The responsibilities never end, from the child's academic responsibilities to building a house and later getting the children married. The list of responsibilities is never-ending and while we try our best to give our children the best experiences in life, we often forget our own needs and requirements. Buy a savings plan that will help you realise your dreams. Save for that dream retirement house you wanted to own and you can simply achieve this by buying a retirement plan.

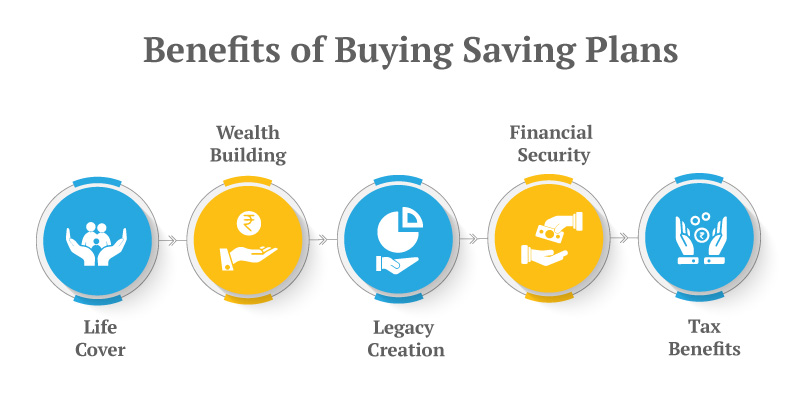

A savings plan that offers guaranteed maturity benefits is essential for your retirement. Here are 8 reasons you should buy the best guaranteed savings plan:

1. Guaranteed Maturity Benefit

Select the premium amount for your saving plan and you will receive the maturity benefit once the saving’s plan duration is complete. The minimum maturity value saves the capital against market performance.

2. Guaranteed Yearly Additions

These yearly additions help them achieve better investment growth, which means more money saved.

3. Loan Against the Cash Value of the Plan

After two years, the policy acquires cash value that increases over time. So, in case there is an urgent need, you can get loans against the policy.

4. Feasibility

It is easier to keep aside a small amount every month rather than giving a large amount at the end of a year, and usually some of the other expenses pile up and the focus shifts from the goal to cater to taking care of these new expenses.

5. Life Coverage

Savings plan helps cover the finances of the family and thus, you can be rest assured that they will be taken care of in case of a mishap.

6. Flexibility

The savings plan can be altered based on your short term and long-term goals, and the premium amount.

7. Tax Benefits

It helps you save the invested amount in a savings plan under section 80C of the Income Tax Act.

8. Better Growth for Long-term Investors

The longer duration will lead to a greater bonus in the long run. The more you stay invested, the higher the returns and benefits. Choose a retirement plan for your long-term financial goals and achieve each of the milestones.

How Invest 4G Plan can Help you?

Invest 4G Plan is a unit-linked individual Life Insurance Savings Plan that can be customized as per your goals and requirements. This plan allows you to gain complete control over your savings and needs. Features of Invest 4G plan:

a) Flexibility to choose to pay for the entire policy term or limited years or once at the beginning of the policy term.

b) Mortality Charges deducted during the duration of the policy term for regular and limited premium paying policies is added to the fund value at maturity.

c) Premium funding benefit under the care option ensures targeted savings contributions are even in your absence.

d) Loyalty Additions and wealth boosters add to your investments.

e) Systematic withdrawal options can create an additional income stream.

f) Milestone withdrawal option at regular intervals during the policy term for enhanced liquidity.

g) Multiple portfolio management options that allow you to optimize returns from the Policy as per your investment preferences.

Also Read - Best Saving Plan in India

Eight Benefits of Buying Invest 4G Plan

1. Diversification in Funds

This plan gives you the option to choose from 8 Unit Linked funds and 4 Portfolio Management Systems to build your savings. Hence, your returns are guaranteed to the policyholder.

2. Loyalty Additions

The Invest 4G plan offers Loyalty Additions related to the fund value from the end of the 5th policy year and every 5th year till the end of the Premium Payment Term if all the due premiums are received on time.

3. Wealth Boosters

Invest 4G plan also offers the additional allocation of units added to the Unit Linked Fund at specific policy intervals, if all due premiums to date have been paid.

4. Reduction in Premium

Once you have paid the premiums for the first five policy years on time, the policyholder has the option to decrease the premium payable under the Policy up to 50% of the Annualised Premium as subjected to the minimum premium limits as applicable based on the Cover Option opted.

5. Settlement Option

The policyholder can choose to receive the maturity benefit through Settlement Option in instalments as per the frequency chosen during the beginning of the policy term over a maximum period of 5 years, or opt for the complete withdrawal of fund value at any time during this period.

6. Tax Benefits

Tax Benefits under section 80C of the Income Tax Act are applicable in the Invest 4G plan.

7. Safety Switch Option (SSO)

As the policy nears maturity, the policyholder can choose to safeguard the funds against market fluctuations. The Safety Switch Option enables them to move the funds systematically to a relatively low-risk Liquid Fund at the beginning of each of the last four policy years.

8. Auto Funds Rebalancing (AFR)

Choose Auto Funds Rebalancing if you want a specific proportion of your allocated funds across different Unit Linked Funds to be maintained, untouched by market fluctuations. Once the policyholder has opted for AFR, it will automatically balance the allocation of your investments in various Unit Linked Funds according to the allocation proportions chosen by the policyholder, after every 3 months.

Now that you have all the information you need, browse our savings plan and choose the best one as per your life and financial goals.

Our Top-Selling Insurance Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Fixed Returns, Zero Risks & Worries

- 4 plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Save, Dream, Plan. Live Peacefully

- 5 plan options

- Option to choose PPT

- Get Tax benefits

- Premium protection cover

Recent Blogs

Popular Searches

- Senior Citizen Saving Scheme

- Post Office Savings Scheme

- What is Sum Assured?

- Money Saving Tips

- Saving Plans for Child

- Endowment Policy

- iSelect Guaranteed Future Plus Plan

- National Savings Certificate

- Tax Saving Plans

- Senior Citizen Savings Scheme Calculator

- NPS and PPF

- Savings & Investment Plans

- Saving Schemes

- Save Money For Salaried Professionals