Recurring Deposits, or RDs, are a well-liked and reputable investment strategy among people of all ages. The question now is, what exactly is a Recurring Deposit account? Recurring Deposits, often known as RDs, are special term deposits provided by Indian banks. It is a mechanism for investing that enables people to set aside money regularly and receive respectable returns.

In India, most banks and NBFCs provide recurring deposit accounts with terms ranging from six months to ten years.

How does a Recurring Deposit Work?

Like FDs, recurring deposits allow you to make regular investments in fixed amounts, such as Rs. 1000 per month. This deposit matures on a specific day in the future.

For example, you start an RD for 60 months (5 years) and will deposit Rs 1000 p.m. If the RD pays an interest of 6% p.a. you will receive about Rs 70,000 five years later while you only deposited Rs 60,000.

As a result, consumers have the chance to increase their earnings through repeated monthly contributions of a predetermined value over a fixed length of time thanks to recurring deposit plans. An RD might last anywhere from 6 months and 10 years.

Features & Benefits of a Recurring Deposit

When you invest money with RD, you receive a constant interest rate on that sum at a set frequency till the term expires. The balance owed at maturity (your invested money) and any unpaid or accrued interest are reimbursed after the period. Let’s discuss a few features of Recurring Deposits:

1. Fixed Income Returns

It offers a return that is assured at maturation. When one invests their money in a RD, they are already aware of the interest rate. Furthermore, throughout the investment, the interest rates remain unchanged.

2. Lowest Investment amount

The best part about RDs is that you don’t need a huge amount of money to begin your investment journey. With a sum as low as Rs.100, you are all set to invest in RDs. This can come in handy if you have a substantial surplus from your salary that you wish to invest.

Must Read - Income from Salary

3. Flexible Period

An individual has the option of opening a recurring deposit account for at least six months and if ten years in the future. Recurring Deposit, or RD for short, allows you the freedom to select the timespan that works best for you.

4. High-Interest Rates

Recurring deposits have better interest rates than standard savings accounts. The interest is typically compounded by banks every quarter.

5. Lock-in Period

The length of the lock-in period for a recurring deposit account might range anywhere from 30 to 90 days, depending on the preferences of the service provider. You won't earn interest on any withdrawals you make during the lock-in period.

6. Pre-mature Pay Outs

In the case of a recurring deposit, consumers are permitted to make early withdrawals, although a fee will be assessed.

7. Lending Facility

You can use loans or overdraft services in exchange for a regular deposit. The funds accessible in the RD account are used to offset loan default costs.

Things to Check Before Investing in RD

Let's examine the variables to consider before investing in the Recurrent Deposits. Before you consider creating an RD account, you must take into consideration the following things: -

1. Investment Size

The bare minimum to open a regular deposit account is one hundred rupees. A recurrent deposit is a practical investment strategy since it doesn't need a sizable initial commitment. Before starting an RD, calculating your investment capital is a crucial element to consider.

2. Duration

A recurring deposit can be made for a duration of between six months and ten years. Once an RD account is opened, the duration cannot be changed until the RD matures. To get the best results, be sure to select the tenure according to your needs.

3. Rate of Interest

A monthly interest payment is made on your investment. The interest rates might differ from one bank to another. Therefore, it is wise to select the recurring deposit option that provides the highest rates of interest for your money.

How to Open a RD Account?

You have the liberty to initiate your RD account via both online and offline outlets. Below we will discuss the steps you will need to take to achieve the same.

a) Online Method

1. To begin, access your online bank account.

2. After that, choose "Open an e-RD Account."

3. Specify the capital investment, the period, and the bank account from where you want to transfer the money. Verify the interest rate that applies and select the name for the RD account.

4. Select the maturation sum and then affirm that you accept all the conditions of the agreement.

5. complete the application at the end. The RD receipt will be sent to you through email and messaging.

b) Offline Method

1. To access your savings account, you must go to the closest bank location.

2. Then, you must provide the investment amount, payment method, term, nominee, and other relevant information on the RD application form.

3. Settle the first instalment's balance in currency or by cheque.

4. Your application will be processed by the financial institution in the allotted period.

Who can Invest in an RD?

Recurring Deposits, or RDs for short, are eligible for opening at both banks and post offices with the same set of requirements. To start an RD account, you will need to have an existing savings account first. A list of legal entities that can open RD accounts follows:

- Owner of a personal savings account

- Minors above the age of 10

- Minors under natural or legal supervision under the age of ten

- a corporation, business, sole proprietorship, or entrepreneurial entity

- government institution

Other Investments Similar to RD

RDs are, no doubt, simple to follow and understand the investment. However, it is not the only one, especially when you are looking at higher – investment, growth and tax benefits. The following investments are comparable, and often beat RD in certain benefits:

Limited Pay Savings Plans

Life insurance savings plans have been a popular choice of investment for those seeking preservation goals for their wealth. These plans simply offer a guaranteed maturity value and bonuses along with the following benefits:

- Tax saving on invested money

- Tax-free maturity value

- Better growth

- Limited pay option, i.e., you can pay the premiums for a 10-year plan in 5 years

- Life cover throughout the policy term

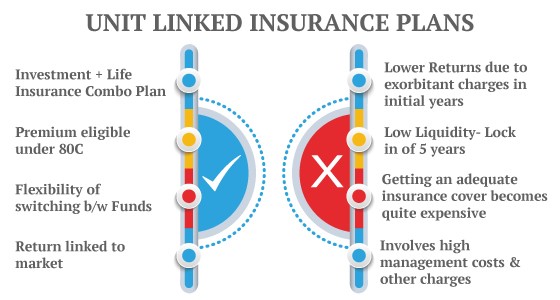

Unit Linked Insurance Plans (ULIPs)

ULIPs are versatile investments which let you invest in diversified portfolios of your choice of asset classes. With ULIPs you can:

- Invest in a portfolio of equity and debt funds

- Invest for a minimum of five years and a maximum of up to 99 years (Invest 4G ULIP from Canara HSBC Life Insurance)

- Bonus additions for long-term investors

- Life cover throughout the policy term

- Premium protection option to safeguard maturity value for important life goals like child’s education

- Partial withdrawals are available after five years in the plan

- Withdrawals, as well as maturity values, are tax exempt in ULIPs

Diversified Debt Mutual Funds

Diversified debt mutual funds are one of the most flexible investment options available. You can invest in monthly SIP mode which is very similar to an RD. However, unlike RD, the mutual fund will not penalise your portfolio if you stop the deposits before your intended investment term.

Also, your investments will be treated as a long-term capital asset in the fund after three years. Thus, while withdrawing you can avail the benefit of indexation on the gains.

If you are earning monthly, investing monthly is your best and fastest option to build wealth. Most banks provide the RD service, which allows customers to deposit money consistently and receive satisfactory returns. You can invest a fixed amount every month and build wealth with the simplicity of recurring deposits (RD). However, do keep an option open for other more tax-efficient investments.

People typically benefit from the increased flexibility and convenience of making investments made possible by the presence of an interest component in addition to the regular deposit element.

Financial Planning - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Save, Dream, Plan. Live Peacefully

- 5 Plan options

- Option to choose PPT

- Get Tax benefits

- Premium protection cover

Recent Blogs