With time, the cost of medical treatment has increased rapidly in India. A change in the lifestyle of people living in the country has led to a rapid increase in the number of health insurance customers. Health insurance offers medical expenses to the policyholder in case of any health emergency. Coverage for different expenses depends on the policy.

As of now, in India, there are numerous health insurance companies and policies. So, it is hard to select the best health insurance policy for your loved ones. The below-mentioned tips and tricks can help you choose among the sea of options.

1. Buy health insurance early

Buying a health insurance at a young age will provide you with the following benefits:

a) Low premium amount

b) The waiting period can be spent when you are healthy

c) Minimal chances of rejection

Find out the right time to buy a health insurance plan.

2. Select the right policy coverage

Try selecting a health plan that can cover a wide range of medical, post and pre-hospitalization cover, critical illness cover, cashless treatment, daily hospital cash benefits, maternity benefits, ambulance charges, etc. When you are buying health insurance for your family, make sure that the health insurance plan can meet the needs of each member of the family.

Write down all your requirements, compare them with various plans available and select the best policy that can meet your needs. Do not forget to check out the hidden factors like policy features, limitations, sub-limits, waiting period, daycare procedure coverage, organ donor expenses, newborn baby expenses, etc.

It is mandatory to go through every word of the policy. Hence, ensure that your family does not need to face any difficulty at the time of the claim.

3. Select a plan with a lifelong renewal feature

Renewal is a prime factor to be considered while choosing a health insurance plan. With age, health problems and diseases also increase. Hence, health insurance is mandatory for any person at an older age. So, while selecting your health insurance plan, check for the policy that offers lifetime renewability. Selecting a lifetime renewable plan will reduce the hassle of buying another insurance plan once you cross the age limit.

For example, if you choose a policy that has an age limit of 50 years, you will have to buy another insurance after you cross 50 years. Hence, it is better to select a plan with lifetime renewability. This will keep you and your loved ones covered for a lifetime.

4. Check for co-payment clause

Take a look at the co-payment clause before selecting the health insurance plan. The co-payment clause is the percentage of the amount that has to be paid from your pocket.

For example, if your policy has a co-payment clause of 5%. For a claim of Rs. 1 lakh, you have to pay Rs. 10,000 from your pocket while the insurance will be paying the rest of the Rs. 90,000 as a part of the claim. There are also policies without a co-payment clause.

5. Check for the waiting period

In general, health insurance plans will include pre-existing diseases, maternity expenses, and certain other treatments only after a specific period. This period varies from plan to plan. Hence, look at the time duration after which the pre-existing diseases will be covered in your policy. It is always recommended to select the policy that has the least waiting period.

6. Prefer a family plan over an individual plan

Individual plans are usually for individuals that don't have a family. But if you have a family, it is better to take a family health insurance plan rather than taking an individual policy. Through a family health plan, you can have maximum benefits at an affordable price.

Check these 5 tips before buying a health insurance plan.

7. Check for flexibility to add new family members

When purchasing a family health plan, it is advisable to choose one where you can easily include any new member of the family. In case any one of the family passes away, then the other family members can continue the same policy without any issues.

8. Wide network of hospital range

Preferring insurance that provides a wide network of hospital ranges is useful. Through this, you can have convenient and cashless settlements irrespective of your location.

9. Limit of room rent

The plan you choose will determine the room you will be given, whether it is a private, semi-private or shared room. If you are not able to choose a plan that has a high room rent limit, the rest of the room rent has to be paid from your pocket. Hence, it is recommended to select a plan that has a high room rent limit.

10. High claim settlement ratio

Select a company that has a high claim settlement ratio. The settlement ratio is the percentage of settled claims over the received claims by the health insurance company. Choosing a company that has a high claim settlement ratio will keep you in safe hands.

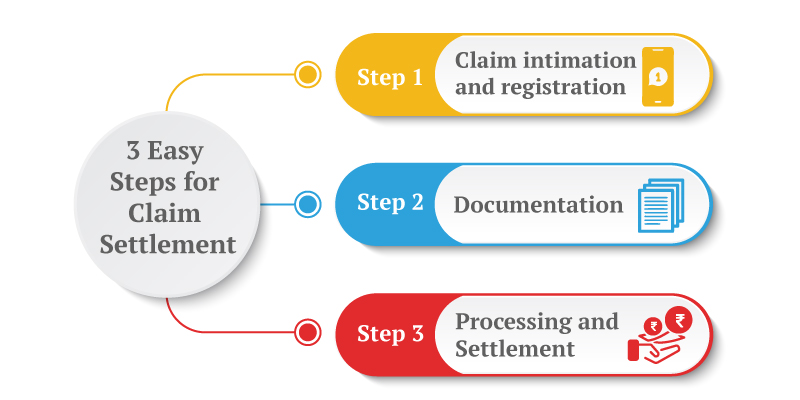

For example, if a health insurance company has a 90% claim settlement ratio, it means that the company has settled 90 claims of every 100 claims received. That is a prime factor to be considered while choosing a health insurance company for your family. Canara HSBC Life Insurance has a Claim Settlement Ratio of 99.23%^ for FY 2023-24. We have an easy and simple claim settlement process.

From factoring in the settlement ratio to looking at the number of network hospitals, you now know how to pick the right insurance plan. By understanding and utilizing the above mentioned ten tips, you can choose the best health insurance plan for your family and loved ones without any difficulty.

Don't know where to start your search? Know your options by checking out health plans from Canara HSBC Life Insurance that can fulfil all your family requirements. Health First Plan offers comprehensive coverage at affordable premiums. It provides you with a lump sum amount when diagnosed with heart and cancer-related conditions and on pre-defined 26 major critical illnesses. This health plan is designed to provide you complete freedom of choosing the cover you need, and also provides multiple customization options to suit your requirements. The lump-sum amount paid can help you overcome the immediate medical expenses without compromising on your lifestyle.

Recent Blogs

Popular Searches

- Family Health Insurance Plan

- What is Health Insurance?

- Health Insurance For Parents

- Health Insurance Tax Benefit Under 80-D

- Health Insurance Facts

- Difference Between Life and Health Insurance

- Difference Between Life and Health Insurance

- Incurred Claim Ratio

- What is Copay in Health Insurance?

- What is Cashless Treatment?

- Accidental Cover in Saral Jeevan Bima

- Accidental Cover in Saral Jeevan Bima

- Tips to Buy Health Insurance

- Short Term Health Insurance Plan

- When Should You Buy Health Insurance?