Life insurance and retirement plans are necessary to safeguard your family's future, but very often, the jargon used by banks and insurance agents is difficult to grasp. These kinds of misunderstandings will lead to many problems in future like overspending or extravagant future plans with the confidence that their saving plans have them covered, only to realize that the sum they will be paid is far less than they realized.

This is a global problem faced by insurance agents everywhere when customers show up and ask for benefits that were not covered in their contracts. Two terms people often confuse with each other are 'guaranteed returns' and 'assured returns", which may sound similar, but relate to entirely different things. While both terms are linked with the monetary benefits of saving schemes, they are not the same.

What are Guaranteed Returns?

In case of guaranteed returns, the conditions that have to be fulfilled regarding the bank's financial health do not exist. This means that the benefits will have to be paid to the investor, regardless of the financial state of the bank or the insurance provider. A guaranteed, predetermined (at the time of the plan's purchase) sum of money will be paid as a monetary benefit.

In life insurance, the guaranteed return is the minimum sum that the policyholder or nominee receives when they reach the age of maturity, or in other words, outlive the life insurance policy tenure.

A policy buyer who wants to buy investment plans in India should look at the amount of the guaranteed returns on the plans they are going through. The higher guaranteed returns sum is far likely to secure your family's future than highly volatile assured returns.

Advantages of Guaranteed Returns

- Regardless of its financial health, the insurance provider is liable to pay the policyholder a premeditated sum of money upon maturity.

- Such plans involve fewer risk factors and often better benefits.

Disadvantages of Guaranteed Returns

- The amount for guaranteed returns is usually lesser than how much an assured return could be. This is because the bank wants to minimize its risk factor to avoid bankruptcy.

- Premiums may be higher.

Things to Consider before Buying a Guaranteed Life Insurance Plan

Before you buy a life insurance plan to meet your investment goals based on guaranteed returns, consider the following factors:

- Non-participatory Plans

Non-participatory plans may guarantee returns in the form of guaranteed additions instead of declaring the bonus assured returns that depend on the profit that insurers make.

- Convoluted Phrases

Sometimes banks claim to offer 'guaranteed returns of 126-138 percent of annual premiums', but these are often convoluted ways of phrasing simple guaranteed returns, which are usually just 8-9% of the premiums.

- Accuracy

Guaranteed additions are not the same as guaranteed returns because guaranteed benefits only accrue and become valid when the policy reaches maturity, and the amount is rarely disclosed accurately to the customer.

- Lower Guarantees

Guarantees come with a cost. The actual guarantees may be low to safeguard the bank's personal interests. The average internal rate of return in a plan is somewhere between 4-6% per annum, and sometimes even lower returns are paid out.

- Start Dates

Guaranteed returns sometimes start on a later date in some cases, when some plans only begin adding guaranteed returns to the policy after a few years. Often, the payouts for guaranteed returns savings plans are paid over a certain number of years after maturity.

The death benefit usually is the higher of the Sum assured on maturity or the premium amount multiplied by a certain percentage. Sometimes, it is 105% of the total premiums paid and is more or less consistent across investment plans in India.

What are Assured Returns?

Assured returns, to put it simply, is offered by the provider of insurance or saving plans when it is already decided that the benefits will be provided, regardless of the market performance of the fund option. Even if the market performance is poor and not up to the mark, or if the bank is experiencing market-related volatility, the investor will have to be paid the money that they were assured.

However, this assured benefit does depend on the capital-resource health and financial state of the insurance company. If the bank or insurance provider declares bankruptcy or simply does not have enough funds to pay off the investor, they will not be entitled to any benefits.

You may be surprised that market performance sometimes has an important role to play in how each insurance plan pays you - banks are businesses too, and lending large sums of money and safeguarding the lives of thousands of people is only possible if there are some profits to keep the infrastructure and the machinery functioning. Small banks often offer assured returns instead of guaranteed returns to ensure that they do not go bankrupt.

Sum Assured does not mean Assured Returns

There are different types of investment options available in INDIA that offers assured return on investment.

The minimum sum payable by the insurer in case of policyholder's untimely demise is referred to as the sum assured. This implies that the sum assured is the actual coverage offered by the plan you chose. It also directly determines how much money the policyholder has to pay a premium for his installments.

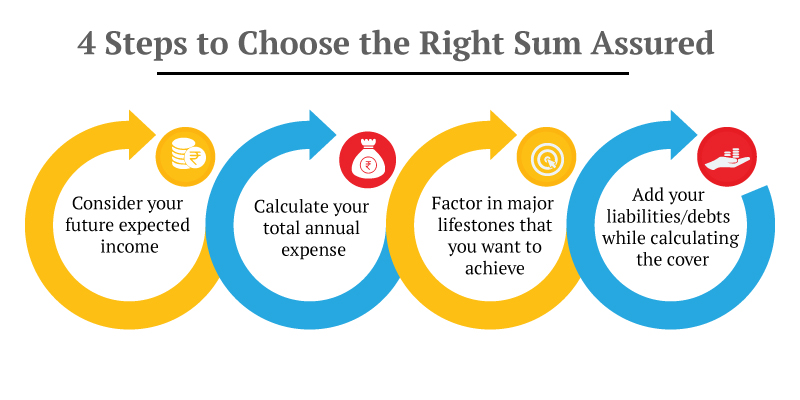

Clearly, the sum assured amount is something you have to look out for when picking out your investment plans.

Advantages of Assured Returns

- If the monetary value of your life insurance grows over the tenure of your policy, your assured sum may increase.

- The risk factor is usually low when a reliable bank is chosen.

- When the bank denies claims they are not in poor financial health, you can always take them to court and ask for compensation.

However, if you are making plans with assured returns, make sure you have a few backup plans ready to avoid a situation where there are no returns.

Disadvantages of Assured Returns

- If you choose to invest in a bank with an unsteady track record, you may not receive a large sum as an assured return.

- Extremely high-risk factors, especially when investing in a small or amateur bank.

- Chance of your nominees being denied death claims or maturity benefits is high. Learn how much time does it take to settle a death claim in a life insurance policy?

Things to Consider before Buying a Plan with Assured Returns

- Risk Factor

Assured returns come with a risk factor that depends entirely on the insurance provider's financial health.

- Bank's Financial State

Make sure that you research the bank's financial status over the past few years. Collect all the information about the bank before you buy a life insurance plan that offer assured returns.

- Track Record

Try to find out the insurance provider's CSR. The claim settlement ratio of any insurance provider is their track record of paying out insurance claims made by their clients.

- Extra Guarantee

Check if your assured plans have guaranteed benefits that you can purchase at extra cost - this way, you will get the benefits of assured sums as well as the guaranteed returns.

While guaranteed returns, assured sum, and assured returns are all elements of life insurance policies and savings plans, you do not always have to buy two separate plans to avail of these benefits. Most policies offer both a sum assured and a guaranteed return, with the catch being that the policyholder will receive only one of the two. The risk you want to take on when you choose a saving plan may not always be clear at the outset, which is why you should have the necessary knowledge to choose the right plan for you.

Guaranteed Savings Plan by Canara HSBC Life Insurance offers guaranteed benefits and the option to choose your savings horizon. If all premiums have been paid, you will receive guaranteed benefits at maturity. This plan provides life cover for the entire term, where you have to pay premiums only for a limited, predetermined period. Nominees will be paid a guaranteed lump sum of money on the untimely demise of the policyholder, and the remaining premiums will have wavered. Guaranteed benefits will be paid to the nominees when the maturity date is reached.

Our Top-Selling Insurance Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Fixed Returns, Zero Risks & Worries

- 4 plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Save, Dream, Plan. Live Peacefully

- 5 plan options

- Option to choose PPT

- Get Tax benefits

- Premium protection cover

Recent Blogs

Popular Searches

- Senior Citizen Saving Scheme

- Post Office Savings Scheme

- What is Sum Assured?

- Money Saving Tips

- Saving Plans for Child

- Endowment Policy

- iSelect Guaranteed Future Plus Plan

- National Savings Certificate

- Tax Saving Plans

- Senior Citizen Savings Scheme Calculator

- NPS and PPF

- Savings & Investment Plans

- Saving Schemes

- Save Money For Salaried Professionals