Suicide is one of the most common causes of death, particularly for 15 to 39 years. According to Forbes, India has the second-highest suicide mortality rate in the world. In 2016, every 17 out of 100,000 people in India had died by suicide. Thus, adding suicide as a clause in a life insurance plan was inevitable in India.

Does Life Insurance Pay for Suicidal Deaths in INDIA

Yes, a life insurance policy pays for suicidal death in India. Suicide was not considered a clause before 2014. Insurance authorities considered suicidal death to be neither natural nor accidental, thereby rejecting the suit of nominees. However, the conversation regarding mental health and suicide has changed. Thus, suicidal death is also a valid clause for a life insurance policy.

The Insurance Regulatory and Development Authority made some amendments to the clauses of death in life insurance plans. Any life insurance policy bought after 2014 is payable in case of the policyholder's death by suicide.

For instance, Akash was an accountant at a big firm in Bangalore. As an accountant, he understood the value of a life insurance policy. Therefore he included a life insurance policy in his financial planning. Unfortunately, Akash passed away due to depression. His family was left without a reliable source of income. But Akash had bought a life insurance policy before he committed suicide. This life insurance plan helped Akash's beneficiary, his spouse, with a lump-sum compensation.

However, the insurance company is not liable to pay compensation for any life insurance policy bought before 1st January 2014.

Why does Life Insurance Cover Death by Suicide in INDIA?

While death is not easy to deal with, suicide is worse. It takes a toll on the mental health of family members. Death by suicide is considered neither natural nor accidental in India, yet it is a plausible cause for a life insurance policy.

However, suicide can still lead to a loss of income, particularly for those beneficiaries that are dependents. This can include children, parents, or a dependent spouse.

Therefore, insurance companies are liable to pay compensation to the members of the family. A beneficiary can also be more than one person, in which case the compensation is divided among the nominees. The insurance company pays a lump-sum amount to the beneficiary from the premiums paid by the policyholder.

Learn everything about a nominee in a life insurance policy.

Exclusions to the Suicide Cover in Life Insurance Plan in INDIA

The terms of a life insurance plan outline the coverage to be provided. As with other clauses in insurance policies, there are some exceptions to suicide cover in the life insurance plan in India.

The insurance company will reject the claim to any maturity bonus during the following circumstances:

- Most life insurance policies have a clause that states that the company is not liable to pay if the policyholder dies by suicidal death within 12 months from the date of issue of the policy. The insurance company is not liable to pay if the policyholder's death occurs before reviving the life insurance policy.

- Life insurance policies usually provide cover for suicidal death after one year. This gap of one year helps insurance policies to confirm that there is no case of insurance fraud. If the death occurs within 12 months of the commencement of risk, then the insurance company provides a percentage of the premiums paid. For instance, if Shyam is an eligible nominee, he might be paid 70% of the premiums.

- An insurance company also needs not to pay any amount if the policy term has lapsed and the paid-up value is unpaid.

- Furthermore, the insurance company is not liable to pay if any insurance fraud is committed on the policyholder's part.

Do all Life Insurance Policies Pay for Suicidal Deaths in India?

Most insurance policies after 2014 have been upgraded with the suicide clause. This means that you will get some lump-sum compensation if you are eligible as a nominee. If the policyholder has died after the stipulated one-year period, nominees are eligible for the compensation.

Know if life insurance in India cover deaths due to COVID-19.

When are you not Eligible for Suicide Cover?

Most insurance companies have a strict rule against any misleading information given by the policyholder. In such cases, the nominee is not liable to receive any payment from the insurance company. The insurance company pays only if the policyholder has not committed any insurance fraud. Moreover, if the policyholder was insured under any group insurance policy, the nominee is not liable for any compensation.

Which Life Insurance Policies Pay Suicidal Death Cover in INDIA?

While most life insurance policies come with the suicide clause, you still need to research. Like, Canara HSBC Life Insurance provides an expansive and flexible range of insurance policies.

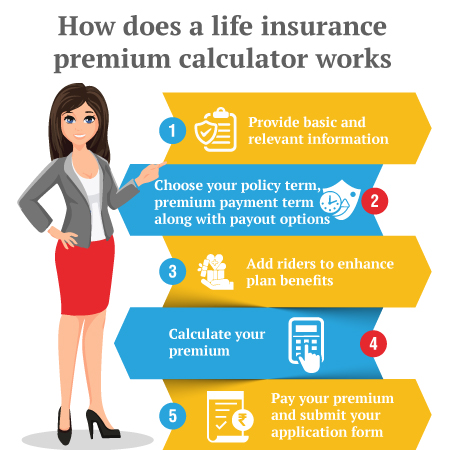

These life insurance policies are updated to include the suicide clause, provided the policy was bought before 1st January 2014. They have a premium calculator which allows you to calculate the amount to be paid.

Life insurance policies should be bought after self-assessment. You can buy a life insurance policy after factoring in your existing wealth. For instance, the iSelect Smart360 Term Plan policy by Canara HSBC Life Insurance is a viable option for middle-class families. If you are looking for a plan that can cover your spouse as well, then this term plan is your go-to option.

It has multiple payouts and protects against accidental death, disability, and suicidal death. You can also opt for Invest 4G, which is an ULIP if you want additional tax benefits for your insurance plan.

Life can be unpredictable for everyone, and depression is common. You cannot risk your family being financially incapable of things. Getting a life insurance policy is your best bet against the mercurial nature of life. With a life insurance policy, you can ensure that your family has a safe financial cushion even after your death.

Disclaimer

This article is issued in the general public interest and meant for general information purposes only. Readers are advised to exercise their caution and not to rely on the contents of the article as conclusive in nature. Readers should research further or consult an expert in this regard.

Life Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs

Popular Searches

- Term Life Insurance

- Whole Life Insurance

- Critical Illness Insurance

- Accidental Death Benefit Rider

- Compare Life Insurance Quotes

- Best Life Insurance Companies In India

- Factors Affecting Life Insurance Premiums

- Insurance For Tax Savings

- Life Insurance For Children

- Life Insurance Rider

- Life Insurance Plans

- Types of Life Insurance

- Term Life Insurance Tax Benefit

- What is Insurance?

- Life Insurance Premium