Today, we are at increasing risk of falling prey to life-style diseases. And according to an article by the Times of India, with increasing prevalence of life-style diseases in the country, about 25% of Indians may die of lifestyle diseases before they are 70. The stats are sure worrying, but sticking to a healthy diet along with regular exercise regime could help reduce the chances of catching these ailments. But owing to other factors like pollution, hectic work conditions and hereditary problems, there can be instances when these illnesses can be hard to avoid. Unlike minor ailments, the treatment in such cases could seem like a financial burden on the family as well as your savings.

Life is unexpected, your insurance cover should not be. Therefore, in order to receive coverage against such events, it is important that you avail of a term insurance plan with a critical illness benefit. Term plans with such benefits can provide a lump sum amount in case you are diagnosed with one of the illnesses mentioned in the predetermined list of the insurance policy.

Applying for a life insurance when you have a history of illness:

As per IRDAI’s (Insurance Regulatory and Development Authority of India) guidelines released in 2013, all health insurance providers have to follow a common set of health insurance related definitions. And a pre-existing medical condition refers to an injury or a related condition for which symptoms have been present for some time. Also, these conditions must have brought into notice of a medical practitioner or have undergone treatment, 48 months prior to the issuance of the first policy.

While a life insurance policy is a must have for every individual, filling a life insurance application form can seem tiresome. However, all the information regarding your medical history, lifestyle and interests is important to measure the risks involved and subsequently, come on a valid premium amount. So, what could this mean for someone with a pre-existing long-term medical condition?

Pre-existing medical conditions have a impact on your insurance policy application. The insurance provider will ask for you to make a full disclosure of your medical history and obviously details and records of your pre-existing illnesses. Though this information may drive up your life insurance policy premiums, not disclosing it or making incomplete disclosure is not an option. Holding back or suppressing facts about your health can lead to severe consequences, some of which include the following:

- The least that can happen is that all of the quotes you’ve received so far will be straight-up wrong and you’ll get offered a much higher premium.

- In a bad-case scenario, you may be denied coverage or if the lie was discovered after the signing of policy document, the policy may get canceled.

- In the worst-case scenario, after you’ve received the policy documents, your death benefit won’t get paid out.

Factors to keep in mind while someone with a pre-existing illness applies for a policy:

When filling a proposal form for application of an insurance policy, it is important to gain thorough understanding of the terms and conditions in respect to your medical condition, to ensure getting your claim approved. Also, consider the following factors:

1) Compare policies from different insurers to look for the best premium rates.

2) Buy a life insurance policy as soon as possible, because deteriorating condition can lead to increasing premiums.

3) Make full disclosure of any pre-existing condition and be willing to undertake a health checkup.

Critical Illness plans to ensure you are covered from future exigencies:

A critical illness plan works differently from a Mediclaim. A critical illness term plan like the iSelect Smart360 Term Plan pays a lump sum amount, equal to the sum insured, in case of death or on diagnosis of Terminal Illness, whichever happens earlier. Such term plans provide a lump sum benefit which can pay for the cost of care and treatment, and all other costs that may be involved. In addition, there are proper health plans also available, ones that payout a lump-sum amount on the occurrence of Heart and Cancer related conditions and on pre-defined 26 Major Critical Illnesses. These insurance plans also offer tax benefits under Section 80D of the Income Tax Act on the premiums you pay on these policies.

Disclaimer

This article is issued in the general public interest and meant for general information purposes only. Readers are advised to exercise their caution and not to rely on the contents of the article as conclusive in nature. Readers should research further or consult an expert in this regard.

Life Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs

Popular Searches

- Term Life Insurance

- Whole Life Insurance

- Critical Illness Insurance

- Accidental Death Benefit Rider

- Compare Life Insurance Quotes

- Best Life Insurance Companies In India

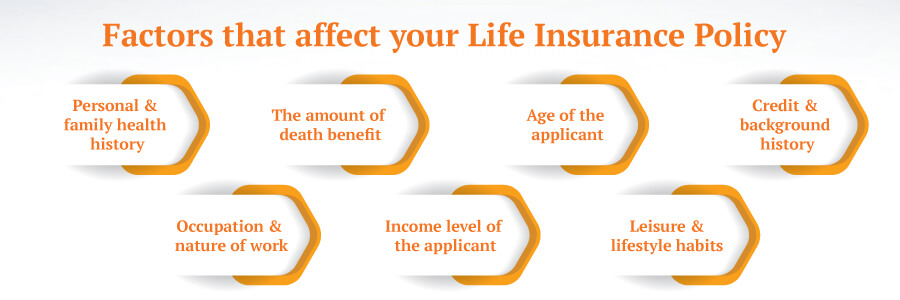

- Factors Affecting Life Insurance Premiums

- Insurance For Tax Savings

- Life Insurance For Children

- Life Insurance Rider

- Life Insurance Plans

- Types of Life Insurance

- Term Life Insurance Tax Benefit

- What is Insurance?

- Life Insurance Premium