In today’s day and age, women are taking up more responsibilities in life and working towards being financially secure. Contrary to the common belief, women nowadays are more focused on maximizing their earnings through investments and have become savvier about choosing saving plans and making tax decisions. As a result, more and more households in India are becoming double-income to tackle the increasing inflation and tax liability.

With more and more women taking center-stage in the financial decision-making for the family, we are witnessing an age of changing mindsets towards financial sustainability. To encourage women to become financially empowered, here are few tips and financial benefits for women to consider.

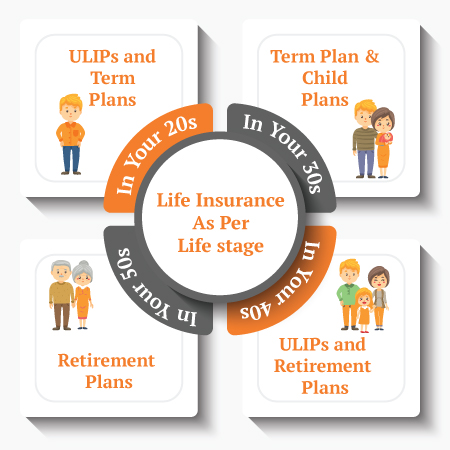

In Your 20s

Like most of us, women, too, choose their career path in their 20s. If you are a working woman in your 20s, it is the right time to consider investment into equities. Doing so will not only help you maximize your savings and tax benefits but also enable you to understand the functioning of the money markets – something that will help shape your future financial planning. You can consider instruments such as equity mutual funds and unit-linked insurance plans (ULIPs) for your long-term goals. At the same time, you must prepare yourself against medical emergencies by opting for a suitable health insurance plan.

In Your 30s

At this age, it is possible that you might have married and even have children. You may have the additional responsibility of taking care of your family while balancing your career. It is at this age that you may look to purchase a term insurance cover that will help protect your loved ones financially, should anything happen to you. At the same time, you can look to diversify your financial portfolio by opting for multiple investment instruments, including child insurance plans and Sukanya Samriddhi Yojana (if you have a daughter), so that you can maximize your returns while reducing your risk.

In Your 40s

When in your 40s, the chances are that you are thinking about supporting your child’s dreams of higher education. For this, you can consider opting for an education loan, which will help fund the college education expenses, while you can avail of tax benefits under Section 80E of the Income Tax Act 1961. It is advisable that you do not use up your retirement savings to fund your child’s education, since it might be difficult to replenish your savings once your primary source of income ceases to exist upon retirement.

In Your 50s

At this age, as you near your retirement, it is advisable that you start shifting some of your riskier investments to less-risky avenues such as debt mutual funds and bank fixed deposits (FDs) while keeping a portion of your equity investments. Also, it is prudent that you make sure to set up different sources of income to support your lifestyle needs post-retirement by opting for monthly income plans, Public Provident Fund (PPF), and Senior Citizen Savings Scheme (SCSS) once you turn 60.

By purchasing the right investment options at an appropriate age will help keep yourself and your family financially secure.

Best Investment options for Women

1. Savings Bank Account

Several banks in India offer ‘women’s savings account’ that provide cash-backs and discounts to women who spend on wellness, shopping, food, and entertainment through the bank’s debit card. With a savings bank account, both working women and homemakers can avail of earnings while they spend. Additionally, there are discounts offered to women, who opt for medical tests specific to female health, so that women prioritize their health and well-being. You can also open a ‘Junior Account’ to fund their children’s education, and link the account to a Recurring Deposit (RD) or a Systematic Investment Plaan (SIP) so that there is no minimum balance requirement for the savings bank account.

2. Health and Life Insurance Plans

As a woman, you can benefit from the available medical insurance schemes and dedicated premium rates customized to suit female health needs. At the same time, life insurance companies offer personalized financial coverage to women, keeping women-centric health ailments such as breast cancer in focus. Thus, you can benefit by investing in a health and life insurance policy. Typically, women applicants are eligible for reduced premium rates and discounts upto a certain age. Even homemakers can now avail of term life insurance protection under their spouse’s policy, thanks to the Married Women Protection Act (MWPA).

In India, women nowadays play an essential part in their family’s well-being, both emotionally and financially. Both working and homemakers are becoming increasingly aware of their needs for financial stability. There are various investment options and schemes that help women become empowered and support their lives financially while looking after their health and family.

At Canara HSBC Life Insurance, we offer a more comprehensive range of life insurance and investment plans that empower women to become more fianically independent. These schemes allow women policyholders to save tax through tax exemptions and deductions under various sections of the Income Tax Act 1961.

Life Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs

Popular Searches

- Term Life Insurance

- Whole Life Insurance

- Critical Illness Insurance

- Accidental Death Benefit Rider

- Compare Life Insurance Quotes

- Best Life Insurance Companies In India

- Factors Affecting Life Insurance Premiums

- Insurance For Tax Savings

- Life Insurance For Children

- Life Insurance Rider

- Life Insurance Plans

- Types of Life Insurance

- Term Life Insurance Tax Benefit

- What is Insurance?

- Life Insurance Premium