Savings has been a habitual thing for Indian investors. Hundreds of investments in India try to channel these savings to the greater good. Much like the investors themselves and their unique financial needs, the investments in India also branch into various types.

Each of these saving and investment plans carries returns and risks, which are directly proportional to each other. In other words, the higher the risk involved, the better will be the chances of returns. When we talk about investment options in India, we can broadly classify the available types of investments into two categories – financial and non-financial. On one hand, the financial assets include market-linked securities, including mutual funds, and fixed income products such as Public Provident Fund (PPF) and Bank Fixed Deposits (FDs). To help you build an investment plan that matches your risk profile and investment needs with its potential to gain profitable returns, here is an insight into the different types of investment options in India.

So, if you want to look for the best investment options in India, you simply need to match the benefits of the investment plan with your needs.

What is an Investment Plan?

As the name suggests, investment plans are financial instruments, which help you create sustainable wealth for your future needs. There are various investment plans available nowadays that enable you to invest your savings systematically into different money-market products and help achieve your financial goals. These investment plans provide the much-desirable advantage of creating wealth through disciplined, long-term investments. Some of the most popular investment options today are –

a) Unit Linked Insurance Plans (ULIPs)

b) Public Provident Funds (PPF)

c) Monthly Income Plans

d) Mutual funds

e) Sukanya Samriddhi Account (SSY)

f) Senior Citizen Savings Scheme (SCSS)

g) Tax saving Fixed Deposits

Top 12 Types of Investment in India

You can classify investments in India into several categories based on their risk profile, investment tenure and taxability. Following are the 12 most popular types of investment options in India:

a) Equity Stocks

Equity stocks are one of the primary capital market investments in India. You can invest in equity stocks directly through Initial Public Offerings (IPOs) and stock exchanges like NSE and BSE.

Since equity stocks are purely market-linked investments in India, buying individual stocks is a high-risk-high-return investment. Stocks offer returns in the following two manners:

i. Dividend declaration

ii. Capital appreciation

If you buy the stocks of firms of fairly large size (blue chip or large-cap), you are likely to experience a stable capital value and receive the majority of the income in the form of dividends. However, smaller firms (called mid-cap and small-cap) are more likely to offer capital appreciation.

Also Read - How to Invest Money?

b) Bonds & Debentures

Bonds are the types of investments that are also capital investments but safer than equity stocks. Bonds and debentures usually offer a fixed rate of interest to investors. However, depending on the market scenario and investor expectations the bond prices may lead to capital gain or loss.

So, bonds have the following modes of earning for the investors:

i. Coupon / Interest Payments

ii. Capital gains/losses

Unlike equity stocks, bonds have limited tenure. Firms may also issue debentures with a conversion option to equity stocks for the investors. Bonds and debenture investments in India are very low to high-risk investments.

You can determine the investment risk for a bond issue through the credit rating of the bonds. The least risky bond issues will have a rating of ‘AAA’, while ‘BBB’ and ‘C’ will be higher risk ratings for bonds.

c) Mutual Funds

Mutual funds are tightly regulated portfolio investments. A mutual fund is one of the best investments in India for small investors seeking to benefit from equity and bond investments. Direct equity and bond investments require skills and understanding of business.

Mutual funds offer this expertise to investors for a nominal fee. Mutual funds offer the following types of investments in India:

i. Equity Mutual Funds :

90%+ portfolio consists of equity stocks and related investments

ii. Debt Mutual Funds :

90%+ portfolio consists of debentures, bonds and related investments

iii. Hybrid Mutual Funds :

Creates a balanced portfolio of equity and debt investments. A portfolio can be dynamic or static as per the fund’s investment objective.

iv. Liquid Mutual Funds :

Invests only in short-term investment options like – money market securities, ultra-short-term bonds and bonds near maturity.

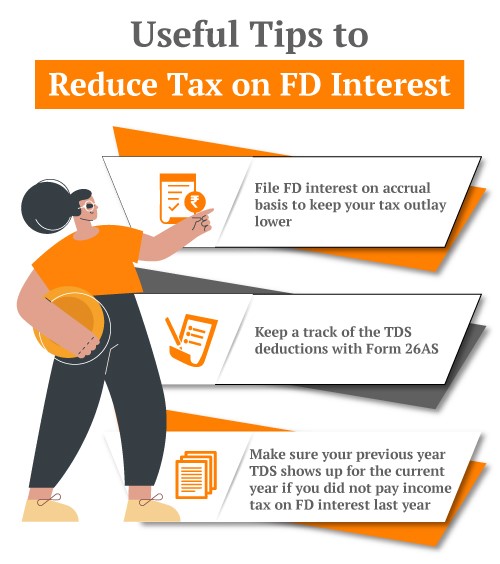

d) Fixed Deposits

Fixed deposits are the oldest and simplest investments in India. You can invest in fixed deposits with banks, post offices and even corporate. While banks and post office fixed deposits carry the lowest investment risk, corporate deposits have a higher risk-return profile.

Fixed deposits are unaffected by market performance and have a fixed tenure and rate of interest. You may have the option to receive interest in your savings account depending on the FD provider.

Banks may offer a higher rate of interest for senior citizen investors in FDs. Coupled with the facility of receiving interest payments in bank account FDs are a good way to generate stable pensions for retired investors.

e) Life Insurance Plans

Life insurance plans are some of the best investments in India for achieving important financial goals in your life. Life insurance plans fulfil specific financial needs for individuals and families. For example:

i. Financial Safety Need for Family :

Term Life Insurance and Critical Health Plans

ii. Child’s Higher Education Goal :

Guaranteed Savings Plans and Money Back Plans

iii. Child’s Marriage Goal :

Endowment Plans

iv. Retirement Savings :

Pension Plans and long-term investment plans

v. Wealth Distribution or Legacy Goal :

Whole life insurance plan

Life insurance plans are some of the best long-term investments in India for wealth preservation as well. You can protect your accumulated money from inflation and taxes using a life insurance plan.

f) Real Estate

Ownership of real estate is one of the basic financial needs of everyone. In any case, you will need to invest in at least one residential property in your lifetime. However, real estate is also a lucrative investment option in India.

Real estate investment is tied up closely with the country’s economic progress and government policies. Thus, real estate investment risk is also high. Here’s how you can invest in different real estate properties:

- Buy residential or commercial assets

- Buy land for residential or commercial use

- Invest in REITs (Real Estate Investment Trusts)

- Invest in Real Estate Mutual Funds (REMFs)

Real estate investments will offer a return on your investment in the following two ways:

i. Regular rental income

ii. Capital appreciation

The best part about real estate investment in India is that the rental income is inflation-adjusted. Thus, investing in real estate for rental income is a good option for retired investors for pension.

g) Retirement Plans

Retirement plans are long-term investment options that help you build an adequate corpus for a comfortable retirement. Some of the most popular retirement investments in India include:

i. Public Provident Fund (PPF)

ii. New/National Pension Scheme (NPS)

iii. Employee Provident Fund (EPF)

iv. Unit Linked Insurance Plans (ULIPs)

v. Equity Linked Savings Scheme (ELSS) Mutual Funds

These are the best investment options in India for building a good retirement corpus over a long time. These plans offer tax savings for you at the time of investment. The majority of these plans offer tax-exempt increment and maturity values as well.

You can invest the accumulated money from these investments into annuity plans and generate long term pension income after retirement.

h) Unit Linked Insurance Plans (ULIPs)

Unit Linked Insurance Plans or ULIPs are unique life insurance plus investment plan. These plans work similar to mutual funds, but with a few added features. Each ULIP offers multiple funds as investment options. These funds will include equity, debt, hybrid and liquid funds.

At the same time, ULIPs also offer a life cover for the policyholder. The life cover ensures that your family can meet the goal even after your untimely demise.

Further, ULIP plans offer automatic portfolio management options for aggressive investors. These options will allow you to manage your investment risk automatically depending on the market movement or time to invest.

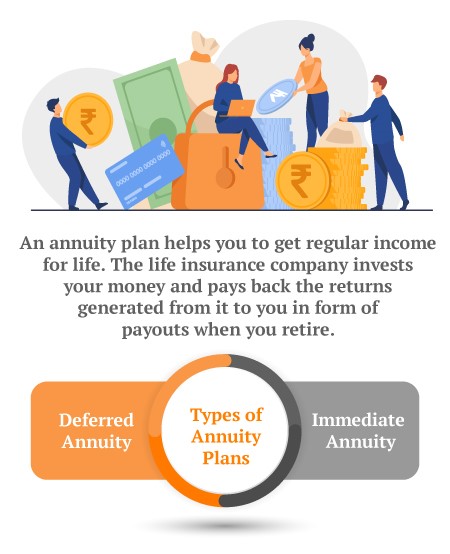

i) Annuities

Annuities refer to investments in India that offer regular income to the investor. You can invest a large corpus or invest for a few years in annuity plans and then start receiving a fixed regular sum of money from it.

The following two kinds of annuity investment options are available in India:

i. Immediate Annuity

ii. Deferred Annuity

An immediate Annuity is the best investment plan in India to start a regular income within one month of investment. However, if you want to start the income after a few years, you can invest in deferred annuity options.

Deferred annuities provide a growth period for your corpus or regular investments before drawing income.

j) Public Provident Fund (PPF)

Public Provident Fund or PPF is the first retirement investment in India for self-employed and small investors. PPF rate of return, although fixed, is revised periodically by the Ministry of Finance.

The return is annually compounded for each financial year. Thus, investing in April of the year will yield better returns than investing in any other month.

PPF is the best investment option in India to build a tax-free corpus of funds as the maturity amount from this saving scheme is completely exempt from tax. The minimum investment tenure for the plan is 15 years. You can extend the account after maturity in batches of 5-years.

You can withdraw money partially after five financial years of investment. Before partial withdrawals, you can borrow from the accumulated corpus if need be.

k) Certificate of Deposit (CD)

Certificate of Deposit (CD) is a money market investment in India. Federal Deposit Insurance Corporation (FDIC) issues CDs against your funds invested in a bank deposit. Like any other money market investment in India RBI governs CD issues.

Prominent features of CDs are as follows:

i. Single issue of Rs 1 lakh and its multiples

ii. Commercial bank CDs can have a maturity period of 7 days to 1 year

iii. CDs from other financial institutions mature within 1 to 3 years

CDs are fixed income securities with short investment tenure. Thus, a CD is one of the safest investment options in India.

l) Bank Products

Banks in India offer some of the best investment plans in India for safe investors. These investments are easy to operate, especially if you have an account in the same bank. Other bank investments include:

i. Fixed deposits for senior citizens

ii. Recurring deposits

iii. Gold / Silver Coins and Bars

iv. RBI Bonds

v. Sovereign Gold Bonds

vi. Portfolio Management Services

vii. Capital Gain Bonds & Deposit

viii. Non-Convertible Bonds / Debentures

ix. Tax-Free Bonds

While bank investment options in India are full of fixed income and safe investments, they also offer investments in alternative assets. Bank’s customized portfolio management services let you participate and grow your wealth with a portfolio of equity, debt, real estate and commodity investments.

Other than these you can also invest in commodities like gold and silver, and investment trusts. However, these investments require big-ticket inflows and offer lower liquidity. On the other hand, some of the most liquid, i.e., easy to sell, investments in India include liquid funds and savings accounts.

Why should you Invest?

Being salaried or even self-employed, you must realize that you cannot achieve your life goals by relying on your savings alone. Instead, it would help if you found ways to maximize your savings and build wealth that meets your and your family’s needs. To do this, you must invest these savings in an investment plan that helps you avail of high returns but with minimal or no risk involved.

On the other hand, if you choose not to invest, you may miss out on various opportunities to maximize your wealth-building potential and financial worth. If you invest your money wisely and on time, you can easily make significant gains throughout the investment tenure.

Click here to use - Compoud Interest Calculator

How to Choose the Right Investment Plan?

To choose the right investment plan for yourself, you need to consider the following points -

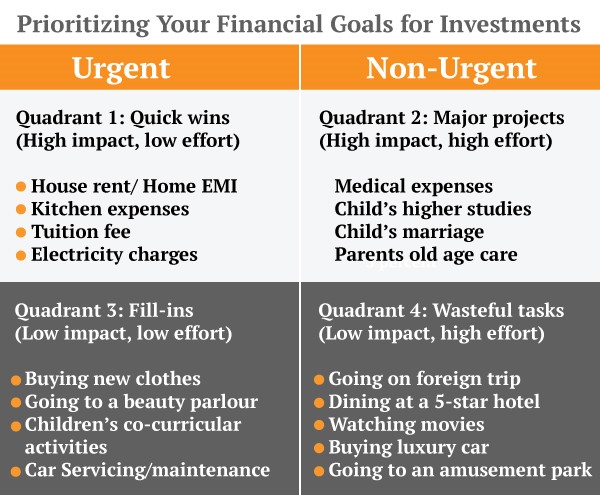

i. Review your financial needs and goals – both existing and future.

ii. Calculate your investment timeline for each life goal.

iii. Develop an investment strategy that comprises the right balance of insurance and investment policies.

iv. Diversify your portfolio to include multiple investment plans and minimize the risk involved.

v. Be aware of the different charges levied under each investment schemes.

vi. Periodically review your investments.

Also Read - Direct Investment

Types of Investment Plans Based on Risk Factor

Each investment instrument carries a distinctive risk profile and potential for return generation. For each of these plans, their associated risk of investment can be described as the probability of the plan performing either below expectations or experiencing an irreparable loss of value.

Based on the risk associated, we can broadly classify different investment plans into three categories –

i. Low-Risk Investments

Low-risk investment plans essentially are those in which there are approximately zero risks involved. These low-risk investment plans usually provide consistent and reliable growth of value, with minimal losses. Such types of investment include –

a) Public Provident Fund (PPF)

b) Post Office Monthly Income Schemes

c) Senior Citizen Savings Scheme (SCSS)

d) Employee Provident Fund (EPF)

e) Sukanya Samriddhi Yojana

f) Tax Saving FDs

g) Sovereign Gold Bonds

h) Life Insurance

i) Bonds

ii. High-Risk Investments

Investment plans categorized as high-risk are suitable for investors who wish to sustain long-term capital growth. While most of these high-risk investment plans are likely to incur fluctuations throughout the investment tenure, they provide ample opportunities to create substantial returns. These high-risk investment plans usually include –

a) Direct equities

b) Unit Linked Insurance Plans

c) Mutual Funds

iii. Medium-Risk Investments

Investments plans classified as medium or moderate risk options not only provide opportunities t avail of diversified and balanced investment returns but also help you accept a certain level of market volatility. These medium-risk investment options, thus help diversify your investment portfolio by including a mix of equity and debt instruments, which then generates stable returns with minimal risks. Examples of these medium risk investment plans include –

i. Hybrid debt-oriented funds

ii. Arbitrage funds

iii. Monthly Income Plans

Factors to Keep in Mind while Investing

Different types of investments in India offer different risk, return and maturity (liquidity) features. For the best results you should check for the following eight factors while choosing different investment options:

i. Investment Volatility

Highly volatile investments offer better long-term growth for your investment. But such investments may need a higher investment amount or a longer investment period.

ii. Investment Tenure

You need a balance of long-term and short-term investments. As short-term investments will ensure the availability of money and long-term investments ensure growth.

iii. Past Performance

Past performance of investments, especially portfolio investments, gives you an idea about their risk-return profile.

iv. Your Financial Goal

The best way to use different investment options for your benefit is to attach them to a financial goal. This will ensure you are clear about the acceptable volatility and tenure of the investment.

v. Your Investment Portfolio

Diversification across time and asset class is features of a good investment portfolio. Always keep a bird’s eye view of your portfolio while selecting a new type of investment.

vi. Your Understanding of the Investment Option

It’s better to park your funds in investments you understand. That way you can wade through market situations without unnecessary stress.

vii. When to Review

Every type of investment needs a review after some time. Reviewing investments will ensure that you stay up to date with the investment and make changes while you still have time.

viii. Investment Frequency

Different investment options in India require different investment frequencies. Not following the same can lead to penalties and losses on the earnings.

ix. Flexibility Available

Flexibility in an investment plan can be for investment tenure, maturity, frequency, amount and withdrawals. More flexible investments are better.

Life Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs

FAQs Related to Types of Investments

Following are the best investment options available in India for parking your savings:

i. Equity Stocks

ii. Bonds & Debentures

iii. Mutual Funds

iv. Fixed Deposits

v. Life Insurance Plans

vi. Real Estate

vii. Retirement Plans

viii. Unit Linked Insurance Plans (ULIPs)

ix. Annuities

x. Public Provident Fund (PPF)

xi. Certificate of Deposit (CD)

xii. Bank Products

If your simple investment objective is to maximise your return on investment, the best investment options in India will be:

i. Equity Stocks

ii. Equity and Hybrid Mutual Funds

iii. New/National Pension Scheme (NPS)

iv. Unit Linked Insurance Plans (ULIPs)

v. Bank Products – Portfolio Management Services

The different types of investments in India often invest in different types of assets. For example, equity mutual fund invests in equity stocks, REITs primarily invest in real estate assets, Gold ETFs will invest only in gold bullions and similar assets.

Asset allocation refers to the amount invested in a specific asset. For example, you can create a portfolio of 60% equity stocks, 20% fixed income securities and 20% gold. Thus, asset allocation for Gold in your portfolio will be 20%.

The investment process generally involves the following five steps:

Step 1: Define your investment objective

Step 2: Identify the most suitable investment options

Step 3: Finalise and start investing in the different types of investment to maintain the diversity of risk-return profile

Step 4: Review the investment performance regularly and increase/decrease investment as needed

Step 5: Withdraw funds to meet your goal

The risk involved while investing depends on the type of investment option you are using. Also, investment tenure plays an important role in the risk profile of the investment option. Following are the important risks involved with investments in India:

i. Inflation risk

ii. Liquidity risk

iii. Volatility/Market risk

iv. Default/Credit risk

v. Reinvestment risk

Popular Searches

- Term Life Insurance

- Whole Life Insurance

- Critical Illness Insurance

- Accidental Death Benefit Rider

- Compare Life Insurance Quotes

- Best Life Insurance Companies In India

- Factors Affecting Life Insurance Premiums

- Insurance For Tax Savings

- Life Insurance For Children

- Life Insurance Rider

- Life Insurance Plans

- Types of Life Insurance

- Term Life Insurance Tax Benefit

- What is Insurance?

- Life Insurance Premium

.jpg)