Sum assured is a term inseparable from insurance, more specifically the life insurance. The literal meaning of the term ‘sum assured’ is ‘promised sum’, or the amount that has been assured to you by the insurer’. It is also called the benefit amount in insurance. However, the benefit amount or sum assured, works differently in different policies.

In general, life insurance policies refer to the benefit amount as ‘sum insured’ and base it on the ‘principle of indemnity’. But life insurance plans do not work on the indemnity principle. Instead, the human life value concept forms the core of life insurance contracts including the unit-linked plans or ULIPs.

To understand the life insurance benefit amount we should have a look at the principle behind this concept.

What Is the Principle Of Indemnity?

Insurance concept works based on seven basic principles. Principle of indemnity is one of these prime rules that every insurance contract must follow. This rule determines the size of financial support that you will receive from an insurance policy when a covered event happens.

For example, in car insurance, when your vehicle meets an accident and you file a claim for repairs. The insurer will assess the damage and then reimburses a part of the total cost.

If you compare multiple claims, you will notice that the reimbursement amount is always lower than the total expense. This is what principle of indemnity states.

As per this principle, insurance should only help the insured to restore his/her financial position before the loss. Meaning, if you insure an asset such as your car for Rs 10 lakh, incur a loss due to damages of Rs. 50,000, the insurer will reimburse a maximum of Rs 50,000.

What is Human Life Value?

It is not possible to estimate the financial loss to a family due to the death of the breadwinner. So, life insurance plans cannot follow the principle of indemnity verbatim. However, they still need to consider the limits and other six principles.

Life insurance plans have the concept of ‘human life value’ or HLV in place of indemnity. You can calculate your HLV based on your current income. In fact, the life insurance companies base it on your current annual take-home income. This also means that your HLV keeps changing with your income.

Insurers agree to this thumb rule of limiting maximum life cover for one person to 10 to 20 times of the annual take-home income.

What Is Sum Assured?

Your total available life cover at any moment should remain within 20 times of your annual take-home income. How will insurers know when you have reached the limit?

Every life insurance policy carries a ‘Sum assured ’ amount, which is usually payable as death claim to your nominees. Sum assured is usually the most prominent number in the life insurance plan at the time of purchase.

For example, if you buy a term insurance cover of Rs 1 crore at the age of 30, you pay an annual premium of Rs. 10,000. 1 crore here is your sum assured, which the insurer has promised (assured) to pay to your family in case of your death within the policy term.

Meaning in case of your death within the policy term, the insurer will pay your family Rs. 1 crore as the death benefit. The policy ceases to exist after paying the claim.

Sum Assured in ULIPs

Unit-linked Insurance Plans (ULIPs) brings the best of both worlds – insurance and investment in one product. ULIP plans are the best way to invest in essential long-term goals such as a child’s education or marriage. The life insurance cover will ensure that your child can meet the goal despite your untimely demise.

Similar to term insurance plans ULIPs too have a life cover associated with the plan. The life cover is the sum assured. But only a part of the death benefit. Death benefit works very differently in ULIPs.

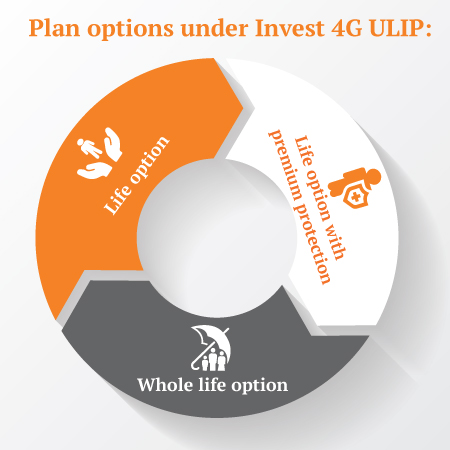

Let’s take the example of Invest 4G ULIP plan from Canara HSBC Life to see how sum assured works in different ways under the same plan.

Death Benefit vs Sum Assured

Options 1 & 3: Life & Whole Life Option

Life and whole life options are simply the life cover with an investment option. The only difference with whole life option is that the cover continues till 99 years of age. This option will pay the highest of the following three as death benefit:

- 1105% of all premiums paid until the death

- Sum Assured of the policy

- Accumulated fund value in ULIPs

How does it work?

Assume that you are 30 years old and want to accumulate Rs. 1 crore in 20 years. With Invest 4G plan, you find that you can invest Rs. 2 lakhs a year and achieve your goal.

Here are a few things that will happen provided you survive the policy term:

- Your total investment in the policy will be Rs 40 lakh

- You will receive approximately Rs 1 crore at the end of the 20-year policy term

- The policy will stop after 20 years

In the case of untimely demise in the 15th policy year:

- You have paid total premiums of Rs 30 lakhs till 15th year

- Your fund value in ULIP is approx. Rs 60 lakhs after growth

- As per the highest of the three option, your family will receive Rs 60 lakhs as death claim settlement

However, if for some reason, such as bad market performance, your fund value is below Rs. 30 lakhs, your family will receive Rs 31.5 lakhs (105% of total premiums paid).

In the case of demise in the 7th policy year:

- The total premium you have paid is Rs 14 lakhs

- Your fund value is approx. Rs 19 lakhs

- As per the rules your family receives Rs 20 lakhs (policy sum assured) as death claim settlement

Option 2: Life Option with Premium Funding Benefits

In this option, the policy helps the family meet the goal even after your death. The policy will pay a lump sum amount immediately at the death, but the investment will continue.

The death benefit in this unit-linked plan will be higher of the following two options (picking up from the previous example):

- Sum Assured of Rs 20 lakhs

- 105% of all Premiums, paid until the death

So, in case the death occurs in or after the 10th policy year, the minimum death benefit for the family will be Rs 21 lakhs (105% of premiums paid). However, before the 10th policy year, it’ll be Rs 20 lakhs (actual sum assured of the policy).

Also, after the payment of death benefit, the policy doesn’t stop. The accumulated fund’s growth continues as intended. The insurer deposits all the remaining future premiums when they are due, and the family will receive the accumulated funds at maturity.

Thus, this option is useful for uncompromising goals such as your child’s education, retirement corpus for the spouse, etc.

Tax Exemption on ULIP Investments

In case you are still wondering ‘Why should you invest in ULIP?’ know that every benefit payment discussed above is exempt from tax. The premiums you pay in the ULIPs help you save tax up to Rs 1.5 lakhs under section 80C of the Income Tax Act.

Also, any payments you receive from the ULIP plan will be tax-free under section 10(10D). The only condition is that you keep your annual investment in the ULIP to less than 10% of the sum assured.

ULIP Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling ULIP insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Don't Just Survive, Thrive

- 3 Plan Options

- Life cover + Guaranteed benefits

- Total Premiums at maturity

- Early income from 2nd policy year

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs