Life insurance plans are essential for any individual who wants to secure their family's future, especially if they are the income source for their household. Paying a fixed amount of money every month to an insurance company as a premium will ensure that if the person passes away, the family's financial downfall will be cushioned by installments of money that will come in every month.

The diversification of the demographic who look for insurances – (with people starting as early as twenty-five years of age) has meant that people are willing to pay large sums of money to secure their future and their family. In India, various companies' life insurance policy offers high customizability levels in terms of duration, frequency of payment, and the coverage amount. It is paramount that you evaluate your financial status, your family's financial literacy, and living expenses to estimate the time and allowance that will be provided to your family after your death.

One such parameter you will have to determine is the length of your insurance cover. This article will provide you with a set of factors to calculate an appropriate duration for India’s life insurance policy.

What is Term Life Insurance Policy?

Term life insurance policy in India involves paying a certain amount of premium in regular intervals for a specific period. At The end of the term, the nominee will be paid an assured sum by the company, or in case you die an untimely death. Most companies that offer term life insurance policy in India do not provide maturity benefits, which is a considerable disadvantage. Still, it offers higher coverage for smaller premiums than other insurance packages available to Indian citizens.

How much Coverage Do I Need?

To see how much coverage you need, to evaluate many factors such as your monthly expenses, any outstanding loans, the number of non-earning members of your family, children who may require additional sums of money in the future, etc.

Step 1: How much is your dependent/family's monthly expense?

Calculate how much your family spends in a month. Do not be stingy when it comes to this estimation – calculate a little above the used amount during an average month where there are no additional expenses like festivities, birthdays etc. You can also consider the medical bills that frequently come – especially if you have a medically compromised person in your family, like an elderly parent or a child with a pre-existing/genetic condition that they were born with that requires extra care.

It is advised that you go for coverage ten to fifteen times the amount spent on annual expenses. If your monthly expense comes to Rs. 60,000, your household will require above Rs. 1 crore in the future, if not more. This amount should also consider factors outside your family, such as inflation rates, rising healthcare costs, etc. Even the prices of household items like vegetables and groceries are on the rise, so it is advised that you calculate 10% higher the number of household expenses you have right now.

Step 2. What are your liabilities?

In this context, liabilities refer to loans and outstanding payments that are yet to be paid off, especially those in your name. In case you die an untimely death, these financial burdens will be placed on the next breadwinner of your family and will take a heavy toll on the rest of your family's standards of living. If your debt exceeds the house expenses, there is a possibility that your family may even go bankrupt. No one wants to leave their family in debt, which is why you should add the liability amount to your estimate.

For instance, if you have an outstanding car loan amount that you need to pay off that is worth ten lakhs, you should consider it. New homeowners, too, can calculate their approximate value based on the length of their mortgage – if your house is leased for thirty years, your plan should be equal to or more than that amount.

Step 3. What would be future life events that your family will need financial assistance?

Every family has goals that they want to achieve together, especially if there are young kids. Every parent wants their child to have the best education possible. Education costs are skyrocketing, so your coverage must include those expenses as well. Depending on how many kids you have and once you have a rough idea of what field they may go into, how bright they are and if there is a chance of them going abroad, calculate the amount to cover their education. Similarly, set aside some money for their marriage as well.

Step 4. Will your spouse/parents require a requirement?

If you have people in your family who are nearing retirement and are not earning at the moment, you may want to set aside some money for their post-retirement upkeep. Spouses, parents, etc., will require a certain amount of allowance to maintain their current living standards. Even if they have a job and a pension plan, setting aside this amount as a conservative estimate will come in handy and can be used by your family to cushion the blow of losing its primary breadwinner.

Step 5: How much do you have now?

If you have already invested money in other life insurance plans, mutual funds, fixed deposits, provident funds, and real estate, calculate it and sum it up to a rounded figure. If you have inherited land or possess gold or other valuables that your family will be okay with selling, add its approximate value to your estimates too. The total amount can be deducted from your coverage because this is a fixed resource that your family can avail of at any time.

Step 6: What is your age?

If you arrive at an exorbitantly high figure for you after all this calculation, you may want to focus on paying off your debts before investing in life insurance. If you are young and healthy with no dangerous habits like smoking, drinking, or driving fast, even amounts as high as two to three crores can be paid off by the time you are fifty. In the same manner, if your children are already settled and married with their sources of income, or if your parents have passed away and your spouse is a working individual, you need not worry about a large insurance sum.

But if you are in the latter half of your life with large sums as outstanding payment, think twice and thrice before investing or paying premiums recklessly. You may leave your family behind in massive debt, for which they will not be thankful. Try to lower your monthly expenses and save up organically, into considering factors mentioned earlier, like future payments, liabilities, inflation, etc.

The higher the coverage amount you have calculated, the longer you will need to pay. Depending on the amount of money you want your family to receive at the end of the plan, whether it is staggered or lump sum, you will have to pay for a more extended period. The duration also depends on how much you can spare every month. If you are already paying off loan amounts and outstanding debt like EMI, it is unlikely that you can regularly put away large sums of money.

Unless you belong to a field where the money is earned sporadically in huge spurts and not in smaller regular amounts, you should not assume that you will pay all your premiums. On the other hand, if there is a chance that you will receive a large sum of money in one go as a part of your work, you can directly invest it in a yearly plan that will cover your insurance expenses for that year. You need to pick your goals appropriately – the length of your insurance coverage depends on your current financial status and your estimates for your family's future.

That being said, life insurance policy in India offers various plans that can benefit even those in crippling debt. They are confident that they can pay the premiums on time. Evaluating your life insurance needs every once in a while, perhaps twice a decade will give you an idea of how much you will need and how much coverage you should go for.

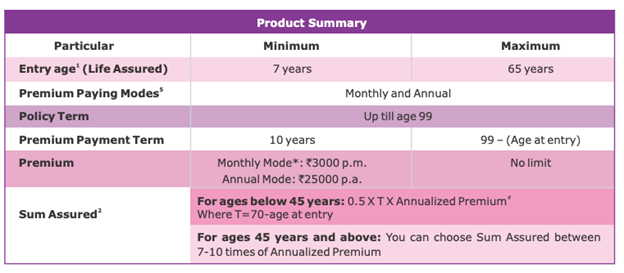

Most companies that offer term life insurance policy in India have packages that last one, two, or three decades. Some companies provide five- or ten-year increments that can extend to 99-year plans, which are perfect for people who can afford to set aside a fixed sum for an extended time and do not have underlying risks of life. 99-year plans are ideal, and can provide you with an unparalleled extended coverage that can take care of your family for decades ahead. The Smart Lifelong Plan provides additional benefits like loyalty benefits and investment funds as well. Here are the details of this excellent plan:

Your decision determines the future of your family, so make sure you take into account all of these factors before you go ahead with your decision.

Life Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs

Popular Searches

- Term Life Insurance

- Whole Life Insurance

- Critical Illness Insurance

- Accidental Death Benefit Rider

- Compare Life Insurance Quotes

- Best Life Insurance Companies In India

- Factors Affecting Life Insurance Premiums

- Insurance For Tax Savings

- Life Insurance For Children

- Life Insurance Rider

- Life Insurance Plans

- Types of Life Insurance

- Term Life Insurance Tax Benefit

- What is Insurance?

- Life Insurance Premium