There are different ways to look at money. You can make the most of the money you have if you understand the time value of money. The value of money is its purchasing power. What money can buy depends on the price level of the item. When the price increases, you can purchase less of it with the same money.

A decade back, with Rs 10,000, you could have bought all your monthly groceries, but today for the same groceries, you may be spending Rs 15,000. It means the value of money has been reduced. You will need even more for your monthly grocery in the coming years.

Definition: Time Value of Money

Assume you have lent Rs 50,000 to your friend who has committed to pay you after a week. However, a week later, he calls you and informs you that he won't be able to return the money for the next three months. However, he assures you that he will return the complete sum in three months.

For a layman, the assurance will bring happiness that the money will come back. However, if you understand the time value of money, you will not be happy with what your friend told you.

According to the Time Value of Money, the money you have in hand today is worth more than the same amount you will have in the future. In the above example, the worth of your loaned money is lower after three months. So even though you will receive the whole money, you are at a loss.

Since money can generate interest, the value of money is less if you receive it in the future. There are two reasons for it:

a) Inflation:

Inflation reduces your purchasing power. If you had planned to buy a TV for Rs 50,000 today, you will not be able to buy it three months from now because of inflation.

b) Opportunity Cost:

If you can invest the same money you may earn interest on it. For example, in fixed deposit. If you keep the money in your pocket or loan to a friend without interest, you end up losing this income opportunity.

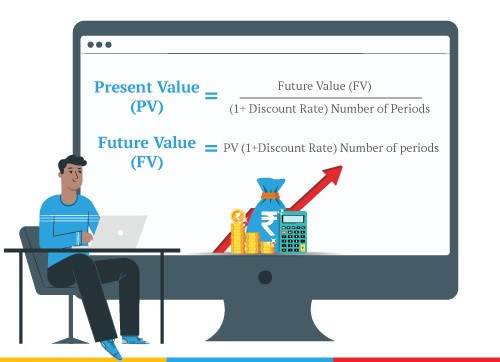

Present Value & Future Value of Money

The present value is the money you have today that is equal to a future one-time disbursal discounted by a suitable interest rate. It provides you with an estimated amount to spend today to have an investment worth a certain amount of money at a specific point in the future. It indicates that whatever money you receive today can earn a return in the future.

Future value is the amount of money that will grow over a specific period with simple or compound interest. For example, if you invest in a fixed deposit that pays you 6% interest on your investment of Rs 1 lakh for a tenure of one year, the future value will be Rs 1.06 lakh.

TVM in Investment

You need to understand how TVM in different instruments works. It will help you make the correct investment. Along with future value, you should also consider taxation when choosing your investments. TVM is calculated using the below formula:

FV = PV x [ 1 + (I/ N) ]^(N*T)

here, FV is the future value, PV is the present value, N is the number of compounding years, and T is the investment tenure.

For example, If you invest Rs 10,000 (PV) for 10 (T) years at an 8% (I) p.a. rate of interest, you will receive Rs 21,589.25 (FV) on maturity.

a) TVM in Fixed Deposits:

Fixed deposits give you a fixed return on your investment. However, the interest you earn is taxable, and hence real return is calculated after deducting the taxes. For example, you invest Rs 1 lakh in a Fixed Deposit at a 6% return for five years, and you are in a 30% tax slab.

Using the above formula, FV will be Rs 161,051. Since you are taxed at 30%, your net gain will be Rs 42,736 only.

b) TVM in Mutual Funds:

Mutual funds are investment options where you have the flexibility to stay invested as long as you want to. Mutual funds have variable market-linked returns. Thus, you can only estimate your future returns based on the past performance of the fund or similar funds.

However, the time value of money for your investments will vary based on your investment horizon, mode of investing and withdrawal. You can estimate your real return after withdrawing the money.

Mutual fund returns are taxed as capital gains only after withdrawal. So, you can easily establish the impact of taxation on your returns.

c) TVM with ULIPs:

ULIP plans also carry investments in multiple funds. However, you can invest in more than one fund option within the same ULIP at the same time. So, you have two kinds of ROIs – 1. Individual Fund’s ROI, 2. ULIP ROI

ULIP’s ROI is a weighted average of individual funds’ ROIs. Since ULIP returns can be completely exempt from tax, your ROI can be free from the tax effect.

Like mutual funds, you can estimate the real ULIP ROI for your portfolio at the time of withdrawal.

How to Maximise TVM for your Investments?

Based on the discussion, it is clear that you are better off if you can earn more on your investments - you can maximize TVM for your investment. Below are a few things you can do to maximize TVM for your investments:

a) Stay invested for the long-term:

The more time you give your investment, the higher you can earn from your investments because of the power of compounding. You not only earn interest on your capital but also on the interest.

Also, investments like Invest 4G ULIP from Canara HSBC Life Insurance, offer bonus additions to long-term investors. Bonuses are free growth for your portfolio only because you continue to invest over a long period.

b) Optimize costs:

Most investment plans have a charge associated with them. If you invest in a non-fixed return investment option, the returns are not in your control. But you should always consider the investment charges. Choose an investment option where the cost is less, to maximize your returns.

c) Invest in EEE options:

You should opt for the EEE investment option where the capital invested, the accrued interest, and the maturity value all are tax-free.

Best EEE Investments

Below are some of the best EEE investment options you can explore:

a) Unit Linked Insurance Plan (ULIPs) :

These are life insurance plans and also savings plans and come with a range of investment features like multi-fund allocation, goal safety, automated portfolio management, etc.

b) Public Provident Fund (PPF):

If you are looking for a safe investment option with EEE benefit, you can opt for PPF. The returns are safe and linked to market rates declared by the Employee Provident Fund Organisation (EPFO) at the beginning of the financial year.

c) National Pension Scheme (NPS):

This investment option is perfect for retirement planning. You can invest 10% of your salary or 20% of your income every year in NPS. It can be withdrawn only at the age of 60.

You should understand TVM and apply it to all your investments. Your goal should be to maximize your returns on your investment to enjoy higher TVM. It’s also simple to do. All you need is to invest as per your investment goals so that you don’t end up withdrawing from long-term investments early.

Maximise your tax-free returns to avoid huge tax outflows when you have a windfall investment gain. Market linked investments are always good for beating inflation.

Disclaimer: This article is issued in the general public interest and meant for general information purposes only. Readers are advised to exercise their caution and not to rely on the contents of the article as conclusive in nature. Readers should research further or consult an expert in this regard.

Financial Planning - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Save, Dream, Plan. Live Peacefully

- 5 Plan options

- Option to choose PPT

- Get Tax benefits

- Premium protection cover

Recent Blogs