The value of saving your hard-earned money cannot be underestimated. Saving money is undoubtedly one of the best financial practices that any person should consider. With a savings plan based on your monthly income plan, you can always have the life you want with some extra cash for backup and protection.

It is never as easy to save money as just cutting back on spending. It goes far further than that, depending on what your goals are. An excellent way to start saving is by evaluating the status quo and knowing how you invest money first. Redistribute your funds by listing your goals – at the same time, ensure that you budget each of these expenses. For example, if your salary is 50,000 a month, you can save 8,000 a month. Put it into an FD or long-term investment or income plan. To cover your costs of living, the remainder of the income should be reallocated.

Best Monthly Saving Plans Offered by Canara HSBC Life Insurance

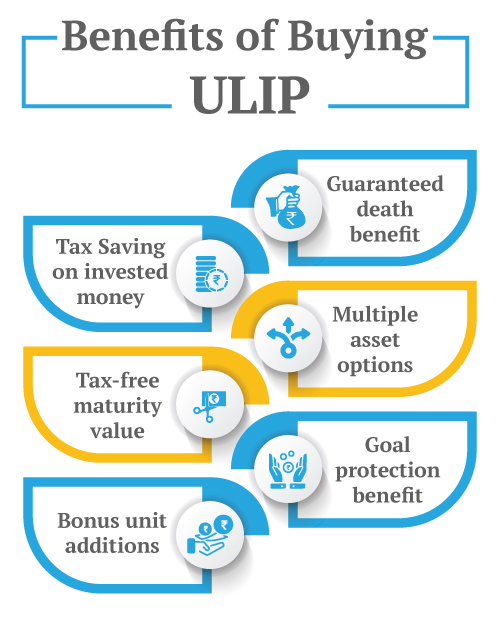

1. Unit-linked Insurance Plans

You can adjust the amount assured over the policy period with community insurance policies from Canara HSBC Life Insurance. Many plans provide the option of opting between a linear and a decreasing amount insured. Master policyholders may also increase the amount of insurance, depending on the members' promotion or salary increase.

The premium payment method of plans can also be altered. You can choose whether to pay the premiums of specific plans monthly, quarterly, half-yearly, or annually.

A wide variety of fund options combined with a wide range of portfolio management strategies help insurance companies develop ULIPs to meet different financial objectives. ULIPs for savings can be divided into three major categories: single/regular premium plans, guarantee/non-guaranteed plans, life-stage/non-life-stage plans. You could either choose to pay a lump-sum fee for ULIP as a premium or opt for the program to allocate small amounts of money at periodic intervals.

2. Smart Monthly Income Plan

One-time premium payment plans are known as single premium plans, while standard premium plans are called multiple premium payment policies.

Canara HSBC Life Insurance Smart Monthly Income Plan will help you plan well as you step towards the glorious years of life. The plan offers:

a) Tax-free, Guaranteed monthly income for 15 years to make your dreams come true.

b) Lump sum money through annual and final bonuses to generate a pool of money for your loved ones.

c) Develop a legacy for your loved ones with a 25-year life cover.

d) Guaranteed profits and incentives

The money to be invested in a savings plan each month depends on income, current financial obligations, and the long-term financial objective. If you have a stable income, you should save at minimum 20% of your monthly income. It is not essential to invest your entire savings into a savings plan as investments should be distributed. Instead, it would be great if you aimed to have a financial buffer of more than ten times your annual income.

You May Also Read About - Post Office Monthly Income Scheme (POMIS)

Why do you Need a Saving Plans?

To lead a happy life, it is necessary to fulfill certain critical financial obligations. These responsibilities may be of various forms, ranging from children's education and marriage to your retirement. Put aside, a specific sum regularly may not be appropriate as inflation may deepen its value. Each purpose involves planned and committed investments, and the best way to create a corpus over time is to have savings plans. Savings plans are also worthy of your attention for several other reasons.

1. Regular Savings

A savings plan lets you instill a habit of saving by daily payment of the premium amount. To keep your savings plan active, you will have to pay premiums regularly without fail. You should set aside a predetermined sum for the savings amount that you can periodically save for your goals.

2. Guaranteed Returns

A savings plan offers assured returns, which separates it from other options for investment. Traditional non-connected savings plans are not subject to market risks, maintaining guaranteed returns. A unit-linked savings scheme also provides the policyholder with a host of options for the preservation of capital.

3. Tax Benefits

The premiums paid for savings schemes are eligible for tax deductions under Section 80C of the Income Tax Act, 1961.

4. Life Cover

You get a life insurance cover with a savings plan. Life cover is not as high as life insurance, but it also offers your family an extra layer of financial protection.

Saving plans are life insurance plans that provide people with a chance to save, invest, and generate funds for their future.

These savings plans enable individuals to spend systematically, build daily saving patterns for policyholders, and bring huge returns. You can have a savings plan with customizable features to meet your needs and preferences. This form of the plan also tends to be one of India's best plans.

Canara HSBC Life Insurance offers various savings plans based on monthly income plans. These saving plans provide an individual with the option of paying monthly and annual premiums as per one's convenience. Such plans are flexible and can be customized for premium payments as per the needs and requirements of an individual.

Our Top-Selling Insurance Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Fixed Returns, Zero Risks & Worries

- 4 plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Save, Dream, Plan. Live Peacefully

- 5 plan options

- Option to choose PPT

- Get Tax benefits

- Premium protection cover

Recent Blogs

Popular Searches

- Senior Citizen Saving Scheme

- Post Office Savings Scheme

- What is Sum Assured?

- Money Saving Tips

- Saving Plans for Child

- Endowment Policy

- iSelect Guaranteed Future Plus Plan

- National Savings Certificate

- Tax Saving Plans

- Senior Citizen Savings Scheme Calculator

- NPS and PPF

- Savings & Investment Plans

- Saving Schemes

- Save Money For Salaried Professionals