It is important to understand that health insurance plan is crucial for every senior citizen. It helps them in achieving financial stability. Senior citizen health insurance is specifically intended for people of more than 60 years of age. Similar to other insurance plans, senior citizens' healthcare policy is an agreement among the insurance company and the policy holder.

Owing to the growing medical inflation and the increasing risk of COVID-19, a health insurance policy including an adequate sum guaranteed is a must for all. It is also vital if you have grandparents at home. As they grow old, they grow more sensitive to several conditions, and they may require visiting the hospital regularly. Suppose both your parents or grandparents are covered under the group health insurance policy administered by your employer. In that case, it is preferable to acquire a separate health insurance policy for senior citizens.

When you buy a health insurance policy, you are required to fund a premium to the insurer. In recovery, the insurer consents to compensate for the medicinal costs you may acquire. One of the notable benefits of health insurance plan for senior citizens that differentiates it from the standard health policies for young people is its costlier premium.

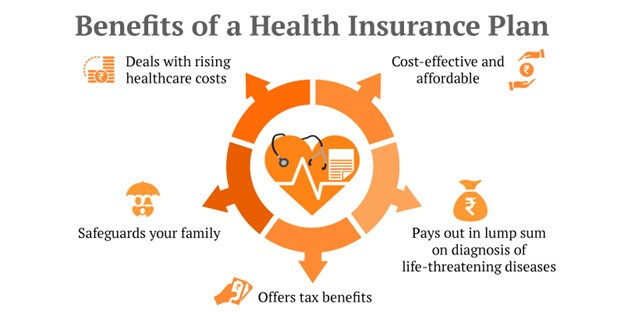

3 Benefits of Health Insurance Plans for Senior Citizens

Health Insurance Plans for Senior Citizens offers a variety of advantages to older people. It compensates for the costs acquired on hospitalization, surgery procedure, critical illnesses, accidental damages, and pre-existing conditions. If the policy is renewed up-to-date, it can cover you until 80 years with lifetime renewal privileges.

Here are some of the fundamental advantages of buying senior citizen health insurance in India:

1. Medical coverage to elderly people

Individuals over the age of 60 years receive health coverage under health insurance plans for senior citizens, as a primary health plan only presents coverage up to the age of 65 years.

Learn how to buy the best health insurance plan for your loved ones.

2. Pre-medical check-up

The majority of the plans do not demand any pre-medical check-ups. In few plans, pre-medical tests may be needed.

3. Tax benefits

A significant additional benefit is that the senior citizen health insurance policy extends tax exemption privileges under Section 80D of the IT Act. The amount of the premium that is spent is qualified for tax exemption advantages for each financial year.

Three Things to Check Before Buying a Health Insurance Plan for Senior Citizens

Now that you are informed of the advantages of health insurance for senior citizens, it would be essential to understand how to purchase a health policy for the old aged people. Especially, during COVID-19 pandemic, buying a health insurance plan has become an extreme necessity.

1. High coverage for hospitalization costs

In essence, all health insurance policies comprise the in-patient hospital charges, which imply the insurer will pay for the expenses you may acquire while admitted to the hospital. The expenditures covered incorporate– doctor consultation charges, medicines, diagnostic tests, etc.

Nevertheless, few senior citizen health insurance policies may have a sub-limit for specific expenses. For instance, few plans covering in-patient hospital costs may hold a sub-limit on the doctor consultation charges or restriction of the bed prices.

Usually, senior citizens may necessitate hospitalization for a more extended span. Therefore, it is eminent that you search for an old citizen health insurance that renders the most significant coverage for hospitalization costs.

2. Comprehend regarding the waiting period

The waiting period relates to when the policyholder cannot register a claim for any pre-existing illness-related costs. All health insurance policies possess a waiting period clause, and it ordinarily varies from six months to four years.

However, several insurers have decreased the waiting period by one year for senior citizens' health insurance. As a thumb rule, you need to look for a policy with the most reasonable waiting period not to fulfill the hospital costs from your pocket.

3. Learn about the exclusion

As it is necessary to identify the policy inclusions, it is equally crucial to be informed of the exclusions. The health insurance for senior citizens does not cover some costs, consisting of cosmetic operation, dental procedure, diseases diagnosed within 30 days after purchasing the policy, treatment expense of STDs, AIDS, etc.

Before you decide to sign policy documents, you should carefully read the fine print to identify the diseases eliminated from the policy to bypass filing false claims. You can support the senior citizens in your family to safeguard their health by providing the best health insurance cover. By carefully analyzing the information, your parents can make the most out of these plans by enjoying their benefits without worrying about the medical expenses. Health First Plan by Canara HSBC Life Insurance is a comprehensive health insurance plan that you can buy online. It offers a lump sum amount on diagnosis of life threatening diseases, which will help in managing the expenses smoothly.

Recent Blogs

Popular Searches

- Family Health Insurance Plan

- What is Health Insurance?

- Health Insurance For Parents

- Health Insurance Tax Benefit Under 80-D

- Health Insurance Facts

- Difference Between Life and Health Insurance

- Difference Between Life and Health Insurance

- Incurred Claim Ratio

- What is Copay in Health Insurance?

- What is Cashless Treatment?

- Accidental Cover in Saral Jeevan Bima

- Accidental Cover in Saral Jeevan Bima

- Tips to Buy Health Insurance

- Short Term Health Insurance Plan

- When Should You Buy Health Insurance?