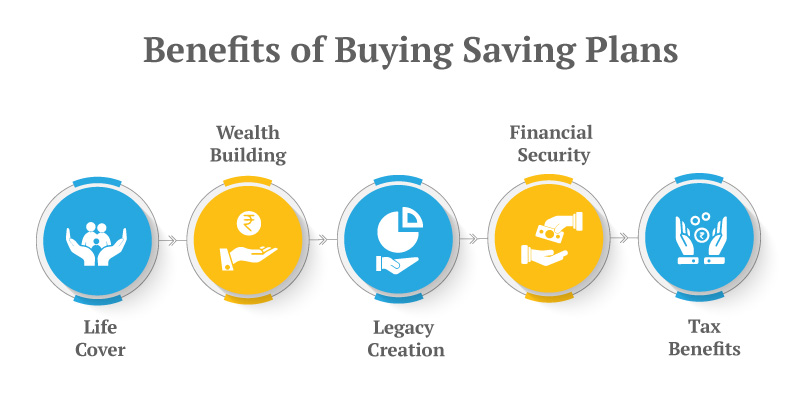

A Guaranteed Savings Plan is a non-linked, non-participating endowment life insurance plan that provides a lump sum at maturity. Such plans provide financial security, an opportunity to create a legacy. Not only that, with a Guaranteed Savings Plan, you can plan for a comfortable retirement.

These life insurance cum saving plans are financial instruments that can help you with various types of financial needs. You can plan for your child’s higher education, or create a corpus for a safe retirement, a savings plan with guaranteed returns – can help you with your financial gaps.

A Guaranteed Savings Plan can help you achieve short-term or long-term financial goals. To find the best savings plan as per your financial needs and goals, compare various saving schemes and plans before finalising on one. For that, you need to keep the below 7 factors in account while buying a savings plan:

1. Assess your Financial Goals

The first and foremost thing that you need to do is - set long-term and short-term financial goals. It gives you a lot of clarity and helps you in understanding how and when you will reach your financial goals. Assessing your goals will assist you in budgeting for your future expenses and that in turn, will be beneficial in saving up for your goals. Not knowing your financial goals will lead up to confusion and you may lose your track in between.

2. Strike a Balance between Risk and Reward

There are life insurance cum saving plans that offer life cover along with market-linked returns. And there are plans that do not divest the premium you pay in the market. Choose a savings plan that helps you maintain the balance between risk and reward. If you do not measure your risk appetite, it will become a challenge for you to find the right savings plan as per your needs. Assess your risk appetite and choose a plan that goes well as per your risk to enhance your portfolio.

3. Liquidity Option

The savings plan that you buy should have some liquidity to help you during contingencies. Life insurance cum savings plan offer loan facility and some other plans offer partial/milestone withdrawal option – using which, the policyholder can avail funds at the time of need. For example, Invest 4G offers multiple withdrawal options. If the policyholder chooses, Systematic Withdrawal Option, it will help them create an additional income stream during the policy term itself. If the policyholder chooses Milestone Withdrawal Option, they can withdraw the pay-outs at important milestone of life, for example – to pay for their child’s higher education, or their marriage.

4. Tax Advantages

Life insurance cum saving plans offer tax deductions on premiums that is paid and on the maturity benefit that the policyholder/nominees receive. Under Income Tax Act, 1961, the policyholder will get tax advantages. Under Section 80C, you will get tax deduction, which limits the deduction to Rs. 1.5 lakhs.

5. Online Accessibility

You can buy saving plans online without the hassle of stepping out of your comfort zone. Compare various plans and finalize the one that suits your financial preference. With an online savings plan, the paperwork and visits to the nearest branch also reduces as the entire process is carried out online.

6. Guaranteed Returns

With a savings plan, you will get guaranteed returns in form of maturity benefit. A few plans also offer additional returns in terms of annual and loyalty bonuses, if the policyholder opts for a longer premium payment term.

7. Flexible Premium Payment Term

You can choose your premium payment term as per your financial circumstances. From paying your premiums every month to paying the premiums in a single shot, you have the flexibility to choose your premium payment term.

Before choosing a guaranteed saving plan, ask all the necessary questions. As there are different terms and conditions, each savings plan may work differently. Therefore, buy a plan only when you are well aware of what it offers. Before you put your money into it, clear away all the doubts about the plan.

You need to consider your financial objectives to make the right decision and then look at the available alternatives for you. Choosing the right plan will help your wealth grow along with keeping your loved ones secured, financially.

Our Top-Selling Insurance Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Fixed Returns, Zero Risks & Worries

- 4 plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Save, Dream, Plan. Live Peacefully

- 5 plan options

- Option to choose PPT

- Get Tax benefits

- Premium protection cover

Recent Blogs

Popular Searches

- Senior Citizen Saving Scheme

- Post Office Savings Scheme

- What is Sum Assured?

- Money Saving Tips

- Saving Plans for Child

- Endowment Policy

- iSelect Guaranteed Future Plus Plan

- National Savings Certificate

- Tax Saving Plans

- Senior Citizen Savings Scheme Calculator

- NPS and PPF

- Savings & Investment Plans

- Saving Schemes

- Save Money For Salaried Professionals