It’s terrible when we fall into a drastic income cut due to unexpected situations like Covid-19 and do not have an emergency corpus to take care of our contingencies. Many people have had to face hardships on the money front in this pandemic. But as they say, it is never too late. People who have missed out on building an emergency corpus could create one in the months ahead through systematic planning.

An emergency corpus is critical in uncertain times and with an emergency corpus in place, you could live worry free. Many investors get carried away by the promise of higher returns on equity and end up never building an emergency corpus for themselves. An emergency fund can be in form - from sufficient deposits in a savings account, to a unit linked insurance plan that allows pre-withdrawals in times of emergency. Ensure whatever the source be, it is accessible in a day or two to help in any crisis, should you face a sudden dip in earnings from disruptions due to a market shutdown, natural calamity etc. Such emergency corpus can help pay for major expenses like children’s education, an equated monthly installment or even usual household expenses, if needed.

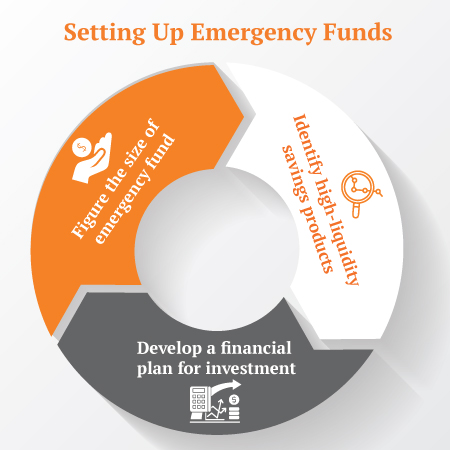

How much savings would you need?

Depending on your income and regular expenses, an emergency fund can be anything between three to six months of your monthly income. If you plan to start an emergency fund now, take account of the amount of money you need for your living expenses, money payable towards school fees, EMIs payable, and other unavoidable expenses. Also, it is advised you review these every few months to monitor and incorporate any increase in expenses. You may even choose to divide your emergency fund into 2 categories, and choose saving instruments accordingly.

a. Long-Term Emergency Funds

These are long term savings plans where you save a large chunk of investments for large-scale emergencies like a sudden medical exigency or a natural disaster. This fund should be invested in plans that offer wealth creation benefits and allow you to earn considerable interests, but may also be liquid to allow emergency withdrawal. For instance, ULIP plans like Invest 4G are a great tool that lets you invest in avenues depending on your risk appetite, ensuring guaranteed results along with partial withdrawal facilities.

b. Short-Term Emergency Funds

This is the fund you must rush to in cases of smaller emergencies that may arise. These funds should allow immediate accessibility, even if the rates of interest are low. Also, these are the funds that can suffice in case of extreme situations, till you gain access to your long-term emergency funds.

Start with making the right investm

Health and term insurance are a must to ensure a secure financial future for your family. In addition, unit-linked insurance policies (ULIP) that promise to pay returns at the end of the tenure are also considerable options. Apart from financial security, insurance policies are also a smart way to build wealth. While investment options such as equity and mutual funds play an important role in long-term wealth creation, there are several plans that can help fulfill both cover and savings needs.

1. Unit Linked Insurance Plans –

ULIPs combine life insurance with investment, as in the premium you pay is divided into insurance and the investment plan selected by you at the time of purchasing the policy. ULIPs let you choose from equity, debt and hybrid fund options according to your needs. Though the returns from the plan are market-linked, you have an option to switch between funds when required. Also, plans like the Invest 4G allows you to make partial withdrawal after a certain lock-in period.

2. Endowment Plans –

If you are a risk-averse, you might want to invest in endowment plans to build wealth. Endowment plans are long-term saving plans that come with life cover. The policy allows withdraw either as a lump sum amount or in monthly installments, on maturity. Also in case the insured survives the policy tenure, the lump sum amount from the policy can be used for financial objectives like children’s education, their marriage etc.

3. Guaranteed Return Plans –

Guaranteed savings plans are a great way to ensure guaranteed returns on policy maturity. Many such policies offer bonus option, where a certain bonus is added to the assured sum of the policy. The Guaranteed Savings Plan by Canara HSBC Life Insurance features high premium booster to ensure that you get extra benefit for making a higher premium commitment.

If you are planning to start saving for your emergency fund, do consider the options listed above. While the returns may not be as high as pure investment plans, the life insurance component of these plans make them a great option for safety with wealth creation.

Life Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs

Popular Searches

- Term Life Insurance

- Whole Life Insurance

- Critical Illness Insurance

- Accidental Death Benefit Rider

- Compare Life Insurance Quotes

- Best Life Insurance Companies In India

- Factors Affecting Life Insurance Premiums

- Insurance For Tax Savings

- Life Insurance For Children

- Life Insurance Rider

- Life Insurance Plans

- Types of Life Insurance

- Term Life Insurance Tax Benefit

- What is Insurance?

- Life Insurance Premium