Life insurance plans help you meet some of the most important financial goals in life. Starting from the very basic financial need of ‘safety’ for your family, life insurance can continue to offer services until your natural demise.

Legally, life insurance is a contract between you and the insurer. Under this contract, the insurer promises to pay a large sum of money to your family for a nominal premium cost. However, life insurance plans offer a lot more than just a tool of financial protection.

You can use life insurance plans to:

- Meet important future goals for the family, like child’s higher education and marriage

- Build wealth while passively investing in equity markets

- Build a tax-free retirement corpus for yourself and your spouse

- Create a reliable source of long-term (lifetime) income after retirement

- Leave a legacy for your children or grandchildren

With so many possibilities, you can even say that life insurance plans can help you look after almost every investment need you will encounter in your life.

Types of Life Insurance Plan

Depending on the use and purpose of the life insurance plan we can have the following types:

Pure Protection Plans

Pure protection plans offer financial safety in case of a contingency. For example, death, illness, disability, etc. Pure protection plans cannot be used for meeting future financial goals. However, they will help the survivors sail through life without financial hiccups.

There is no investment component in these plans.

Saving Plans

Savings plans consist of safe investment plans. These plans can help you preserve your wealth and achieve very important goals. Most of these plans will offer guaranteed returns, where you can estimate the maturity value of your investment in the beginning.

These plans are best for saving money towards very important life goals and offering protection to such goals of your family.

Unit Linked Insurance Plans

Unit-linked life insurance plans or ULIPs are excellent investment plans which also let you invest in equity markets. If you are an aggressive investor who wants to manage your high-risk portfolio passively, ULIPs are the best option for you.

ULIPs offer many features and options for you to ensure that your money keeps working as per the market movements even without your intervention.

Invest 4G by Canara HSBC Oriental Bank of Commerce Life Insurance is one such plan that you may consider investing in.

Pension Plans

Pension plans are the life insurance plans which help you build a reliable income stream. These plans are also safe investment plans. However, they focus on a long-term regular income, rather than only the growth of your portfolio.

These plans are best if you need to have a reliable long-term source of income out of a large corpus. You will usually get two choices with pension plans:

1. Immediate Annuity Plans: The income period starts immediately after investment

2. Deferred Annuity Plans: The income period will start after a few years from investment

For example, if you invested Rs. 2 crores and want to receive a quarterly income, the immediate annuity plan will start paying off right after the first three months. The deferred annuity plan, on the other hand, will ask you for the deferment period first.

So, if you choose a five-year deferment period, your first pay-out will happen five years and three months later.

| Pure Protection Plans | Saving Plans | Unit-Linked Plans | Pension Plans | |

|---|---|---|---|---|

| Purpose | Provide financial protection to the insured and family | Provide a long-term and safe investment option | Provides an aggressive investment portfolio for wealth building | Provides reliable and long-term regular income |

| Maturity | Plan expires at maturity | Pays the guaranteed value or maturity value | Pays the fund value at the time of maturity | The plan expires and nothing is paid out |

| Life/Protection Cover | 100% Sum Assured | 10-15 times of your annual premium | 10-15 times of the annual premium | 10 times the annual premium |

| Benefit Pay Out Options | Lump-sum and regular income mode | Regular money backs and lump sum maturity | As per investor choice & systematic withdrawals | Paid as regular income at fixed intervals |

| Riders | Accidental Death & Disability, Critical Illness, Child support benefit | Accidental Disability, Goal/ Premium protection | Accidental Disability, Goal/ Premium protection | Terminal illness |

| Bonus | NA | Loyalty and Guaranteed bonuses | Loyalty additions and wealth boosters | Guaranteed additions |

| Joint Holding | Available | Available | Available | Available |

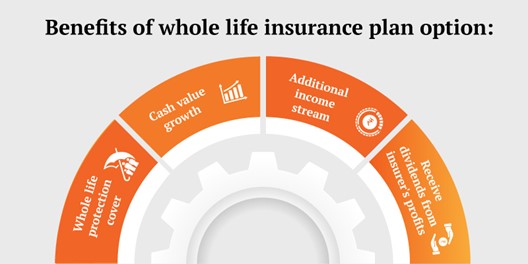

Whole Life Plans

Whole life plans are a simple variation of the existing plans. The only difference is that these plans can continue to cover your life until you reach 99 or 100 years of age. There are two types of whole life plans:

- Whole Life Term Plan: Lower premium and saving component and continues till the age of 99. You can choose a limited premium payment term or equal to the policy term.

- Whole Life Endowment Plan: Higher premium and saving component, achieves higher cash value and can work as a retirement financial support.

Both these plans will help you leave a legacy for your family.

Is it a Smart Investment?

Life insurance is a tool and will only be as good as the choices of the user. However, if you choose the right plan for the right goals, this tool will definitely be your smart choice. Apart from all other features related to protection and investment, the following benefit makes life insurance a smart investment:

- Investment in life insurance plans is deductible from your taxable income in any fiscal year under section 80C, within the limits of Rs. 1.5 lakhs

- Any accrued interest and partial payments received from a life insurance plan is exempt from tax

- Maturity value and death benefits are also exempt from tax

Thus, life insurance helps you beat both inflation and taxes if used properly.

A life insurance policy is a protective layer added to you and your family members. It also does not let your family suffer due to a financial crunch in the case of your untimely death.

Life Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs

Popular Searches

- Term Life Insurance

- Whole Life Insurance

- Critical Illness Insurance

- Accidental Death Benefit Rider

- Compare Life Insurance Quotes

- Best Life Insurance Companies In India

- Factors Affecting Life Insurance Premiums

- Insurance For Tax Savings

- Life Insurance For Children

- Life Insurance Rider

- Life Insurance Plans

- Types of Life Insurance

- Term Life Insurance Tax Benefit

- What is Insurance?

- Life Insurance Premium