Retirement planning has changed over the years, and what may have worked a decade ago may not work anymore. Traditionally, real estate, FDs, gold, EPF and a regular insurance plan have constituted the bulk of retirement plans in India. However, rising life expectancy and healthcare costs coupled with the inability of traditional investment instruments to generate wealth returns, retirement planning is witnessing a shift in approach.

Today, average life expectancy in India has increased to 68 years and if you have access to good healthcare and live a relatively healthy life, you can easily live up to 80 years of age. Since you will retire at the age of 60, it means that you must have a retirement corpus that can at least meet your monthly expenses for 20 years.

So, keeping your financial goals, returns, risk appetite, tax burden and inflation in mind, how do you chalk out a robust retirement plan? Here’s a step-by-step plan!

Step 1: Choose your retirement age

Whether you want to retire early or wait till 60 years of age, it’s up to you. But then, it also depends on your financial goals and liabilities. Most millennials today want to retire at the age of 50. In that case, you must have substantial retirement savings that can sustain you and help you lead a comfortable retirement life for the next 30 years; assuming that you live up to 80 years.

Step 2. Find out average life expectancy

Once you decide on your retirement age, you need to arrive at a figure that correctly estimates your retirement corpus. To do that, you need to estimate your life expectancy based on your age, medical condition, family history and other factors.

The table below is a ready reckoner for estimating your average life expectancy based on your current age, according to World Life Expectancy.

| Age | Life Expectancy | Age | Life Expectancy |

|---|---|---|---|

| 5 | 73.5 | 55 | 77.7 |

| 10 | 73.8 | 60 | 78.6 |

| 15 | 74.1 | 65 | 80.1 |

| 20 | 74.3 | 70 | 82 |

| 25 | 74.7 | 75 | 84.5 |

| 30 | 75.5 | 80 | 87.4 |

| 35 | 75.1 | 85 | 90.6 |

| 40 | 75.9 | 90 | 94.3 |

| 45 | 76.3 | 95 | 98.3 |

| 50 | 76.9 | 100 | 102.6 |

According to the table, if you are a 30-year-old, your average life expectancy is 75 years and six months. Therefore, if you have decided to retire at the age of 50, you need to have enough retirement savings to last you at least 25 years post-retirement. This will help you calculate the size of your retirement corpus.

Step 3. Calculate your retirement corpus

Calculating the correct retirement corpus is the moment of truth in retirement planning. You have to keep many factors in mind and there are chances of miscalculation. Of course, you cannot reach the exact amount but you should be able to reach a ballpark figure.

To avoid any shortfall in reaching your ideal retirement fund size, you need to keep a few factors in mind such as inflation, current age, medical condition, current liabilities, retirement age and current monthly expenses.

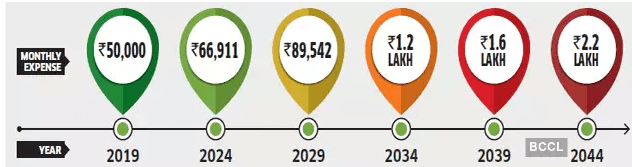

The best way to calculate your ideal retirement corpus is to take your current monthly expenses and expand it to your retirement age while keeping an average inflation rate in mind.

For example, if your current age is 30 years and monthly expenses are Rs. 50,000, it will rise to Rs. 1,06,000 per month by the time you reach the age of 50, assuming that inflation rate will remain at 6%. Therefore, if you want to retire at the age of 50, you need to save for another 30 years. According to the calculation, you need to have a retirement corpus of more than Rs. 3 crore to meet your monthly expenses for 30 years (Rs. 1,06,000 x 30 years).

Monthly Expense at 6% Yearly Inflation Rate

Planning for regular monthly income is important

Once you retire, you will still need regular income to meet your monthly expenses. Therefore, it is a must to invest in a pension plan or annuity plan post retirement. To achieve your ideal retirement savings goal you need to start saving early and choose the right investment instrument.

Unit linked insurance plans (ULIPs) allow you to have a robust retirement plan as it provides the triple benefit of insurance protection, wealth generation and tax savings. It is vital to remember that there are few factors that can erode your retirement fund; that is inflation and tax. Therefore, when you start retirement planning, choose an investment tool that provides inflation-beating returns and gets you maximum tax benefits.

ULIPs have consistently provided returns at the range of 9-12% and they are the most tax-effective investment instruments available in India. Start investing for a comfortable retirement life with Invest 4G ULIPs from Canara HSBC Life Insurance.

Related Articles

- How life insurance policy can help you save taxes

- Make sure that you add a rider to your plan

- Things you didnt know about ulips

Retirement - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Retire Grand with Flexi Benefits

- Guaranteed Lifelong Income

- Limited premium payment term

- Multiple annuity options

- Option to defer the annuity payments

Save, Dream, Plan. Live Peacefully

- 4 Plan options

- Option to choose premium payment term

- Get Tax benefits

- Premium protection cover

Recent Blogs

Popular Searches

- Retirement Calculator

- Best Retirement Plan

- Senior Citizen Card

- Saral Pension Plan

- NPS Withdrawal

- Pension4Life Plan

- Retirement Planning

- 5 Retirement Tips

- National Pension Scheme

- NPS Pension Calculator

- Types of Pension Plan

- Guaranteed Pension Plan

- Is Pension Taxable

- How to Check Old Age Pension Status

- Benefits of Pension Plan