Trying to choose the best financial plan for yourself and your family can get challenging if you do not see the bigger picture. While there are several life insurance plans available for you to choose from, knowing the benefits of each plan helps the decision-making easier. One of the most common ways to ensure that your assets and dependents like family are safe from any financial losses in case of any mishap is through insurance.

In simple words, insurance involves paying a certain amount, known as premium, to the insurer. In return, the insurer covers the damage and pays you a certain amount for the damage. This amount is pre-determined by the insurance plan you choose.

As we know, a thorough knowledge of the insurance options available helps you make an informed decision. It helps you find what is best for you and ensures that you don't fall prey to any fraudulent practices.

The name of the plan and the amount of compensation by insurance varies from different insurers. However, all the different insurance plans can be broadly classified under:

a) Life Insurance

b) General Insurance

Difference between Life Insurance and General Insurance

The most noticeable difference between a life insurance policy and general insurance is that life insurance provides financial support to the family in case of the policyholder's death. On the other hand, general insurance covers the monetary compensation for the non-living assets like your property and vehicles and health and travel expenses.

| Parameters | Life Insurance | General Insurance |

|---|---|---|

| Coverage | Offers coverage in case of the demise of the life assured or upon the maturity of the policy. | Insurer provides compensation in the events of damage to property or things human-made or natural disasters, theft, vandalism, etc. |

| Purpose | Is to have a financial backup for family in case of the earning member's premature demise. Its main purpose is to protect the family and help them lead a normal life. | Acts as a financial backup to give you the time and resources to build things back. Cover medical bills and expensive procedures so that you don't have to spend a large amount of money. |

| Contract | These are long-term insurance plans. Some life insurance plans offers cover till 100 years and do not require renewal every year. | These are short-term plans. And hence, you need to renew them time and again. |

| Claim | A policyholder's presence is not required usually because mostly the claims are made by the beneficiaries after the demise of the policyholder. | The presence of a policyholder is necessary both at the time of buying the policy and making a claim on the policy. |

| Premium Payment | Has to be paid in instalments or you have the option to pay in a single shot. | Premium has to be paid in lump sum only. |

| Value | Value of the policy plan and the final sum can be adjusted as per the insurance holder's paying capacity at the time of buying the policy. | Upper limit of the claim is decided based on the value of the asset that is being insured. The amount payable is restricted to the value of the damaged assets. |

What Type of Plans are Covered Under Life Insurance Policies?

As the name suggests, life insurance is related to compensation for the nominees stated by the policyholder. It is mostly in place for the protection of family members in the event of the premature demise of the family's earning member. Life insurance plans are designed to help your family stay financially secure and keep your kids' education, or general goals, on track.

Life insurance plans can be of various types, namely:

1. Term Insurance Plan

These are the simplest plans available. It is a pure protection plan. The best part about term life insurance plans is that they offer broader coverage at an affordable premium, e.g., non-smoking earning members can get coverage up to 10-15 times their annual income.

The insurance pays the nominee the assured amount to help them carry on with their daily expenses. However, if you survive the term plan, the term life insurance policies do not have any maturity benefits. In simple words, it means that at the end of the policy tenure, if you are fine, you do not get back the premiums you paid or any monetary or financial benefits.

Some insurers have come up with premium term life insurance plans. In these plans, the insurer returns all the premium deposits if you survive the policy term. However, they are a bit more expensive as compared to the regular term plans.

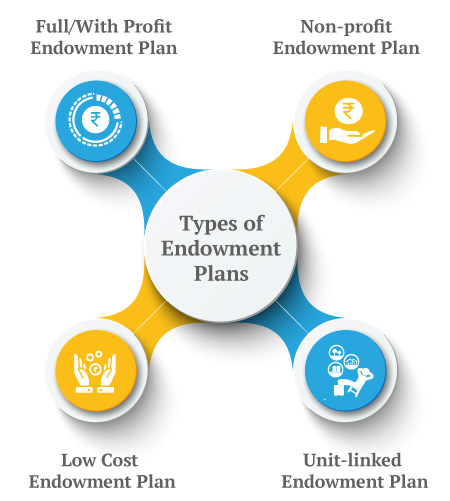

2. Endowment Plan

If you are looking for insurance plans and also interested in saving, endowment plans are the ones for you. As a blend of saving and life cover, endowment plans offer your family insurance coverage and help you build up financially for essential life goals. On every deposit, a certain part of the premium is invested in low-risk avenues.

In case of the policy holder's demise, the nominees get the assured sum. In case, you survive, you get monetary maturity benefits in the form of the sum assured. You also receive the accumulated bonuses.

3. Money Back Plan

Money-back policies are more or like similar to endowment plans. You get the usual benefits of investments and monetary coverage. However, in money-back plans, instead of receiving all the benefits only on the policy term's maturity, the insurers pay you predefined sums in between the policy term at regular intervals. Once the policy matures, the policyholder also receives the monetary maturity benefits as well as the bonuses.

4. Unit Linked Insurance Plan

Unit linked insurance plans, or ULIPs are also plans that combine investments and insurance. Like endowment plans, a certain portion of the premium is kept for providing life cover for your family, while the rest of it is invested in the market.

The investments under Unit linked insurance plans (ULIPs) can be in different asset classes like equities, debt, and hybrid, where they are invested to generate returns.

5. Whole Life Insurance

Whole life insurance policies are ones that cover your entire life. They can extend up to even 100 years as long as the policyholders pay the premiums regularly.

Upon surviving the policy term, the policyholder gets the maturity benefits. For those who want to stay ensured all their life, whole life insurance plans work the best.

What Type of Plans are Covered Under General Insurance?

General insurance plans cover everything that is not related to the life of the policyholder. It can be for your real estate property assets, business, or even your house and expensive household products. General insurance plans cover a wide range of assets. However, they are broadly classified into four categories:

1. Health Insurance

Irrespective of your age, a health insurance plan is something you must-have for your family. It reduces the load on yourself and your family in case of any medical emergency. You can choose between standalone general health insurance plans for individual family members or opt for family floater plans for your whole family.

Some plans also cover critical illness and provide a lump sum upon diagnosis of a critical illness.

2. Motor Insurance

As the name suggests, motor insurance plans provide coverage to your vehicles against accidents, damage, theft, vandalism, etc. They also offer the rider personal accident coverage via third parties.

3. Home Insurance

Home insurance plans come in handy when there is damage to property because of natural or human-made calamities. Some home insurance policy plans cover the expense of living while your house undergoes renovation.

4. Travel Insurance

Travel insurances cover loss due to cancelled or delayed flights, loss of baggage. They also cover cashless hospital bills in case of any mishap during travelling.

In the comparison between life insurance plans and general insurance plans, there is no winner. Both serve different purposes and are equally vital to keep you financially covered in all aspects.

Life Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs

Popular Searches

- Term Life Insurance

- Whole Life Insurance

- Critical Illness Insurance

- Accidental Death Benefit Rider

- Compare Life Insurance Quotes

- Best Life Insurance Companies In India

- Factors Affecting Life Insurance Premiums

- Insurance For Tax Savings

- Life Insurance For Children

- Life Insurance Rider

- Life Insurance Plans

- Types of Life Insurance

- Term Life Insurance Tax Benefit

- What is Insurance?

- Life Insurance Premium