Life insurance is a contract between an insurer and a policyholder. By far, it gives out payment after the person dies for their respective family. Is it beneficial for a woman to invest in a life insurance policy? Yes, often more so for women, this plan can prove to be a financial safety-net for unforeseen emergencies for homemakers. With changing trends, women are now moving towards financial liberation by exploring insurance and other financial instruments as a savings mechanism.

Women and girls represent the largest contingent of this unenviable group. From having the power to handle half the workforce to playing the central role of being a mother, sister, wife, daughter, and homemaker, it is not uncommon for women to be called the 'money manager' of the house in Indian families.

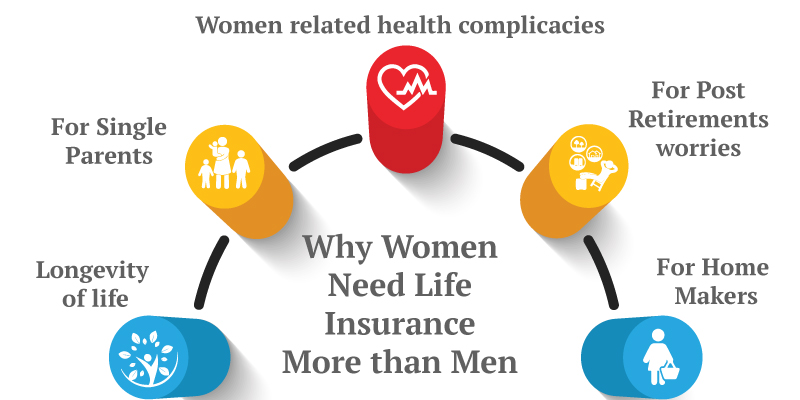

The following reasons will help you understand why and what will be the benefits of a life-changing insurance plan:

a) Peace of mind - It can allow women to be freer physically and financially to pursue their goals.

b) Cost-effective - A more cost-effective way of saving your income and securing your substantial coverage.

c) Saving for your future helps secure your household's dual-income well after your partner's and your retirement.

d) Leaving behind a legacy - Your children can use the monetary benefits of your insurance.

Why and When a Woman must Buy a Life Insurance Plan?

Buying a life insurance policy is best done while you are still young and relatively healthy. The older you become, the more the need grows to save for any further emergencies throughout your life.

Your life insurance gives your family choices by providing the benefits to help pay off debts, meet housing payments and ongoing living expenses, fund college educations for your children or grandchildren, and much more. Life insurance plan provides financial stability when it's needed most.

1. An Investment Strategy for Beginners

Before taking the investment plunge, you must determine your long-term or short-term financial objectives as an investor. Do you want to build up a corpus to fund your child's education? Are you saving for your wedding expenses? Or, is investment merely a tool for making quick money for you? The reason why setting your final objective in coherence with the total capital invested and the net earnings expected should always be your first and foremost priority.

2. Term Insurance Plans for Women

A term insurance plan is the first and straightforward tool for investing. As the name suggests, term plans are essential life insurance covers having systematic premium pay-outs over a fixed period. The significant benefit of term plans has to be the simplicity of the cover and the added tax benefits. For young women who have just started working, term plans are incredibly affordable. The low premium is one of the significant benefits of a term plan. For example, if you bought a Rs 1 crore term plan at the age of 25, you would be paying a premium of as little as Rs 500 a month or Rs 6,000 for the year.

3. To Manage Regular Expenses

Often, single women do not get themselves insured since they have no one who depends on them to provide food and shelter. But you have to realize that in the unfortunate event of you passing away, the burden of car loans, education loans, and even home loans are something that your families would have to look after. A term insurance plan is an excellent option for a single woman.

Are you still planning to work after your 60s? Make a smart choice and invest your money smartly. Staying fit after the 60s is a big challenge. Therefore it is fair that you have health insurance coverage to be assured of a financial backup if a medical contingency arises.

How much Life Insurance Cover should a Woman have?

The ideal life insurance should be at least 5-10 times her income and savings. Enough life insurance will help you and your family in the long run. A report from Insurance Regulatory and Development Authority of India (IRDAI) says women comprise 48% in this country in which only 32% of insurance policy was sold in total in 2017-18, which gives us how a women's growth and contribution towards the society is increasing every year.

Also, insurance agents are encouraging more and more women to buy a life insurance plan. The insurance agents and other intermediaries have successfully sold insurance to only 139 women out of a population group of 10,000 women. It indicated that they did not approach either a large number of women or a large number of women have declined to consider life insurance as a beneficial financial instrument.

Women's contribution to economic growth and society is increasing every year. The number of women buying life insurance is increasing rapidly. India's most trusted life insurance corporation, the most trusted by women, concludes that the proportion of LIC sold by them is 39%, while for private investors, it is 27%.

Life insurance coverage is suitable for anyone at any life stage. Individuals at varied stages of life can make the wise decision to grow their wealth, build their dreams and nurture their loved ones' aspirations for a better and brighter future by understanding the vital role of life insurance in financial planning. This life insurance policy will help women and every individual who wishes to take up insurance in their life. Lack of insurance of any family member can affect the rest of the family members' financial and emotional well-being. Therefore, it is always advisable to take up insurance plans seriously and always read each plan before jumping to conclusions.

Suppose a woman working somewhere must get their life insurance for their safety. Also, women should not ignore taking life insurance to protect their future life. Plus, they should not think that they aren't eligible to take the policy because they don't earn. It would be best if you had protection from nearby casualties.

Life Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs

Popular Searches

- Term Life Insurance

- Whole Life Insurance

- Critical Illness Insurance

- Accidental Death Benefit Rider

- Compare Life Insurance Quotes

- Best Life Insurance Companies In India

- Factors Affecting Life Insurance Premiums

- Insurance For Tax Savings

- Life Insurance For Children

- Life Insurance Rider

- Life Insurance Plans

- Types of Life Insurance

- Term Life Insurance Tax Benefit

- What is Insurance?

- Life Insurance Premium