In a world full of uncertainties, life insurance has assumed paramount significance. Securing your family’s future with a life insurance plan has become vital to safeguarding financial needs. Life insurance policies can help secure finances to meet long-term goals such as child education, child marriage or retirement plan.

The rapid spread of the Covid-19 pandemic across several nations has presented unique challenges for governments and healthcare professionals. The pandemic has caused several deaths and compelled governments to impose a nationwide lockdown to control the spread of the coronavirus. Economy has witnessed a huge blow with most businesses shut during the lockdown. Amidst this growing uncertainty, many people have covered their family with life insurance plans that provide a protective shield against unforeseen situations.

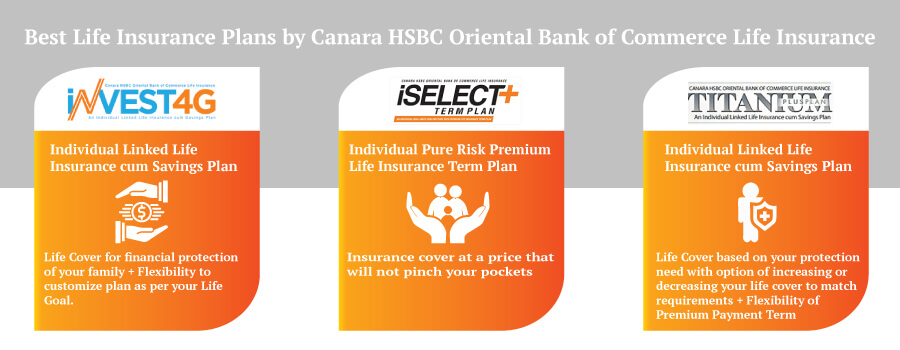

We now take a look at the best life insurance plans by Canara HSBC Life Insurance.

1. Invest 4G:

Invest 4G is a unit linked insurance plan that offers a wide range of options to invest your savings along with the benefit of a life insurance cover. Here are the key features and benefits of this plan.

- Death benefit: In the unfortunate event of the death of the policyholder, the family will get higher of the following:

- Sum assured less applicable partial withdrawals

- Fund value as on date of intimation of death claim

- 105% of all premiums paid up to the date of death

- Sum assured less applicable partial withdrawals

- Choice of funds: The plan offers a choice of 7 different funds and 4 portfolio strategies for investment. Based on your risk capacity, you can choose to allocate the premium in all or a combination of unit linked funds. You have the flexibility to switch between funds to benefit from market movements.

- Return of mortality charges: Mortality charges deducted during the policy term are added to the fund value on maturity.

- Loyalty additions: The plan offers fund value related loyalty additions at the end of the 5th policy year, 10th year, 15th year and so on.

- Wealth boosters: Along with loyalty additions, the plan offers wealth boosters based on premium payment term. These are added in the same proportion as the value of total units held in the unit linked funds.

- Partial withdrawals: You also have the option to make partial withdrawals to meet unplanned contingencies.

2. iSelect+ Term Plan:

This is a life insurance term plan that offers whole life cover, multiple payout options, return of premium, increased coverage option and several other benefits. Here are the key features of this flexible term plan.

- Flexibility: You can choose from different options of coverage, premium payment and benefit payouts. You can choose to get cover for a limited period or your entire lifetime.

- Additional inbuilt coverages: You can benefit from additional inbuilt coverages to augment your cover. These include accidental death benefit, child support benefit, accidental total and permanent disability benefit.

- Add spouse: You can cover your spouse in the same policy.

- Flexibility in premium payment: You can choose from multiple premium payment options. You may choose to pay during your working years only.

- Options to receive benefits: You can receive benefits in lump sum, monthly income or a combination of the two.

- Increase cover: You can enhance your life cover at key life milestones.

3. Titanium Plus Plan:

This is a savings and protection oriented unit linked insurance plan that can be customized according to your financial goals and changing requirements. Here are the key features of this plan.

- Death benefit: In the event of death of the policyholder, the family receives the higher of

- Sum assured less applicable partial withdrawals

- Fund value as on the date of intimation of death claim

- 105% of all premiums paid up to the date of death

- Sum assured less applicable partial withdrawals

- Choice of funds: The plan offers a choice of 7 unit linked funds. Based on your risk appetite, you can choose to allocate your premium to one or more of these funds or a combination.

- Portfolio management: You can choose from multiple portfolio management options to maximize your returns.

- Switch funds: The plan lets you have full control over your investments. You can switch between funds to take advantage of market movements or align your investment with changes in risk preference.

- Loyalty additions: You get regular loyalty additions. Beginning from the 6th policy year onwards, extra units are added to the unit linked fund at the end of each policy year.

- Wealth boosters: Wealth boosters are offered in the form of units that are added to the unit linked fund at specific policy intervals.

- Changes in premium payment term: You can change the premium payment term after the first 5 years and align it with changes in your financial situation.

Conclusion: In the current global health crisis, life insurance plans have sparked tremendous interest among consumers. You must secure your family’s future with a life insurance plan that can help meet your long-term financial goals.

Choose a plan like the iSelect+ Term Plan from Canara HSBC Life Insurance. This plan can be aligned to your specific requirements of coverage, benefit payouts and premium payment. You can also benefit from additional inbuilt coverages such as accidental death benefit, child support benefit and permanent disability benefit.

Life Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs

Popular Searches

- Term Life Insurance

- Whole Life Insurance

- Critical Illness Insurance

- Accidental Death Benefit Rider

- Compare Life Insurance Quotes

- Best Life Insurance Companies In India

- Factors Affecting Life Insurance Premiums

- Insurance For Tax Savings

- Life Insurance For Children

- Life Insurance Rider

- Life Insurance Plans

- Types of Life Insurance

- Term Life Insurance Tax Benefit

- What is Insurance?

- Life Insurance Premium