Life insurance plans act as financial support for your loved ones in your absence. By including it in your financial goals, you build a corpus and provide a life cover to your family. Life insurance policies save tax and act as a long-term investment.

Imagine this; you spend your life providing for a family. Your family is dependent on you for everything. Have you ever wondered what would happen to them once you are no longer there?

Life is unpredictable, and the pandemic has been a lesson. People are looking to buy life insurance covers for their families, as human value has increased. However, those with existing life insurance policies have the edge over others.

Five Reasons to Invest in Life Insurance Policy

The foremost reason that people need to invest in a life insurance policy is the pandemic. Covid-19 has changed the perspective of many, as people have realized how unpredictable life can get. In such unprecedented circumstances, most people are getting life insurance cover for their families.

Here are 5 reasons why life insurance is important in 2021:

1. Smart financial planning and life insurance

Life insurance policies are an integral part of smart financial planning. It allows you to achieve your long-term and short-term financial goals. A life insurance policy cushions you in case of emergencies, particularly post-retirement.

Read how life insurance is the key to happiness post-retirement.

2. Financial assistance for dependents

Financial assistance is the most important reason that one gets a life insurance policy. It is a safety net for dependents and helps them repay any debts taken in the policyholder's name. Moreover, a life insurance policy covers any educational expense of your children as they receive maturity benefits.

It would act as a replacement for the loss of income, especially if your family were solely dependent on you for income. Certain add-on riders also cover terminal illness, accidents, disabilities, and surgery.

3. Diversify your investments with life insurance

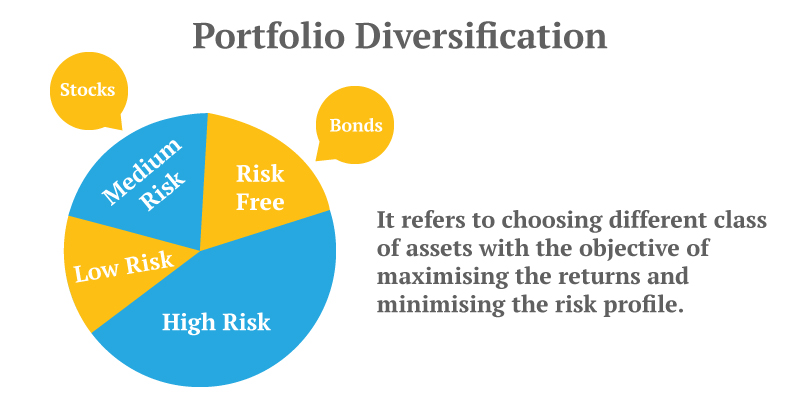

Life insurance policies are low-risk investment options. You can diversify your investment portfolio by investing in life insurance. This ensures that you have a stable investment that balances your risk options.

4. Build retirement corpus with life insurance

A life insurance policy can be cheaper at a younger age. For instance, Rahul, aged twenty-five will be charged a lesser premium than Sheela at thirty-three. This is because Rahul will be expected to pay premiums for a longer period. By enjoying low premiums, you can keep your investments intact.

5. Life insurance has tax benefits

A life insurance policy helps you save on tax because of the attached benefits. It is a tax-saving investment option for policyholders and investors. The premiums are deducted from taxable incomes as per the provisions of section 80C.

The total amount of the premium should be equal to or less than 1.5 lakhs for this provision to take place. Moreover, the maturity bonus or the death benefits under a life insurance policy are tax-free under section 10.

Types of Life Insurance Policies

There are three types of life insurance plans available in India, and each has its unique feature. These are tailored to suit the unique needs of people and have different premiums.

1. Term life insurance

Term insurance is the most popular form of life insurance in India. Term life insurance has low premiums, which makes it a popular choice with middle-class families. However, term life insurance has a specific tenure, such as 10 years, 20 years, and 30 years.

2. Universal life insurance

Universal life insurance also has a low premium policy and comes with investment savings. The premiums of Universal Life Insurance Plans are usually flexible, though there might be a single lump-sum premium or scheduled fixed premiums.

3. Whole life insurance

A whole life insurance policy has guarantees and comes with additional death benefits. You get cash value and the maturity amount if you outlive your tenure.

Understand the difference between Universal Life Insurance and Whole Life Insurance.

Best Life Insurance Plans Offered by Canara HSBC Life Insurance

Canara HSBC Life Insurance has a wide variety of life insurance plans that you can choose from as per your financial goals and requirements. Choose the best life insurance plan to provide a safe and secured financial future to your loved ones.

1. 4G ULIP

Invest 4G is a ULIP or Unit Linked Individual Life Insurance Savings Plan. This is a customizable plan which can be molded as per your financial goals. The plan comes with the flexibility of paying a single lump-sum premium or for a fixed tenure. The deducted mortality charges are added to your fund value after maturity.

2. Guaranteed Savings Plan

Guaranteed Savings Plan provides a life cover for your entire term while you pay premiums for a limited tenure. It is a guaranteed benefit, which you can receive after maturity if you have paid all premiums.

It has a relatively higher premium, but the value you receive is more. It also comes with added tax benefits under section 80c.

3. iSelect Smart360 Term Plan

This versatile plan can cover your spouse and has a limited premium payment option. Moreover, you get an increasing sum at an affordable price. Canara HSBC Life Insurance also gives you multiple payment options.

Existing policyholders have the edge over others as their plan already includes death due to Covid-19 as a clause. It can also be upgraded to include Covid-19 as a clause. However, new policyholders need not fret as getting a life insurance policy is now easier. One can easily apply for a suitable life insurance plan online.

Life Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs

Popular Searches

- Term Life Insurance

- Whole Life Insurance

- Critical Illness Insurance

- Accidental Death Benefit Rider

- Compare Life Insurance Quotes

- Best Life Insurance Companies In India

- Factors Affecting Life Insurance Premiums

- Insurance For Tax Savings

- Life Insurance For Children

- Life Insurance Rider

- Life Insurance Plans

- Types of Life Insurance

- Term Life Insurance Tax Benefit

- What is Insurance?

- Life Insurance Premium