Purchasing a life insurance policy early in life offers financial protection to your family in your absence. It provides your nominees a death benefit in the future to help them fulfil their dreams. In order to achieve this, life insurance plans require policyholders to pay a stipulated premium as per a frequency that is agreed at the time of purchasing the policy for the entire duration. It is important to make premium payments regularly to ensure you continue to enjoy policy benefits. However, there can be an instance when you fail to pay the premium on time. This can have severe repercussions on your term insurance policy leading to it being terminated.

What happens when you do not pay the premium on time?

Both term insurance plans as well as life insurance plans provide you a life cover in exchange for the premium paid for the desired policy term. If you forget to pay the premium on the specified date due to any circumstances beyond your control or because you do not wish to continue with the policy, a grace period is provided. This can range anywhere from 15 days to 30 days depending on your insurer and policy guidelines. While a grace period of 15 days is applicable for policies with a monthly payment mode, you can avail up to 30 days of grace on all other payment frequencies including yearly, half-yearly and quarterly.

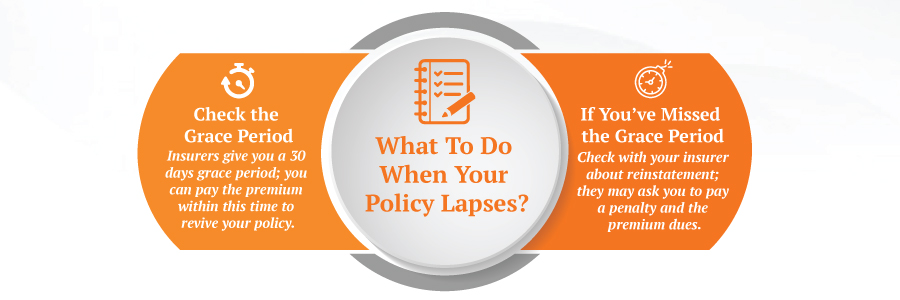

A grace period is an extension provided by the insurer post your policy due date to help you pay your premium so that you can revive your insurance plan and continue to avail the coverage. However, if the premium payment is not made by the insured even during this grace period, the policy becomes null and void. The insurance company will not provide you coverage, even if you paid previous premiums diligently. Your insurance plan benefits no longer apply and your policy is officially considered lapsed.

When does an insurance policy lapse?

Depending on the plan that you have opted for, the time when you policy stops becoming operational may differ. Let us take a look:

Unit-Linked Insurance Plan (ULIP): Life insurance plans such as ULIPs come with a compulsory 5 year lock-in and if you fail to pay premiums during this time, your policy might lapse. The accumulated amount is moved to a discontinuance fund with up to Rs 6000 levied as a charge for discontinuing your policy. Failure to make premium payment after the 5 year window leaves you with the option to either surrender your ULIP or revive it. Some insurers also allow you to go for policy modification and convert it to a paid-up plan with a lower sum assured than earlier.

Term insurance plans: A traditional insurance plan such as a term insurance policy is deactivated in the event of non- payment of premium as soon as the policy acquires a surrender value. Paid-up policies continue to stay functional albeit with a reduced sum assured.

Lapsed policies do not qualify for any of the insurance benefits associated earlier. Your dependants would receive no compensation from the insurance company in the event of your death if your policy is not valid anymore.

How can you revive a lapsed policy?

The Insurance Regulatory and Development Authority of India have directed insurance providers to allow policyholders to revive a lapsed policy within duration of two years from the time it is deactivated. This rule is however dependent on your policy being active for three years since the time of purchase. The earlier you opt for policy revival, the lesser penalty you end up paying. Ideally, reinstating your life insurance policy within 6 months of its lapse is a good idea.

Post this period, not only do you have to pay the premium overdue for the period, but also a penalty ranging anywhere from 12 to 18% on the total premium paid till date. Your insurer might ask you to produce a certificate to confirm your current health or undergo a health-check-up. Your premium may also be increased.

Paying the premium of life insurance plans regularly before the due date is the easiest way to keep your policy in force and safeguard your family’s financial future. Consider Canara HSBC Life Insurance’s Invest 4G Plan that combines a life cover with your investment goals.

You can choose from 4 portfolio strategies that allow you the choice of 7 different funds in tune with your risk appetite to grow your wealth. Save tax on your premium along with loyalty additions and wealth boosters and fund your child’s education or your retirement alongside.

Life Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs

Popular Searches

- Term Life Insurance

- Whole Life Insurance

- Critical Illness Insurance

- Accidental Death Benefit Rider

- Compare Life Insurance Quotes

- Best Life Insurance Companies In India

- Factors Affecting Life Insurance Premiums

- Insurance For Tax Savings

- Life Insurance For Children

- Life Insurance Rider

- Life Insurance Plans

- Types of Life Insurance

- Term Life Insurance Tax Benefit

- What is Insurance?

- Life Insurance Premium