Investing is a regular activity. You can invest your surplus and withdraw money when you need it. However, without investment management, you may find your investments slacking. Adequate and timely investment management can help you optimise your investment needs with the market growth.

While financial planning gives you an idea of your financial needs and resources, investment management starts with the execution of the plan. The moment you want your money to work harder for you, you will face the challenges and questions of investment management.

Definition: Investment Management

If you buy and sell stocks, that does not amount to investment. Such actions are merely transactional.

Handling financial assets and devising prudential strategies for acquiring and disposing of assets from your portfolio is a better definition of investment management.

Some of the commonly used terms to refer to investment management:

- Portfolio Management

- Money Management

- Wealth Management

Scope of investment management:

- Banking

- Budgeting

- Tax services

- Trading

- Acquisition and disposal

Must Read - What is Net Present Value?

Factors Affecting Investment Management

Investment management must account for the following important factors to provide effective guidance to your money. These factors are usually a part of your financial planning exercise:

1. Rate of Return:

If you are investing for the long haul, you may focus on wealth creation, whereas shorter-term objectives generally look at immediate cash flows and income generation.

2. Investment Horizon:

If you are planning for retirement, a pension fund is a place to go. If buying a car is on your wish list, a bank deposit is relevant.

3. Degree of Risk Tolerance:

Equity helps generate wealth but is volatile, real estate is illiquid and PPF accounts give moderate but stable returns. You will have to strike a balance when allocating your money across asset classes.

4. Liquidity:

What are your cash flow requirements? How much money do you want within reach each month? At which points in time in future do you expect more than usual outflow of money? Basis these answers you must spread your investments across liquid and illiquid assets.

Types of Investment Managers

Investment managers are key people in managing your money, growing it and returning it to you as safely as possible. They work under tremendous risk and invest your money keeping in view your financial objectives and your risk appetite. However, all investments have one objective in common-to grow your money. The aspired quantum of growth may vary depending on the risk appetite.

Some of the common avatars of investment managers:

a) Fund Manager:

A fund manager manages your money and allocates them amongst stocks, bonds and g-secs.

b) Portfolio Manager:

A portfolio manager would manage multiple funds that have objectives of their own.

c) Financial Advisor:

A financial advisor provides expert tips on investing your money. A financial advisor has information on returns, costs and terms for various financial investment avenues available in the market.

Style of Investment Management

Investment styles vary across investment experts and also depend on your objectives and timelines. Different investment styles can also carry different investment risks and your choices will depend on your risk appetite:

1. Active:

If you want to take advantage of short-term volatility in the market, an active strategy works best. However, keep the transaction costs in mind. The costs, of trading, should not exceed the money made from trading in stocks. (High-risk)

2. Passive:

In this case, you keep an eye on your investment but don’t touch the money in the short term. You will reap better benefits if you stay invested. (Low-risk)

Know More - Passive Investing

3. Growth:

This is a hybrid strategy depending on the trend of the stock and the underlying business fundamentals. (Medium-risk)

4. Value:

Investing based on price to book value gives an intrinsic view of the stock and how would it fare when there is a market correction. (High-risk)

5. Income:

The focus here is on earning money from dividends and interest on bonds. (safe to low risk)

Safe income funds will focus on generating income through fixed income securities like bonds and debentures. Aggressive income funds invest in blue chip equity stocks to generate income through dividends.

Also Read - Income from Salary

Performance Measures in Investment Management

You can rely on different performance measures to assess the results of your investments over time. Each method offers a unique perspective and should be used in appropriate scenarios. For example, CAGR is the most common method for representing mutual fund growth, while IRR would be more appropriate for regular investors.

You can consider any of the following measures to assess your investment choices:

a) Compound Annual Growth Rate (CAGR):

CAGR tracks the average annual growth, of your investments, over the defined period. It displays the average rate of return on your investments over a year. CAGR is helpful because it accurately measures growth (or degrowth) over time.

b) Internal Rate of Return (IRR):

IRR estimates the potential profitability of your investments.

c) Assets under Management (AUM):

AUM is the total market value of the investments that your fund manager manages on your behalf.

d) Portfolio Risk:

Portfolio risk can be measured with beta which determines the systematic risk of your portfolio. It is the weighted average of the beta coefficient of different stocks in your portfolio.

CAGR of Popular Investment Options

The majority of the portfolio investment options in India provide a CAGR for their historical performance.

Here are three popular investment options and their CAGR over a period:

a) National Pension Scheme (NPS):

NPS has given a historical return of anywhere between 8.63% to 12.83% per annum, over 10 years, depending on the scheme chosen

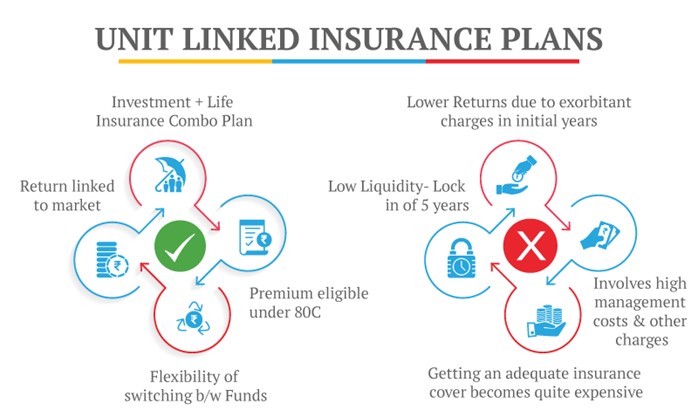

b) Unit Linked Insurance Plans (ULIPs):

The ULIPs offered by Canara HSBC Life Insurance have given a CAGR in the range of 6% to 24%, over 3 years, depending on the fund chosen.

c) Equity Linked Savings Scheme (ELSS):

The ELSS category has fetched an average return of 15% per annum over 10 years.

Must Read - NPS Withdrawal Rules

CAGR vs IRR in Investments

The CAGR of NPS and ULIP can vary a lot due to the range of fund choices within these investments. You can invest in a safe portfolio consisting of mostly government securities or invest in an aggressive portfolio of majorly equity stocks. The higher the risk, the higher your long-term returns can be.

Another factor you should consider is the bonus additions available to long-term investors in ULIPs. ULIPs like Invest 4G from Canara HSBC Life Insurance add wealth boosters and loyalty bonuses if you continue to invest for more than 5 and 10 years. Thus, your IRR from the ULIP plan will be very different from the CAGR reflected by the funds.

Investment management ensures your money is diversified across asset classes and financial instrument. The investment is made basis a clear growth plan, factoring in your risk appetite, and short/medium/long-term financial goals. Strategizing investment will help reduce transaction costs, save on taxes and fetch a better return on investment.

Disclaimer: This article is issued in the general public interest and meant for general information purposes only. Readers are advised to exercise their caution and not to rely on the contents of the article as conclusive in nature. Readers should research further or consult an expert in this regard.

Financial Planning - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Save, Dream, Plan. Live Peacefully

- 5 Plan options

- Option to choose PPT

- Get Tax benefits

- Premium protection cover

Recent Blogs