Having over million active cases recorded in late April, it is not wrong to say that the second wave of the COVID-19 pandemic hit India pretty hard. With the 3rd wave being inevitable, one ought to be worried about how to safeguard themselves and their family from its wrath. This is where a life insurance policy can help you. In this article, you'll learn how a life insurance policy can help protect you from the COVID 3rd wave, but before that, let's begin with some basics.

A life insurance policy is an arrangement between an individual and an insurance supplier, wherein the insurance organization grants financial security to the policyholder in return for monthly payments (known as premiums).

Given the plan, in case of the policyholder's demise or if the policy matures, the insurance supplier will pay the individual or his family a lump sum amount after a specific measure of time. There are different sorts of life insurance policies to suit the individual necessities and prerequisites of the policy buyers.

Significance of Life Insurance during COVID-19 3rd Wave

These vulnerabilities called attention to the benefits of life insurance in the middle of a crisis. Numerous individuals in the nation developed more interest towards life insurance that covers COVID-19 cases and started to consider how this financial product can end up being very helpful to policyholders.

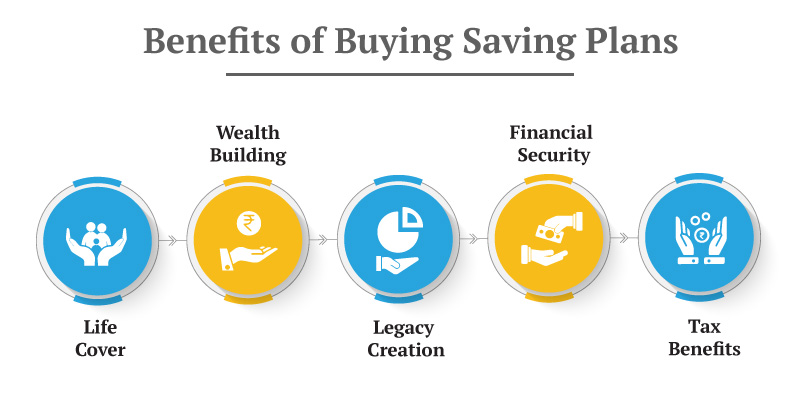

Numerous benefits of life insurance help individuals distinctly tackle vulnerabilities. Directly from offering lump-sum benefits as a piece of the life cover to conveying market-linked returns, there are numerous reasons why life insurance ends up being critical during the pandemic.

How can a Life Insurance Policy help Manage the COVID-19 3rd Wave Effects?

If you are looking for life insurance plans, you may come across options like term insurance, guaranteed return products, and Unit Linked Insurance Plans (ULIPs). They each can help you manage the effect of the upcoming COVID-19 3rd wave of the pandemic in a unique way -

Term insurance

Term Insurance is one of the most popular type of life insurance plans. Term plans give security to the life assured for a particular term. A death benefit is advanced to the nominee if there should be an occurrence of the life assured's death during the arrangement term. In addition to these benefits, term insurance is likewise quite possibly the most suitable life insurance product since it permits you to appreciate a higher sum assured in return for a premium that is exceptionally moderate.

Term plans can help policyholders manage the effect of the 3rd wave of the pandemic if it hits them by offering financial security that surviving individuals can depend on. This assists them with meeting their monetary commitments such as loan repayments, educational expenses for kids, and actual event and utility expenses.

Unit Linked Insurance Plans

Unit Linked Insurance Plans (ULIPs) are market-linked products that offer the dual benefits of investment combined with insurance inclusion. They give the policyholder the double benefit of putting resources into either equity or debt funds reserves (or both) while giving life insurance inclusion.

ULIPs help policyholders manage the effect of a crisis like the pandemic by making it conceivable to take advantage of the benefits of market developments. Indeed, even on account of the COVID-19 pandemic, the business sectors recuperated essentially after an underlying difficult time. With ULIPs, policyholders may acquire from market developments like this. Moreover, they likewise offer life insurance that covers COVID-19 cases as well.

Guaranteed return products

These products are non-participating savings plans that empower you to amass a corpus in a structured way over the long term to meet your life objectives. Savings plans give the upsides of insurance just as guaranteed benefits. The life insurance cover empowers you to protect your friends and family in your absence. Likewise, savings plans accompany the benefit of guaranteed returns toward the finish of the maturity period.

This sort of life insurance can likewise end up being of great assistance during an emergency like the pandemic because the life cover it offers can provide financial security in case of any unanticipated episodes. Also, if the life assured lives through the arrangement term, the guaranteed benefits end up being a decent return on the investment. Canara HSBC Life Insurance offers Guaranteed Income4Life – a guaranteed savings plan that can help you plan your financial future.

Learn more about Guaranteed Income4Life.

Having over million active cases recorded in late April, it is not wrong to say that the second wave of the COVID-19 pandemic hit India pretty hard. With the 3rd wave being inevitable, one ought to be worried about how to safeguard themselves and their family from its wrath. This is where a life insurance policy can help you. In this article, you'll learn how a life insurance policy can help protect you from the COVID 3rd wave, but before that, let's begin with some basics.

A life insurance policy is an arrangement between an individual and an insurance supplier, wherein the insurance organization grants financial security to the policyholder in return for monthly payments (known as premiums).

Given the plan, in case of the policyholder's demise or if the policy matures, the insurance supplier will pay the individual or his family a lump sum amount after a specific measure of time. There are different sorts of life insurance policies to suit the individual necessities and prerequisites of the policy buyers.

Protect yourself from COVID-19 3rd Wave with Canara HSBC Life Insurance

Canara HSBC Life Insurance realizes how your family is your utmost responsibility, and their well-being always is your prime concern. To help you minimize the tension during these unpredictable times, all the life insurance policies provided by Canara HSBC Life Insurance offer facilities of hassle-free online application, and rapid claim settlement procedure.

The occurrence of the pandemic has rendered us increasingly exhibited to ambiguities than ever before. Hence, life insurance is your leading pick to ensure your family's financial protection from the upcoming COVID 3rd wave.

It is clear how significant life insurance is regarding your protection from the COVID 3rd wave. Regardless of the kind of life insurance you decide on, you only continue to benefit from them differently. To buy a sufficient life cover that ensures your family's protection from vulnerabilities of the COVID-19 pandemic, make sure to choose a life insurance plan by Canara HSBC Life Insurance!

Disclaimer

This article is issued in the general public interest and meant for general information purposes only. Readers are advised to exercise their caution and not to rely on the contents of the article as conclusive in nature. Readers should research further or consult an expert in this regard.

Life Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs

Popular Searches

- Term Life Insurance

- Whole Life Insurance

- Critical Illness Insurance

- Accidental Death Benefit Rider

- Compare Life Insurance Quotes

- Best Life Insurance Companies In India

- Factors Affecting Life Insurance Premiums

- Insurance For Tax Savings

- Life Insurance For Children

- Life Insurance Rider

- Life Insurance Plans

- Types of Life Insurance

- Term Life Insurance Tax Benefit

- What is Insurance?

- Life Insurance Premium