If you are in your 30s, it is natural for you to feel safe about your retirement years. However, imagine your life without your salary income for a few months, and you will feel the pressure building up.

Before you can retire, you need to build a corpus large enough to provide you with a regular income. You will invest this corpus into an immediate annuity plan and hope to receive an adequate regular income as you take it easy with life.

What is an Immediate Annuity?

An annuity is a contract between you and the insurance money. As part of the contract, the insurance company makes payments to you either immediately or in the future. An annuity is a fixed amount you receive every month (or year) for the rest of your life.

There are two types of annuity plans:

1. Deferred Annuity:

These are plans in which your regular payment starts after a specific date. There are two phases to it. In the accumulation phase, you invest and accumulate by paying a regular premium. The next phase is the vesting phase. You receive the policy benefits as a regular income in this phase.

2. Immediate Annuity:

In an immediate annuity, there is no accumulation phase. You purchase the annuity plan by investing a lump sum amount, and the vesting phase starts immediately.

The insurance company, in return, gives you a monthly income for a specified period or a lifetime.

Benefits of Buying an Immediate Annuity Plan

As you come close to retirement, other long-term goals are complete. You tend to slow down. Being a retired person, you stop investing and start consuming what you have saved and invested in the past. A regular income is needed to spend happy retirement years.

Below are some of the reasons you need to have regular income:

1. Financial Independence:

If you do not have a regular income, you may have to depend on others or compromise on your basic needs. With a regular income, you live life on your terms.

2. Monthly Expenses:

The average lifespan of humans has increased over the last few decades. No one is sure how long they are going to live. Hence, withdrawing the saved amount is not a good idea. You need a regular income source for monthly expenses as long as you live.

3. Health Issues:

Health issues increase with age. You must have a good health insurance plan. If you don't, a regular income is needed to take care of health bills.

If you are retired, you can receive a regular monthly income by investing in annuity plans.

Below are the benefits of investing in an immediate annuity plan:

1. Simplicity:

Once you make the payment to the insurance company, you don't have to do anything else. You don't need to monitor your investment.

2. Immediate Income:

For retired people, the salary stops but with these plans, they continue to receive a regular income. The pay-out starts within the first year.

3. Customization Available:

You can build an income stream for yourself or two depending on your needs. You can cover your spouse in the same plan to receive the regular income when you are not around. Also, you can receive pay-outs for a specific period or lifetime.

4. Tax Benefits:

The interest you receive is taxed as ordinary income, but the principal amount is exempt from taxes as it is a return on your investment. Hence, you have a partially tax-free income source.

How to Select the Best Immediate Annuity Plan?

There are different types of immediate annuity plans available in the market. You must know how to select the best annuity plan for yourself. Below are parameters that will help you choose the right annuity plan:

1. Safety:

You must choose a plan that gives you a high level of safety. The insurance company should be one you can trust and in a position to meet all its liabilities.

2. Rate of Return:

Annuity is a long-term investment plan, and you should look at the rate of return. The rate of return should be able to beat inflation. It should grow every year so that you can maintain the same living standards.

3. Withdrawal Possibility:

Generally, annuity plans do not offer you any liquidity. It means you cannot withdraw the money you have invested. However, look for a possibility or a clause that allows you to partially withdraw money at least for an emergency.

4. Select the Right Type:

Within immediate annuities, there are different types. An immediate annuity plan may vary depending on how the income will change for you with time. It could be fixed, variable, or inflation-indexed income. Select the option that works best for you.

Annuity Plans by Canara HSBC Life Insurance

Canara HSBC Life Insurance offers a variety of annuity plans to suit your specific retirement needs. Given below are some of the best immediate annuity plans you should consider for your retirement:

1. Guaranteed Income4Life

Canara HSBC Life Insurance offers you three different annuity options under Guaranteed Income4Life:

- Guaranteed Income (for short to medium term, up to 10 years)

- Guaranteed Long-term income (for 15 to 20 years income)

- Guaranteed Life-long income

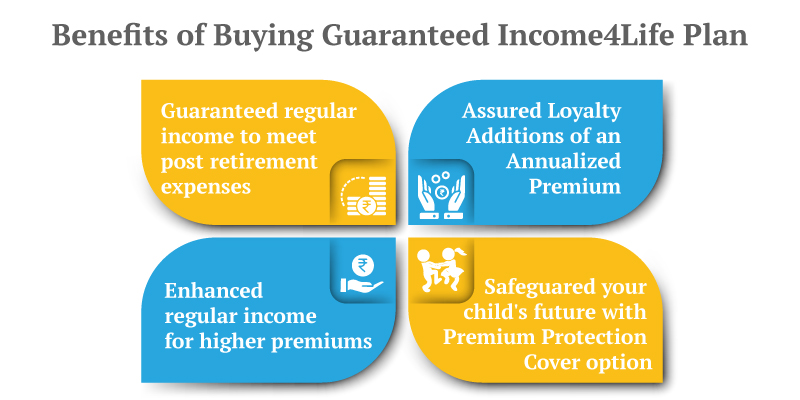

Of the three, Guaranteed Life-long income gives you an immediate annuity option. You can choose your regular income as monthly, quarterly, semi-annual, or annually. Also, there are other benefits:

- Hold jointly with the spouse so that spouse will continue to receive a pension without having to buy another annuity after your demise

- Accidental Total and Permanent Disability cover offers financial assistance in case of severe accidental injuries

2. Pension4Life Plan

There are seven different options for you under this plan, and five of them are immediate annuity plans. With an immediate annuity plan, one continues to receive payment till the death of the last survivor. There are death benefits as well. Upon your death, the purchase price (value of your investment corpus) is given to your beneficiary.

This plan offers additional benefits and options such as:

- Return of invested money on the diagnosis of critical illness or accidental total and permanent disability or death

- Joint life annuity with return of purchase price on the death of second annuity holder

3. Invest 4G

It is not an immediate annuity plan but a good saving option for early investors. You can invest in the Invest4G plan and create substantial wealth before retirement. The plan offers a century option of investing where you can use the single plan to:

- Build a significant retirement corpus

- Start an annuity as you retire using a systematic withdrawal option

While you invest you also receive bonus additions to your portfolio and the plan allows partial withdrawals after the five year lock-in period.

You work hard all your life to secure your after-retirement life. You want to live a stress-free life, and for that, you need a regular income. Annuities are a perfect solution for you as they help you create a regular income from the wealth you have accumulated over the years.

You can enjoy the second inning with your loved ones without worrying about the market fluctuation. Immediate annuities from life insurance providers offer a safe and reliable way to convert your wealth into income.

Disclaimer: This article is issued in the general public interest and meant for general information purposes only. Readers are advised to exercise their caution and not to rely on the contents of the article as conclusive in nature. Readers should research further or consult an expert in this regard.

Retirement - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Retire Grand with Flexi Benefits

- Guaranteed Lifelong Income

- Limited premium payment term

- Multiple annuity options

- Option to defer the annuity payments

Save, Dream, Plan. Live Peacefully

- 4 Plan options

- Option to choose premium payment term

- Get Tax benefits

- Premium protection cover

Recent Blogs

Popular Searches

- Retirement Calculator

- Best Retirement Plan

- Senior Citizen Card

- Saral Pension Plan

- NPS Withdrawal

- Pension4Life Plan

- Retirement Planning

- 5 Retirement Tips

- National Pension Scheme

- NPS Pension Calculator

- Types of Pension Plan

- Guaranteed Pension Plan

- Is Pension Taxable

- How to Check Old Age Pension Status

- Benefits of Pension Plan