The financial needs of people change as per different life stages and milestones in life. A young, unmarried, working professional, whose parents are independent, may not have significant cash outflow as compared to a married person, has children and even dependent parents. Financial planning should take into account both the current as well the projected needs. The young professional will also someday get married, have children and retire. Life insurance plans should be seriously considered while planning life, health and money.

The benefits, life insurance coverage provides is unprecedented and is the most comprehensive financial instrument covering health, savings, wealth creation, retirement and financial protection against death.

What Does Your Life Cover Include?

Life insurance cover is an indispensable part of a life insurance policy, which means that your life is financially protected irrespective of the kind of policy that you sign up for. A quick insurance policy review will give you insights into the advantages of life insurance coverage:

1. Term Life Insurance Cover

Live peacefully without worrying about what if you are not around? Your family is financially safeguarded with a pure term cover that can be as much as 15 times your annual income. The iSelect Smart360 Term Plan has some added benefits that give you more peace of mind.

a. In the fortunate event of you surviving the policy term, you can opt to get all your premiums back.

b. You can even include your spouse in the policy at a nominal additional cost thus saving money from buying two separate policies.

c. You can opt for additional riders that pay out an extra lump sum amount in case you are unfortunately inflicted with a critical illness or suffer a total permanent disability.

d. There is a special Child Care Benefit (CCB) rider that helps your child continue his/her education despite any challenges to your life.

e. Understandably, you do not want a huge life cover when you are single but may need one when you have a family and additional responsibilities. With iSelect Smart360 Term Plan, you can increase Sum Assured (and therefore the premiums) matching specific life stages so that you get the best of both.

2. Life Cover Under Investment Life Insurance Plans

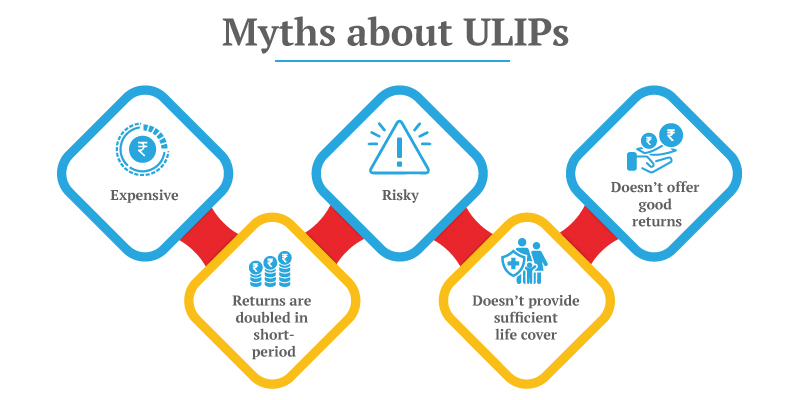

ULIPs are ideal if you are contemplating wealth generation in the long run. Take the example of Invest 4G plan offered by Canara HSBC Life Insurance, which gives you complete control over your finances. You can move your money across funds to take advantage of the aggressive returns provided by equity and also fall back on the safety and security of debt instruments. You can also define the % allocation to equity/debt and that would be automatically adhered to under all circumstances.

ULIPs also carry a life cover sum assured which is a guaranteed payable amount in case of your early demise. Similarly, other life insurance investment plans including guaranteed plans provide a fixed sum assured as life cover.

3. Life Cover Under Pension Plans

Pension plans and retirement saving plans from life insurance companies also provide a limited life cover. If you have invested in such plans, you likely have this life cover as well.

Life insurance policies such as GuaranteedIncome4Life and Guaranteed Savings Plans give you guaranteed income streams after you invest for a fixed term. Such plans carry a life insurance cover by default and add to the contingency fund available to your family in your absence.

Five Reasons to Review Your Life Cover

You should review your life cover whenever there is a significant change in your family’s lifestyle, income, or overall expenses. Following are the five most prominent events where you should consider upgrading your life cover:

1. Growth in Family Members

You may have some life insurance in your kitty. But it is now time to review it so that your investments are aligned to your current circumstances and future needs. Rise in living costs due to lifestyle changes, spiralling inflation are the top reasons.

Marriage, children and your aspirations are some of the top reasons to invest in life insurance plans. If your parents have sacrificed their earnings to give you a comfortable life and are retiring with inadequate savings, you will have to factor in that expense as well.

2. Additional Financial Goals

You plan to buy a spacious house at the end of 10 years from now which also coincides with your child’s Class 12 passing out the year. If you have planned to send him/her abroad for professional education, you will need a sizeable corpus for that as well.

3. Significant Rise in Income

If you are earning more now, your Human Life Value (HLV) is also much more than it was before. It is wiser to avail a larger term cover to safeguard your family so that they remain financially stable even in case of your unfortunate demise.

4. New Liabilities

Buying a home is always an exciting moment in life. Home loans are also now so easily available that anyone dreaming of a home can buy one depending on the repayment capability etc. But in the case of the demise of the borrower, the dream can turn into a nightmare as repayment defaults start piling up.

If the default continues, the bank may even attach the flat and recover the loan. To mitigate this risk, specific term plans can be availed to settle the loan in case of demise.

5. Rising Cost of Living

As illustrated in the table earlier, inflation can erode the value of your hard-earned money if not invested wisely. Another word of caution. Inflation numbers that you see in the news are average rates, which means that specific sectors will be affected more severely than others.

Healthcare inflation may be higher than average and you should be concerned because a significant portion of your savings may be spent on health during your old age. Education is another area you should be concerned about if you have kids or plan to have them soon.

Insurance is an indispensable part of modern investment portfolios. Although you may have invested some money in insurance, the deeper question is whether it is sufficient? It is time to relook at your insurance planning keeping in view the above factors and expanding your exposure to diverse insurance products that will give you safety, security and assurance.

Life Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs

Popular Searches

- Term Life Insurance

- Whole Life Insurance

- Critical Illness Insurance

- Accidental Death Benefit Rider

- Compare Life Insurance Quotes

- Best Life Insurance Companies In India

- Factors Affecting Life Insurance Premiums

- Insurance For Tax Savings

- Life Insurance For Children

- Life Insurance Rider

- Life Insurance Plans

- Types of Life Insurance

- Term Life Insurance Tax Benefit

- What is Insurance?

- Life Insurance Premium