Pension is one of the most important components of your post-retirement financial life and how you manage the pension is as important as receiving the pension amount. One of the greatest challenges post-retirement is tax saving as any pension is taxable as salary income.

So, any pension product that you use for receiving regular pension after retirement will give you two options:

- Receive pension equal to or lower than minimum exempted amount; i.e. Rs.5 lakhs per year or approx. Rs.40,000 per month.

- Pay tax on any additional amount that you withdraw.

You have several saving plan options to create your ideal pension post retirement. However, you should note that if you want to receive tax-free money after retirement, you need to have a plan prepared in advance.

While experts suggest that you should start saving for your retirement between 45-50 years of age, there is no specific age to start investing in a pension plan because the earlier you start the better. Here are the most popular investment options to consider:

National Pension Scheme (NPS)

National Pension Scheme or NPS is a great tool for achieving your retirement goal. But if you have not invested in NPS so far, worry not and start immediately. You can begin as early as possible or move your retirement corpus to a NPS account by the time you turn 50. A NPS account matures when you hit 60,

NPS allows you to withdraw 60% of your total corpus tax-free. The remaining 40% must go to the pension component, paid at maturity. Also, you can defer your withdrawals for both options until the age of 70. So, here’s how you can make the best use of its features:

- After 60 you have 10 more years to withdraw the corpus in parts to ensure constant funds.

- If you have large expenses like house purchase etc. planned, you can utilize the lump sum money.

- You can deposit your annual lumpsum withdrawal in a liquid fund and receive a fixed amount every month.

- Any interest gained from the liquid fund through the year will be taxable, but since you do not have any other taxable income, it has to be more than Rs. 500,000 to attract any tax as per the defined slabs.

Now you can run your expenses using your lumpsum money for only 10 years. You will still need a pension after that. To build your alternate pension, you can withdraw the pension corpus and invest in deferred annuity plans.

This will help you start your taxable pension later. Plus, pension plans like Pension4Life from Canara HSBC Life can give you additional benefits as a NPS account holder.

Also read - Is Pension Taxable?

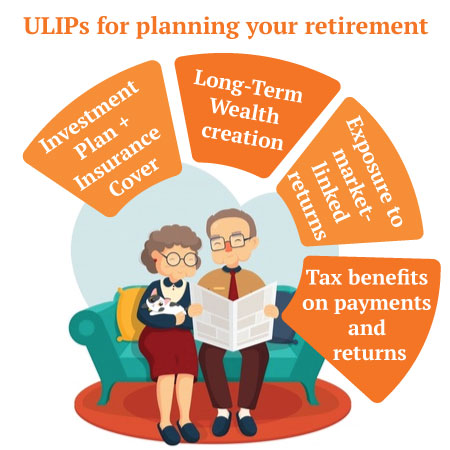

Unit-Linked Insurance Plans

If you are below 50, you can start moving your corpus to ULIP plans, and ensure that the corpus you want to use for pension is in ULIPs. ULIPs are the only way you can create a tax-free pension for yourself.

Conditions for Tax Exemptions:

Before you jump into this investment, here are a few things you need to remember and follow a structured plan to ensure tax-free pension:

- The lock-in period before you can withdraw funds from ULIP is 5 years.

- Maximum entry age in ULIP could be limited to 50 years. So, if you are above 50 years of age, this option may be close to you.

- Your annual investment in ULIP cannot be more than 10% of the life cover sum assured. This will also ensure tax deduction under section 80C of up to Rs. 1.5 lakhs. E.g. if you want to invest Rs 10 lakh a year your life cover would be 1 crore in the ULIP plan.

- Sum assured is pure protection component of ULIP and you will likely not need a life cover post-retirement. Thus, this is a minor cost you pay, but only until your corpus exceeds the sum assured amount. E.g. you invest Rs 10 lakhs for 10 years in the ULIP plan. As your total fund value in the plan exceeds Rs 1 crore, the cost of your life cover goes to zero.

Maximum maturity age of ULIPs is about 80-85 years unless you opt for a whole life option, where maturity age is 99 years. One of the ULIP plans which offer whole life option is Canara HSBC Life’s Invest 4G Plan.

You can start withdrawing funds from ULIP for your monthly expenses from the age of 60. Your entire withdrawal amount will be exempt from tax regardless of the amount. Your interest from the savings account will still be taxable if it exceeds the limit of Rs. 50,000 per annum, which means if your savings account gives you a 6% interest you can withdraw up to Rs 8.3 lakhs a year without tax.

So, if you are below 50, you should consider moving your entire pension corpus to ULIP plan, preferably with a whole life cover option. So, you can enjoy a tax-free pension throughout your life. Another benefit of whole life ULIP is that in case of your natural death the remaining corpus will go to your surviving spouse or children.

Click here to Use - Retirement Calculator

Other Notable Investment Options for Retirees

It may not always be possible for you to create a customized pension plan, as you have seen the many conditions attached to them. The most prominent condition is age. In case you are starting late, chances are you will have to bank on the traditional pension plans only.

Some of the most popular traditional pension plans are:

- Annuity Plans from Life Insurers

You can start with a large deposit with a pension starting from the next month (immediate annuity). Or you can postpone the pension for a few years (deferred annuity). You can have a life cover attached to the plan or opt for whole life pension in these plans. - Senior Citizen Saving Scheme

Senior Citizen Saving Schemes are a popular mode of receiving a monthly income after the age of 60. However, you can invest only up to Rs 15 lakhs. The account has a maturity period of 5 years. - Monthly Income Plans

Offered by mutual funds and post office, these plans pay your deposit back in monthly instalments. While post office MIS (monthly income scheme) matures in five years, mutual funds can continue until your corpus lasts.

With so many pension and retirement plan options available to create a post retirement income, it still pays to plan and start investing early on.

Retirement - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Retire Grand with Flexi Benefits

- Guaranteed Lifelong Income

- Limited premium payment term

- Multiple annuity options

- Option to defer the annuity payments

Save, Dream, Plan. Live Peacefully

- 4 Plan options

- Option to choose premium payment term

- Get Tax benefits

- Premium protection cover

Recent Blogs

Popular Searches

- Retirement Calculator

- Best Retirement Plan

- Senior Citizen Card

- Saral Pension Plan

- NPS Withdrawal

- Pension4Life Plan

- Retirement Planning

- 5 Retirement Tips

- National Pension Scheme

- NPS Pension Calculator

- Types of Pension Plan

- Guaranteed Pension Plan

- Is Pension Taxable

- How to Check Old Age Pension Status

- Benefits of Pension Plan