Planned retirement is when you decide based on your thought and reasons to retire. Here the company has no say.

But there are times when the company you work in is not doing well financially. They may have to downsize. During this time schemes such as VRS are introduced wherein the company will provide you benefits to retire early.

Now since there are good benefits involved, you might be tempted to opt for VRS given that you pass the basic conditions of being over 40 and working for more than 10 years.

But before you do, think about the following questions.

1. Are you financially stable?

2. Are the major investment goals of you and your family have been achieved?

3. Will the VRS amount be enough?

These might scare you but are important to take into consideration. To overcome these challenges, you can:

a. Look for Employment: Opting for VRS does not mean you can't work again. You can work anywhere but the company you were previously in and any of its sister concerns. VRS becomes a good option if you have some opportunities in your hand

b. Invest VRS Money Wisely: If you do not want to work, you need to make sure that your money will be enough for you to live on. To make this sure, investment in some assets is a must.

Three Investments to Receive Regular Income

Here are certain saving schemes and plans in which you can invest to replace the income you used to get.

a. Monthly Income Plan (MIP)

1. MIPs can be a good option for you to invest in as it helps to create a steady income source for you after taking retirement.

2. MIP invests in majorly debt securities and some part of equity to provide monthly income to you.

3. Many MIPs have a death benefit as well. Income received by you in the form of dividends is tax-deductible.

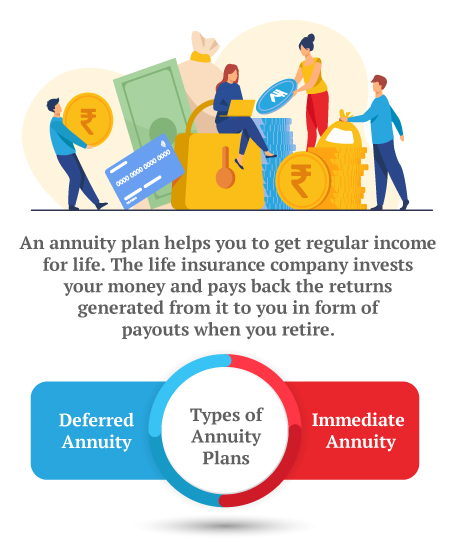

b. Annuity Plans

1. An annuity is a financial arrangement between you and the insurance provider.

2. Under this arrangement, the sum you invest in the plan over some time is turned into a regular income stream in the future.

3. The income you receive from the annuity plans is guaranteed, making it a very safe source for you to invest your VRS proceeds in.

4. The principal amount stays protected. The return will not go below the principle.

c. House Property

Investment in a house property with your VRS proceeds can also be a good idea due to the following reasons:

1. Putting the house you purchase on for rent can create a strong and steady source of income for you in the form of rent

2. A house in a good location can also get you higher rent which can provide a good boost to your existing corpus

3. The rental income received from real estate can efficiently combat inflation levels prevailing as well.

4. It helps in the diversification of your assets.

5. Also helps in tax savings as a rebate is available on the interest that you pay on a home loan.

Two Investments you can Consider to Achieve your Family’s Financial Goals

You will want to make sure that the goals of your family members are taken care of even if you are retired. Investments in plans such as endowment plans and ULIPs can help. The VRS money that you will receive can be used to fund the premiums of these plans.

a. Child Endowment Plans

A child endowment policy can help you secure your child’s future. This plan provides you insurance while allowing you to save. Your child is entitled to receive a lump sum amount when the policy matures.

This can help in attaining goals such as

- higher education

- marriage

You can use this lump sum VRS money to opt for a single premium endowment plan.

- A single-premium child plan involves only a one-time payment.

- This will help you avoid the stress of paying premiums every month. Also, you are entitled to discounts on this single premium payment.

b. Plan with Child ULIPs

Unit-linked insurance plans can also help in achieving your goals. This plan provides you with life insurance and an opportunity to invest and grow your wealth.

Invest in debt funds to ensure the safety of funds

ULIP gives you the right to choose which fund you want to invest in. As a safe investor, you can park all your money into debt funds. These carry low risk and thus will keep your fund value safe.

Relieve the stress with Canara HSBC Life Insurance’s ULIP, Invest 4G

ULIPs like Invest 4G, have a feature called a premium protection plan. Here is how it helps

- If you die during the policy and have chosen a premium protection feature, then the remaining premiums will be funded by the company.

- This will remove the burden on your wife and child and they can still achieve their goals.

Clear your Debts as Soon as Possible

You do not want the stress of loan payments after you retire, invest in these options if you want to pay off your loan fast.

ULIPs with equity option:

Earlier we talked about moving your money into debt funds. But in debt funds, the growth rate is not very attractive due to the safety it offers. If your risks appetite allows, you can invest in equity funds as well.

Why invest in equity funds?

Equity has the capability to increase your fund’s value considerably well and more quickly than debt funds. This can be a great way to pay back your loans. When you invest in equities, there is a possibility that your return will be higher than the rate of interest you are paying to the bank. But this is based on certain conditions.

These are:

Make sure you have a job.

Investing in equity is only recommended when you are able to land yourself a job after receiving VRS. When you get a job then the income from the job can be used to pay off the loans you have taken. The VRS fund will act as an extra sum which you now can invest in the ULIPs equity fund.

Make sure the loan’s interest rates are low.

If the loan's interest rates are inexpensive and can be managed with your current income, only then this strategy could be adopted.

If you don’t want to get employed then you can pay the loans with VRS so they don’t haunt your post-retirement life.

Retirement - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Retire Grand with Flexi Benefits

- Guaranteed Lifelong Income

- Limited premium payment term

- Multiple annuity options

- Option to defer the annuity payments

Save, Dream, Plan. Live Peacefully

- 4 Plan options

- Option to choose premium payment term

- Get Tax benefits

- Premium protection cover

Recent Blogs

Popular Searches

- Retirement Calculator

- Best Retirement Plan

- Senior Citizen Card

- Saral Pension Plan

- NPS Withdrawal

- Pension4Life Plan

- Retirement Planning

- 5 Retirement Tips

- National Pension Scheme

- NPS Pension Calculator

- Types of Pension Plan

- Guaranteed Pension Plan

- Is Pension Taxable

- How to Check Old Age Pension Status

- Benefits of Pension Plan