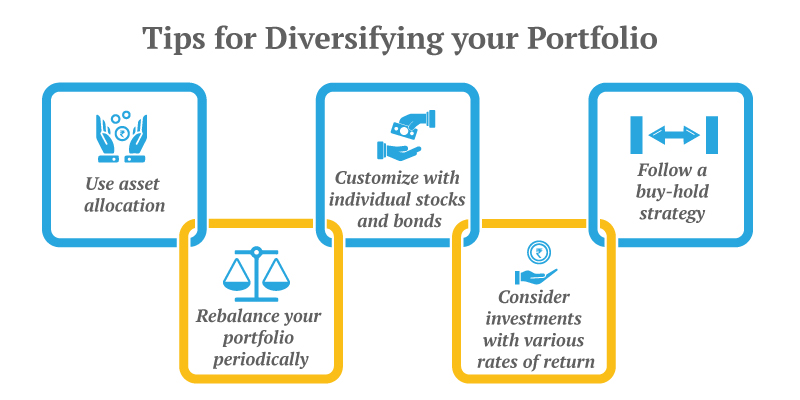

Instead of putting all your eggs in one basket, investing in savings plans with guaranteed income safeguards your financial portfolio in case all of your high-risk investments do not pan out as planned. It is important to have different investments with varying levels of risk so that you can take maximum advantage of the financial options available to you, and savings plans are a great investment for the diversification of your investment portfolio.

6. Plenty of Options to Choose From

The insurance market in India today offers a diverse array of savings plans with guaranteed income. Canara HSBC Life Insurance offers Guaranteed Income4Life, which is designed to help you achieve your long-term financial goals while saving you money in the area of taxes. A few benefits of Guaranteed Income4Life are:

- A Guaranteed Regular Income after retirement will ensure that you are self-sufficient and comfortable in the penultimate years of your life.

- Limited premium pays so that you can align the premium payment with your financial status and goals, depending on the stage of your life when you purchase the plan.

- Nominees will be paid death benefits upon the demise of the policyholder.

- You can choose from – Guaranteed Income, Guaranteed Long-term Income, and Guaranteed Life-long Income options as per your income and needs.

- Assured loyalty additions provided that all due premiums have been paid off.

Having a savings plan like Guaranteed Income4Life will ensure that the remainder of your life after retirement is spent in comfort and not in anxiety. Adding such a guaranteed savings plan to your financial portfolio will ensure diversification, low-risk, and safety in case of medical emergencies that are likely to occur with old age.

Our Top-Selling Insurance Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Fixed Returns, Zero Risks & Worries

- 4 plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Save, Dream, Plan. Live Peacefully

- 5 plan options

- Option to choose PPT

- Get Tax benefits

- Premium protection cover

Recent Blogs

Popular Searches

- Senior Citizen Saving Scheme

- Post Office Savings Scheme

- What is Sum Assured?

- Money Saving Tips

- Saving Plans for Child

- Endowment Policy

- iSelect Guaranteed Future Plus Plan

- National Savings Certificate

- Tax Saving Plans

- Senior Citizen Savings Scheme Calculator

- NPS and PPF

- Savings & Investment Plans

- Saving Schemes

- Save Money For Salaried Professionals