After you retire, you look forward to enjoy your life and using your free time to do things which you couldn’t do earlier. Now you can spend more time with your wife, grandkids, and can take on new hobbies, travel the world, etc.

But after retirement, you will soon start to realize that your age is catching up with you. As you age, your body tends to be less productive.

Like everyone else, you would also not want to see either yourself or your parents grow old but who can stop life. With old age, the body becomes weak and fitness takes a toll. Also, several health concerns can start to crop up.

According to studies, healthcare costs prove to be a major chunk of a senior citizen’s post-retirement expenses.

Healthcare costs are increasing with each passing year, especially for senior citizens. To provide you with some relief from these costs, the income tax act included deductions under section 80D.

What is Knee Replacement Surgery?

Knee replacement surgery is the final solution to the joint problems happening due to old age. Knee replacement surgery has both physical as well as a financial costs. A knee replacement can cost you anywhere between Rs 5-10 Lakhs for:

- Treatment and hospitalization expenses

- Household support while you recover from the surgery

Such unforeseen healthcare expenses can dent your retirement corpus. Thus, you need health insurance that can help you shoulder the burden:

Good health insurance can cover full or part of your medical expenses in exchange for a premium. Though health insurance takes care of huge medical costs, not all health insurance includes knee replacement surgery in their plans.

Go through the policy thoroughly and make sure your policy includes knee replacement.

How much can it Cost you?

The actual cost to be incurred depends on the condition of your knees and the severity involved.

Following cases can happen:

a) Both the knees will be replaced

b) One knee replacement

c) Partial replacement

The costs are different for each of the above cases. With the highest cost of both knee replacements.

Other costs that will be incurred other than the procedure cost are:

a) Cost of tests/scans

b) Cost of staying at the hospital

c) Cost of medicines

d) Consultation fees

e) Household modifications while you are recovering

Health Insurance Plans which Cover this Cost

The huge costs involved in knee replacement surgery, it becomes important to have a policy that covers this surgery’s costs.

Now there are health insurance plans and Mediclaim’s which are specifically designed for knee surgery.

What is Comprehensive Health Insurance?

Comprehensive health insurance policies and Mediclaim offer extensive coverage. These cover a wide variety of diseases, both critical and minor. Knee-replacement surgery is also covered under a comprehensive health insurance plan.

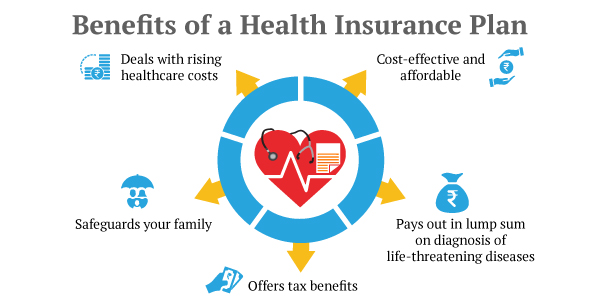

These plans act as a shield and help you tackle the financial obstacles that are brought by ever-increasing medical costs.

Apart from giving you extensive coverage, comprehensive health insurance also provides you with some other benefits:

1. Includes Both Pre and Post-Hospitalization Costs

Yes, the main operation or treatment is the biggest cost to be incurred, but these are not the only ones. Many other expenses follow before and after your treatment thus shooting the bill further. Comprehensive health insurance takes care of these expenses as well. For example, consultation costs, check-up costs, etc.

2. Includes Cover for Day-Care Procedures

Some treatments involve going to the doctors at regular intervals. For example, dialysis, etc. These are also covered under this plan.

3. Cashless Treatment

These plans work in a cashless manner. All the costs that you incur are directly paid for by the company. You just have to make sure the hospital is in the company’s network. This reduces the burden and hassle of payment from your family at the time you are suffering from a disease.

Tax Benefits Available with Health Insurance Plans

Health insurance reduces your annual tax liability. You can claim a deduction of up to Rs 25,000, towards the premium paid for your health insurance u/s 80D of the Income-tax Act. This amount is increased to Rs 50,000 if you are a senior citizen.

Section 80D Deductions

Section 80D includes deductions on premiums paid towards medical insurance.

a) Section 80D allows a deduction of Rs 25,000 if the policy is taken for itself.

b) However, if you or your parents are in the senior citizen category, then a deduction of Rs 50,000 is available.

c) If the taxpayer, as well as the parent, is 60 years or above, then the deduction available under this section is up to Rs. 1 lakh.

One big health concern that is most likely to arise in old age, is knee pain. With age, your knees can become weak and thus become unable to you. This can result in huge pain. Due to high stress work-life, if you do not take care of yourself, this condition might even come early.

Though pain in the knees is common, sometimes it can be so excruciating that you might require to undergo surgery.

Health Insurance Plans for Every Age

Health insurance plans generally cover the health risks which can cause a dent in your pocket. However, you need to have active health insurance to receive financial support.

At any given age the following two types of health insurance plans will help you shoulder almost any treatment cost:

- Mediclaim insurance

- Critical health insurance

Mediclaim insurance supports you in the case of hospitalisation and certain daycare treatments. This policy will reimburse a large part of the treatment and medical costs you incur.

Critical health insurance, on the other hand, offers a large sum of money if you are diagnosed with a covered disease. For example, cancer, heart failure, renal failure, etc.

Canara HSBC Life Insurance Health First Plan is critical health insurance. It offers wide coverage with up to 26 major/critical illnesses. You can also select cover for minor stages of cancer and heart diseases.

This plan offers you a lump-sum payout in case you get diagnosed with a cover disease immediately. It also provides a payout in the form of monthly income to take care of your family.

Recent Blogs

Popular Searches

- Family Health Insurance Plan

- What is Health Insurance?

- Health Insurance For Parents

- Health Insurance Tax Benefit Under 80-D

- Health Insurance Facts

- Difference Between Life and Health Insurance

- Difference Between Life and Health Insurance

- Incurred Claim Ratio

- What is Copay in Health Insurance?

- What is Cashless Treatment?

- Accidental Cover in Saral Jeevan Bima

- Accidental Cover in Saral Jeevan Bima

- Tips to Buy Health Insurance

- Short Term Health Insurance Plan

- When Should You Buy Health Insurance?