A health insurance policy can be defined as financial coverage against medical expenses incurred owing to accidents, illness, or injury. An individual can pertain to such a policy against monthly or annual premium payments for a specified term. During the applicable period, if an insured gets involved in an accident or is diagnosed with severe disease, the expenses incurred for treatment purposes are provided by the health insurance policy.

Health plans do cover COVID-19 expenses. However, you should check with your insurer whether they cover COVID-19 in your existing policy. If not, you must look for a new health plan that covers COVID-19.

Six Tips to Buy the Best Health Insurance Policy

Buying the best health insurance plan will help you protect your loved ones. Health insurance policies help you financially when you are diagnosed with a life threatening diseases. Here are six tips to buy the best health plan online in India:

1. Select the right coverage amount

Select a health plan that secures you against a wide range of medical problems. It must provide benefits such as pre and post-hospitalization fees, daycare expenditures, transportation, illnesses, ailments that might be related to your family's medical history, etc.

If you are buying a health insurance policy for your family, check the applied terms and regulations for each member of your family.

Explore these 10 tips to find the best health insurance policy for your loved ones.

2. Choose a reasonable plan

The selected health insurance must fulfill your requirements, and it must suit your budget too. It's important to choose an affordable insurance. In the beginning, choose a plan wisely that covers your basic medical needs. Later on, you can review your plan and increase cover with premium features according to your income, family size, and requirements.

3. Choose family plans over individual health plans

Individual health plans are suitable if you do not have a family to support. If you are buying a health insurance policy for your family, it gives you more coverage and benefits.

4. Prefer a policy with lifetime renewability

One of the most important factors to remember always prefers a health insurance plan with a lifetime renewal option. When you buy a health plan, don't forget to check for applicable policy tenure and whether it serves a limited renewability period or not.

5. Compare health insurance online

Look for health insurance policies on different websites and compare quotes to ensure that you buy a favorable health insurance plan. You can even request the policy details online by entering your requirements on the website and get an estimated premium for your policy.

6. List of hospitals covered

After selecting a list of health insurance plans, check the list of hospitals that are included in the mediclaim. Look for the names of your preferred hospitals and doctors in the hospital network. Always choose an insurance company that has a wide network of hospitals across the world or which covers many hospitals.

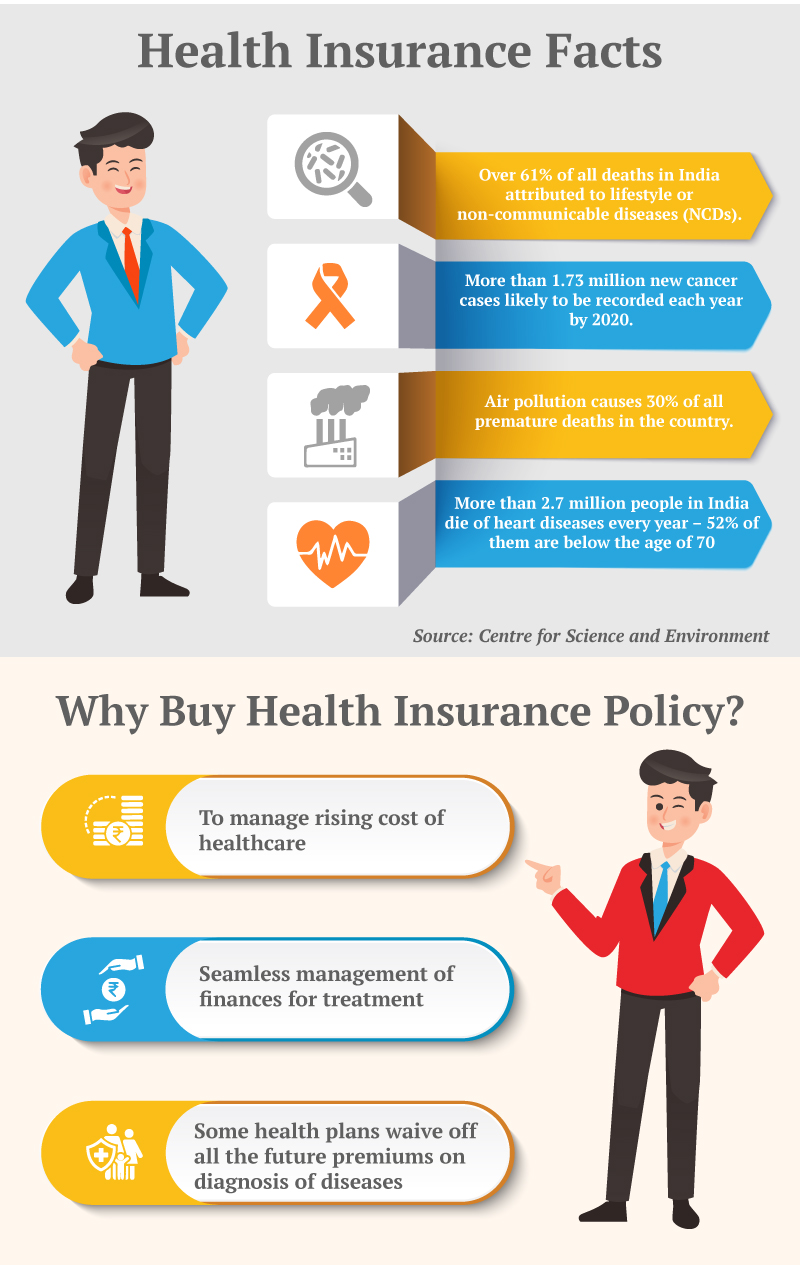

Why do you need a Health Insurance Policy?

As the COVID-19 pandemic rages on, the death toll has increased rapidly. Medical services and hospital treatments have gained tremendous importance due to COVID-19. A constant rise in the cost of medical services has been observed, so it's better to be prepared with a medical insurance policy to cover your medical expenses in case of emergency.

Choose a medical insurance policy if you already haven't. During such times, it is important to have a protective shield around you and your family. Buy your health insurance from Canara HSBC Oriental Bank of Commerce Life Insurance. Health First Plan is a comprehensive health plan that gives you option to cover yourself against heart ailments, cancer, and other major critical illnesses.

Disclaimer

This article is issued in the general public interest and meant for general information purposes only. Readers are advised to exercise their caution and not to rely on the contents of the article as conclusive in nature. Readers should research further or consult an expert in this regard.

Recent Blogs

Popular Searches

- Family Health Insurance Plan

- What is Health Insurance?

- Health Insurance For Parents

- Health Insurance Tax Benefit Under 80-D

- Health Insurance Facts

- Difference Between Life and Health Insurance

- Difference Between Life and Health Insurance

- Incurred Claim Ratio

- What is Copay in Health Insurance?

- What is Cashless Treatment?

- Accidental Cover in Saral Jeevan Bima

- Accidental Cover in Saral Jeevan Bima

- Tips to Buy Health Insurance

- Short Term Health Insurance Plan

- When Should You Buy Health Insurance?