Bachelor life has its advantages. You may love the freedom, the time-out with friends and frequent parties. This is also a great time for exploring new ways of amusements in life. Another part of life that is greatly defined by your efforts in this time of life is financial matters.

Your financial decisions at this age have a profound impact on your thought process and financial stability for a very long-time. Therefore, careful financial decisions can help you compound your financial growth and ensure stability later in life.

Buying a life insurance plan is one such financial decision. You could be overwhelmed initially with the amount of information available on the subject. However, deciding on your needs is simpler than it seems.

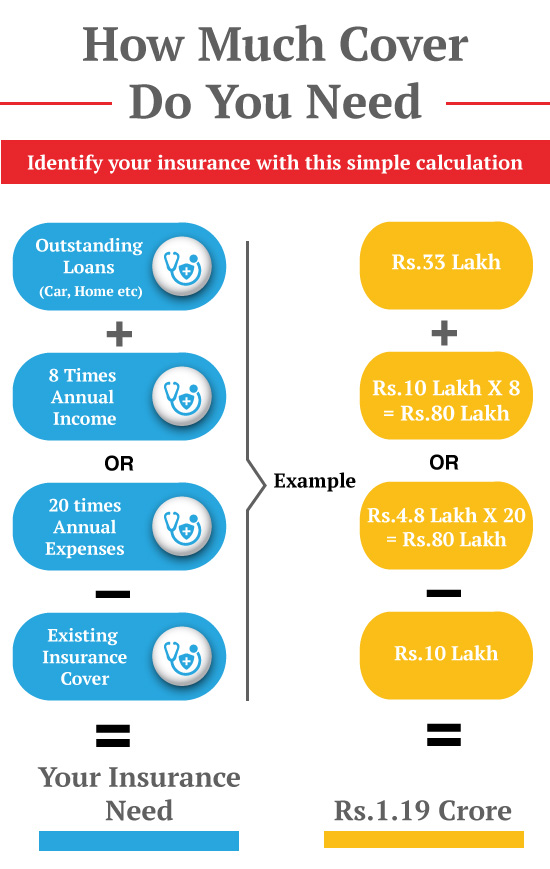

How much Life Insurance Cover do you Need?

The amount of life insurance cover for you depends on your present financial value. Your financial value or worth depends on your annual income. Thus, your life insurance need depends on your present income.

However, your life cover amount should provide your family with the following, while you are still living a bachelor life:

a) Adequate money to look after their regular expenses if you have a direct financial dependent.

b) Money to pay off your ongoing debts.

c) Meet any other financial need related to your untimely passing.

d) Also, if you are saving to fulfil a financial goal for a family member you would want to protect it from your sudden demise.

An amount equal to 15 times the annual expense of the dependent family member is enough to provide a lifetime income to the person. The loan amounts are easy to judge, and you can take an educated guess for other expenses.

Overall, the life cover to look after the first three heads would be about 5 to 8 times your annual income.

Why do you Need a Life Insurance Plan?

If you know the basic concept of life insurance, you will think that you don’t need it until you have financial dependents. Though life insurance need has little to do with your direct dependents, i.e., spouse and children.

Once you have a source of income you will face financial responsibilities, loans, and other liabilities at every turn in life. This is the financial part of your life, and life insurance can help you in more than one way, apart from protecting your family members:

a) Reduce your tax outflow

b) Invest for tax-exempt wealth

c) Secure future goals with guaranteed investments

d) Safeguards retirement

Life insurance plans are a great way to preserve your wealth, whether it’s for your future or the next generation’s. Additionally, plans like Invest 4G ULIP, give you the option to invest aggressively in equity and debt portfolio for a tax-free maturity sum.

Still, the question remains, ‘how much life insurance should you really have?’

Benefits of Buying a Life Insurance Early

One of the major advantages of buying a life insurance coverage early in your life is the lower premium cost. If you choose to pay an annual premium for your life cover, the premium remains the same throughout your life.

Since the premium for the same amount of cover is lower for younger policyholders, you can enjoy the lower premium throughout your life. Thus, instead of limiting your life insurance cover to 5 to 8 times your annual income, you can go for the maximum eligibility.

Maximum life cover eligibility for term insurance cover is 10 to 15 times your annual income. However, you also need to take care of future conditions.

Read more about the advantages of buying a life insurance plan at an early age.

Securing Financial Goals with the Best Life Insurance Plan

Securing your financial goals with life insurance is a slightly different affair than securing future income and present loans. This security would need that your family member can receive adequate money upon your early death to fulfil the goal on her own.

Since there is no certainty when the amount would be needed or needed at all, figuring out this amount is not easy. However, specific life insurance plans can make your decision easy.

Life insurance plans like guaranteed savings plan and unit-linked insurance plans (ULIPs) are investment focused plans. With these plans, you also get the option to safeguard the goal from untoward incidents.

Plans like Invest 4G and Guaranteed Savings Plans from Canara HSBC Life Insurance offer premium protection option. This option will allow the insurer to continue investing the due premiums in the plan on your behalf.

Thus, even after the family receives the sum assured from the plan upon your demise, the investments continue. The plan will ultimately pay the maturity value of the invested sum to the family at the time of intended maturity.

Life Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs

Popular Searches

- Term Life Insurance

- Whole Life Insurance

- Critical Illness Insurance

- Accidental Death Benefit Rider

- Compare Life Insurance Quotes

- Best Life Insurance Companies In India

- Factors Affecting Life Insurance Premiums

- Insurance For Tax Savings

- Life Insurance For Children

- Life Insurance Rider

- Life Insurance Plans

- Types of Life Insurance

- Term Life Insurance Tax Benefit

- What is Insurance?

- Life Insurance Premium