Coronavirus was considered fatal before because of the speed of contagion. However, during the second wave of COVID-19, the drastic effect of its contagiousness and impact on the immune system has put people of all ages at risk. During the first wave, doctors and health experts claimed that the virus does not severely impact young and healthy people.

This year, the statistics showcase a completely different case. Older people, especially those who are already battling diseases such as diabetes, heart problems, etc., are at the most risk of being severely affected by COVID-19. Due to this a lot of people started buying life insurance cover for their financial protection.

The mutant that has been spreading throughout the country poses a fatal risk to senior citizens and young people, especially children.

Why are the Elderly at a Higher Risk of Contracting COVID-19?

Owing to their age and the current living conditions, most senior citizens are already suffering from chronic diseases. These diseases have made their immune system weaker, thereby increasing their chances of contracting COVID-19.

Along with that, with age, the ability of the human body to ward off diseases and viruses wears down. It cannot protect the body against parasites and external pathogens, putting the body at risk.

The second wave of the pandemic has brought forward even tougher situations. Along with more people testing positive for COVID-19, there is now a severe shortage of medical aid.

5 Ways to Protect Children and Elderly from the Second Wave of COVID-19

The best way to protect them against the virus is to follow preventive measures all the time. Here are some of the mandatory precautions to ensure the safety of your children and elderly against the virus:

1. Social distancing

Social distancing measures like keeping at least two meters of distance from people and avoiding any physical contact, must be followed religiously. Make sure you wash your hands for at least 20 seconds using soap or an alcohol-based sanitizer.

2. Lockdown protocol

If your parents or grandparents live separately, avoid meeting them. Along with that, limit all outdoor activities. Engage the children in indoor games and hobbies so that they do not go outside to play. To ensure the safety of your whole family, ensure that you do not make any travel plans until the lockdown persists.

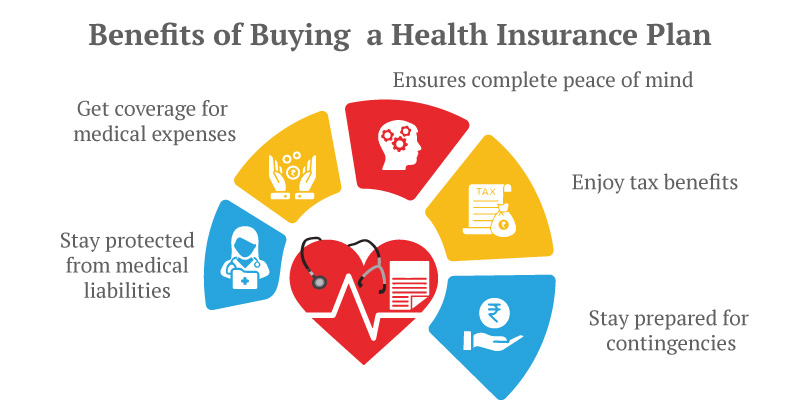

3. Get a term or health insurance

If you do not already have health insurance for your family, then you should get one now. Sign up for term insurance or a special planned coronavirus health insurance that covers all your loved ones. Various insurance companies offer health insurance, especially for coronavirus, that covers the hospital bills, testing expenses, etc.

4. Maintain hygiene

Ensure that if you go outside to buy groceries and other essential items, you keep washing your hands with sanitiser. When you get back home, remove your clothes for washing and take a bath before touching or using any household items. Clean and sanitise your house with disinfectant daily.

5. Build Immunity

Now is the time to ensure that your body is in optimum health. Search some elderly and children suitable exercise plans for your family members. Along with regular exercise, make sure that you and your family have a balanced diet rich in proteins. If there are any additional supplements prescribed by the doctor, especially for children and senior citizens, then make sure that they have them at the prescribed time.

Also, when the vaccine is made available for children and the young generation, make sure that they get both the doses at scheduled intervals to safeguard your family against the health implications of the third wave.

Do you have the Right Insurance Policy?

If you already have a life insurance policy, then you should review the terms and conditions of the plan to ensure that it can cover you and your family against COVID-19. You can contact your insurance provider to know whether your current health insurance can be modified to better fit the current health situation.

Here are 4 features you should check to ensure that your current health insurance policy is right and all-encompassing:

1. Number of people covered under the plan

The insurance plan should also allow the number of people or family members covered under the health insurance plan. There are a lot of term insurance plans that cover terminal illnesses and also allow you to add your spouse in the same plan. For example, iSelect Smart360 Term Plan by Canara HSBC Life Insurance allows you to add your spouse to the same policy at discounted rate.

Learn more about iSelect Smart360 Term Plan.

2. All features included in the insurance plan

Various essential features should be included in the health insurance plan to ensure that if anyone in your family contracts the virus, all the expenses related to the disease are covered under the plan. Many insurers are offering death payout if the policyholder passes away due to COVID-19.

3. Duration required to make accidental hospitalisation claims

Most insurance providers and financial institutions dictate a definite duration that needs to be covered before the policyholder can make accidental hospitalisation claims. It should be no more than 30 days from the date when the policy was sanctioned.

4. Cashless claims

The insurance provider should provide the option for cashless claims. Through this, the policyholder can claim the insurance policy from the network of the hospital itself.

Importance of Health Insurance for Senior Citizens and Children during the Second Wave of COVID-19

A specialised health care insurance can ensure that your children and elders are shielded from the impact of the second wave of coronavirus. You should also ensure that the policy covers positive cases for better coverage for your complete family.

The insurance policy may also cover the expenses for testing. However, take all possible measures to ensure that your family members do not require health insurance coverage. Educate your children so that they keep cleanliness around themselves and limit contact with other people.

Learn the role of insurance in restructuring your life post-COVID.

Furthermore, make sure that the senior citizens in your family are treated appropriately for any other pre-existing diseases. A coronavirus health insurance will also be beneficial if the third wave of COVID-19 sweeps through the country.

Life Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs

Popular Searches

- Term Life Insurance

- Whole Life Insurance

- Critical Illness Insurance

- Accidental Death Benefit Rider

- Compare Life Insurance Quotes

- Best Life Insurance Companies In India

- Factors Affecting Life Insurance Premiums

- Insurance For Tax Savings

- Life Insurance For Children

- Life Insurance Rider

- Life Insurance Plans

- Types of Life Insurance

- Term Life Insurance Tax Benefit

- What is Insurance?

- Life Insurance Premium