When you plan for your future, one thing that does not come top-of-mind is the possibility of untimely death. What will happen to your family and loved ones if you die? It can be uncomfortable to plan for it in advance, but if you do so, you will do a lot of good to your family. To protect your family from every kind of situation, you need to take a Permanent Life Insurance Policy.

What is a permanent life insurance policy?

A permanent life insurance policy is a popular name given to whole life insurance plans in the USA. A whole life insurance plan is a type of insurance plan that provides you with death benefits as well as survival benefits. When you opt for a whole life insurance plan like iSelect Smart360 Term Plan, the policy gives you cover for as long as you live.

You pay the premium for 10 or 15 years, depending on the option you chose. You get insurance cover for your entire life. For example, you are 25 years of age, and you buy a whole life insurance plan for 15 years and a sum assured of Rs 50 lakh. You will stop paying the premium when reaching 40 years of age. The death benefit will last for life.

How Does Whole Life Term Plan Work?

When you decide to go for a whole life term plan like iSelect Smart360 Term Plan from Canara HSBC Life Insurance, below are the steps you follow:

1. In the first step, you choose the policy term to ensure it continues till you reach 99 years of age. For example, if you are 30 years of age at the time of buying the plan, you need a policy term of 69 years.

2. Next, you can choose a premium payment term (PPT). Select a shorter premium payment term to ensure all premium payments before retirement. With the iSelect Smart360 Term Plan you can select a premium payment term up to the age of 60.

3. Next, you can choose a coverage option:

a) Level life cover

b) Increasing life cover

In the level option, you have an option to increase your Sum Assured thrice during the policy term. The option to increase the life cover amount is available at three crucial stages in your life:

- Marriage

- Childbirth

- Home purchase with home loan

For example, you buy a term plan in your 20s with a sum assured of Rs 1 crore. You get married at the age of 30, within one year of your marriage, you have an option to increase your Sum Assured by 50 per cent. So after your request is processed, you will have a Sum Assured of Rs !.5 crores, under the same policy.

At the time of birth of a child or, purchase of a house, you have an option to increase Sum Assured by an additional 25 per cent, i.e. new sum assured will be Rs. 1.75 crores.

The premium, of course, will also increase as per the new sum assured. However, the increase will be nominal compared to buying a new life insurance plan.

Increasing In this option, the sum assured will increase by 5 per cent (of the initial sum assured) every year. The maximum increase in the sum assured will be 100 per cent of the original Sum Assured.

Learn how an increasing sum assured in a term plan is your weapon against inflation.

For example, you buy a Whole Life Term Plan with a Sum Assured of Rs 50 lakh. The Sum assured will be Rs 62,50,000 at the end of 5 years, Rs 87,50,000 after 15 years, and Rs 1 crore after 20 years. Post this, it will continue to remain the same.

4. Once you have decided on the coverage option, you can add riders to your plan. You can choose from multiple options like Accidental Death Benefit (ADB), Accidental Total & Permanent Disability Benefit (ATPD), or Child Support Benefit.

5. Last, you decide how benefits should be paid to your nominee. It can be a lump sum, monthly income, or a combination of two. If you go ahead with monthly income, you can start increasing the payment by 5 or 10 per cent every year. Under the combination option, you can decide the per cent you want a lump sum and how much should go to monthly income.

The plan will expire under the following circumstances:

- A death claim is filed under the plan

- A terminal illness claim is filed

- You outlive the plan past the age of 99 years

This term plan has a very high chance of paying the benefit amount to your nominees. Since you can change the nomination anytime during the policy term, the policy works both as a protection plan and a legacy plan for you.

How Does Whole Life Insurance Work?

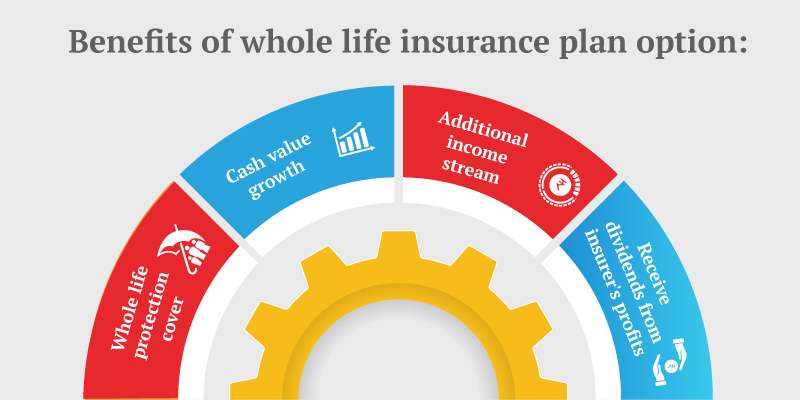

If you choose the Life Plus option under the iSelect Smart360 Term Plan, you get the features offered by a whole life insurance plan. Under this iSelect Star’s whole life cover you get the following benefits:

- You can choose a premium payment term that extends up to the age of 60

- All the premiums you paid for the policy will be returned to you at the end of the premium payment term

- The policy continues without the need of further premiums until your natural demise or contracting a covered terminal illness

- If you reach the age of 99 without a claim you will receive the policy sum assured

Now that you know the types of permanent life insurance and how they work, you can easily pick the right plan without any confusion. Buying a permanent insurance plan helps you not only protect your family while you are building their future but also leave a legacy when you are done.

Additionally, you may choose a limited premium payment term for your policy. Ideally, you should be able to pay off all the premiums for the entire policy tenure within your employment period. That way you will not have to worry about premiums during retired life, and the policy can work as a legacy plan after you.

Life Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs

Popular Searches

- Term Life Insurance

- Whole Life Insurance

- Critical Illness Insurance

- Accidental Death Benefit Rider

- Compare Life Insurance Quotes

- Best Life Insurance Companies In India

- Factors Affecting Life Insurance Premiums

- Insurance For Tax Savings

- Life Insurance For Children

- Life Insurance Rider

- Life Insurance Plans

- Types of Life Insurance

- Term Life Insurance Tax Benefit

- What is Insurance?

- Life Insurance Premium