Becoming financially wise at a young age can significantly improve the quality of your later years. When you hit your 30s, financial goals become indispensable, and the fact that you are getting closer to your retirement years, you need wiser financial management. That’s why a major chunk of financial experts believe that how you spend your retirement years depends on how well you plan during your 30s!

Although managing finance is necessary as soon as you start earning, establishing financial goals during your 30s can help you prepare well for your autumn years. So, here are some major financial goals you must master during your 30s with a proper financial planning.

6 Financial Goals for your 30s

Your 20s might have had fewer responsibilities, but once you hit your 30s, you need to seek concrete financial planning to be a backbone for your future. You must emphasize savings as this is the decade that can decide how financially stable you remain after you retire.

1. Budgeting and Savings

For effective budgeting, most financial experts recommend using the 50-30-20 rule. The 50-30-20 rule is the simplest way of planning your budget, where your expenses are divided based on requirements. According to this, 50% of your expenses must be spent on needs, 30% on wants, and the remaining 20% must go into savings.

However, in your 30s, the rule comes with some significant amendments to save more and spend less. This does not mean cutting down on personal expenses completely, but adjusting the proportions by increasing the savings from 20% to about 30% can work.

2. Make Retirement Plans

Retirement plans are pivotal for a secure future. Mastering this financial goal in your 30s can help you maintain a good standard of living even in your old age.

Unfortunately, most Indians in their 30s do not have a retirement plan in place. The primary reason behind this is that most of their income is being drained on current needs. Here, cutting down on expenses and investing money in retirement plans is the need of the hour.

The best way towards a good retirement plan is to assess your current financial situation and set goals. Think about long-term investments, such as investing a certain amount of your savings in index funds and bank fixed deposits.

3. Keep Track of your Credit Score

Credit scores play an essential role in your borrowings. Without having a good credit score, you might not be suitable for several financial schemes or availing of loans. Having a poor credit score instantly creates a lousy impression on financial institutions about your credibility.

These simple tips might help you from getting stuck in the never-ending loop of debts.

a) Pending bills and debts need to be paid off immediately.

b) Repay all your loans on time

c) Don’t be lured to offers like easy EMI, zero interest EMI, etc.

d) While applying for loans, always use an EMI calculator for accurate estimates of repayment.

Remember to keep your credit score above 700. This might sound difficult at first, but you will realize its benefits in the long term. By getting your debt under control, you can stop the snowball effect. This simple strategy not only improves your current financial condition but also helps you achieve future goals.

4. Allocate Funds for Emergencies

Life is full of uncertainties, and a financial crunch can be major trouble in such situations. Especially as you enter your 30s, you need to prepare for unprecedented circumstances. You might need more medical cover, or you need to fund your child's college education, etc. Here, building an emergency fund is one of the most important financial goals to master in your 30s.

Let us say Animesh was a healthy man, but just before his 50s, Animesh succumbed to a critical illness. It was difficult for the family to cope, as Animesh was the sole earner. Fortunately, Animesh had set aside an emergency fund that was enough to sustain his family for a while.

An emergency fund can be created using any income instrument such as mutual funds, insurance policies, and investment in stocks and shares. It helps you create a financial cushion for yourself and your loved ones.

5. Insurance is a good idea

You have a good saving habit. This has helped you save for the future. Unfortunately, saving is not the only way to secure your future. Insurance policies are a great way to make the best out of your savings in your 30s. They act as a safety net for your family and can be an effective retirement plan too.

However, life insurance policies need you to dispense some wealth in certain intervals to yield good returns during tough times. Thankfully, insurance policies in India are very affordable and are offered by most trusted banks such as Canara HSBC Life Insurance.

Moreover, life insurance plans also help you save taxes and are a viable option for additional income.

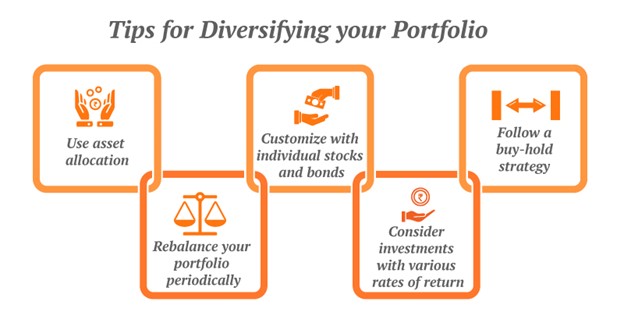

6. Diversify investment portfolio

Creating a diverse portfolio helps you cope with the risk factor of investments. It doesn't matter if you have a high-risk appetite; having a diverse portfolio is still recommended as you can safeguard your wealth to a certain degree.

Different forms of investments and various assets can create a balance of rewards and risks, which helps you deal with market fluctuations. The rule is simple: begin investing in your 20s and diversify in your 30s!

While financial goals can start as soon as you earn, entering your 30s calls for a much-sophisticated approach. No wonder your retirement years largely depend on your financial plans during these crucial years. These smart wealth goals instill a sense of responsibility and help you deal with future uncertainties.

Learn how to make money grow even as you sleep, or you will find yourself working even when you are 60. By having financial goals in your 30s, you can achieve financial stability for the rest of your life!

Financial Planning - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Save, Dream, Plan. Live Peacefully

- 5 Plan options

- Option to choose PPT

- Get Tax benefits

- Premium protection cover

Recent Blogs