As new parents, we tend to do all that we can to protect the future of our children. Looking for and investing in life insurance for a child is vital. The idea of saving deliberately for your child, developing your investment, and getting the advantages at a suitable time is one that, as a parent, you may have in your mind.

By investing in a fitting savings plan, you can secure the future of your child with no difficulty. Saving plans are basically a type of life insurance plan that offers people a chance to save, invest, and aggregate assets to address the issues in the future. They are planned such that it assists policyholders in building up a financial safety net in the times of need.

A life insurance policy offering coverage on your child can help you save and invest your money for your child. The amount of money received from a child life insurance plan can be utilized for various purposes; it can be for uncertainties such as the accident of your child, illness faced by your child, or it can be simply for your child's future schooling expenses.

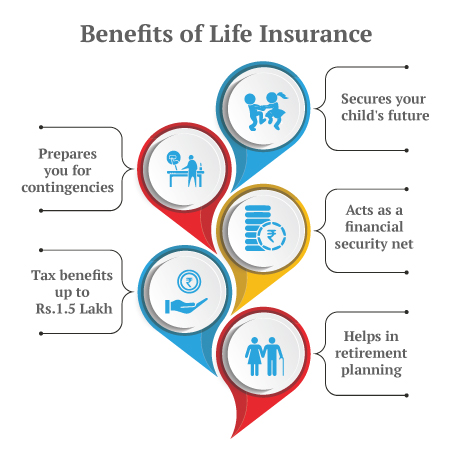

4 Ways Having a Life Insurance for your Child Benefits you

Getting a life insurance for your child can help you in various ways. Being prepared financially for the unfortunate event always provides an edge to handle such situations better. Hence, it is better that you protect the future of your child, their dreams and aspirations.

1. Expenses for Contingencies

Surely, no measure of cash can make up for the loss of a child. Yet, should the inconceivable happen, life insurance can help pay for memorial service and related costs. Today, burial services can cost quite a hefty amount, a sum that numerous families may not have.

While placing cash into an emergency fund can be another option for financing last costs, a life insurance policy can ensure that you will have a specific amount of money from the day the policy is bought. What's more? In light of the fact that the premium expense for children is normally very low, numerous families can purchase life insurance coverage and pipe money into an emergency fund.

2. Medical Expenses

Notwithstanding memorial service costs, there might be clinical costs because of a mishap or disease your child endured before their passing that is not covered by health insurance. A term life insurance plan can likewise help pay these bills.

3. Future Protection Cost

An additional benefit of having life insurance coverage on a child is that it can help guarantee assurance when the individual in question gets older. This can be particularly gainful if your child encounters health issues over the long run and experiences difficulty getting life insurance.

In the event that, for example, the child is safeguarded with a lasting child life insurance plan, the coverage can stay in power all through their lifetime. With a perpetual life insurance policy, the premium is ensured to continue as before. Notwithstanding age or health issues, the insured will pay the same amount as they did when they bought the policy.

4. Tax-deferred Savings

A lasting life insurance policy can likewise assist the child with building tax-free investment funds in the cash value part of the policy. Since no taxes are expected on the development of the money until the time funds are removed, the cash can develop and compound consistently.

Understand tax benefits available under child insurance plans.

In case you wish to borrow funds against the policy, you can regularly do so at a tax-free low financing cost. Alternatively, if you wish to pull out your funds, you can frequently evade withdrawal charges once a specific measure of time has passed.

How Guaranteed Savings Plan can help you?

Viewing the significance of ensuring a safe and sound future by having savings to fulfil every unforeseen expense related to your child's life, life insurance for a child is an unavoidable necessity. You need a life insurance plan that permits you to save routinely to arrive at your goal. Second, you need the plan to work and your objective to be accomplished regardless of whether anything happens to you.

Introducing Canara HSBC Life Insurance Guaranteed Savings Plan that offers guaranteed benefits alongside the adaptability to pick your savings skyline.

Benefits of the Plan

- Assured benefits payable on maturity of the policy, given all due charges, have been paid.

- Bestows life cover for the whole term while you pay the premium just for a restricted period.

- Improved safety for your family - Life insurance security through payment of lump-sum amount benefits on death, all excess premium payments need not be paid and guaranteed benefits payable on maturity (under Guaranteed Savings with Premium Protection Option).

- Choice of premium instalment terms that can intently adjust to your instalment limit.

- Multiple arrangement term choices to help you select the most appropriate approach term which is firmly adjusted to your monetary objectives.

- A better incentive for higher premium responsibility - High Premium Booster to guarantee that you get an additional advantage for making a higher premium responsibility.

- Tax benefits on the premium and benefits under Section 80C and Section 10(10D), according to the Income Tax Act, 1961, as altered every now and then.

Buying a term life insurance plan for a child can be an intelligent decision to guarantee that family funds stay unblemished in case of a child's demise. However, before pushing ahead, consider how much coverage your family needs, which kind of coverage appears to be best for your circumstance, and how a policy finds a way into your general financial plan.

To get suitable life insurance coverage, it is always recommended to consult an insurance expert or counsel to help evaluate your coverage needs.

Life Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs

Popular Searches

- Term Life Insurance

- Whole Life Insurance

- Critical Illness Insurance

- Accidental Death Benefit Rider

- Compare Life Insurance Quotes

- Best Life Insurance Companies In India

- Factors Affecting Life Insurance Premiums

- Insurance For Tax Savings

- Life Insurance For Children

- Life Insurance Rider

- Life Insurance Plans

- Types of Life Insurance

- Term Life Insurance Tax Benefit

- What is Insurance?

- Life Insurance Premium