An insurance policy acts as an umbrella on a rainy day. It is a saving tool and will provide you peace of mind, and protection for your family. When it comes to purchasing a life insurance policy, there are several options. This means you need to do your homework and ensure that you not only get adequate coverage but also:

- A convenient way for your family to receive the benefits

- Safety from additional risks that may affect your earnings

- A life cover that can do a lot more for you and your family

- An insurance plan that keeps up with your life and progress

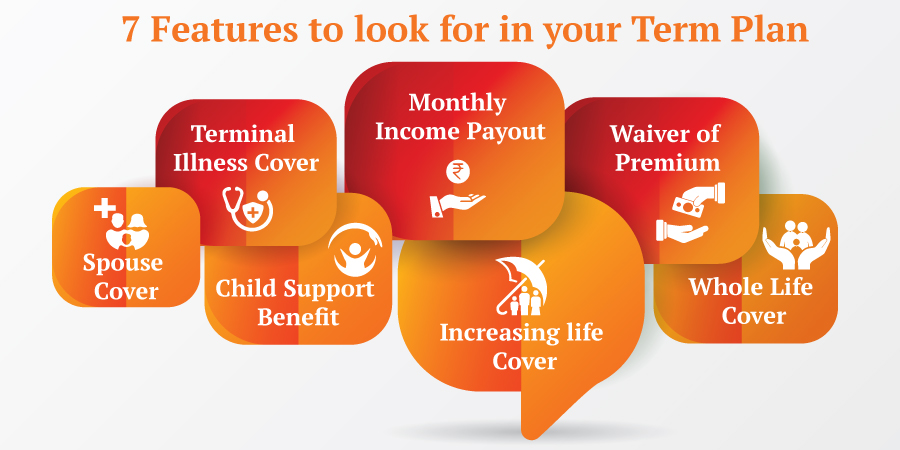

You need to carefully analyze the features offered in the policy and ensure that these 7 features are present in the one you choose to buy.

1. Regular Income as Policy Pay-Out

Choose a plan that not only provides a lump sum amount but also offers a regular monthly income to your family. Why monthly income you might ask. Here’s a scenario that should help you understand the importance of the monthly income as a life insurance claim pay-out:

Your household expenses run on a monthly budget. So far as you are there to provide the budget, your household is running smoothly. But, imagine if you are not there to assign that household budget out of your income.

You might say that the family will still have a large sum from the life insurance policy. Technically yes, but they not only need to run the household out of this pool, but they also need to ensure the following:

- They don’t end up exhausting all the money too quickly

- Meet all the future goals

- Don’t compromise too much on the lifestyle

- Keep tax liabilities to a minimum on the interest

These are not easy questions to answer, and even many financial and investment experts may falter at times. Plus, if you want to convert a part of the pool to ‘safe’ regular income, you need to get an annuity plan from a life insurer.

So, in a way, unless your family receives the regular income from a life insurer, they’ll need to invest a part of the pool back with the insurer. The regular payout directly as life insurance proceeds can help fill the gap and save your family unnecessary efforts.

Additionally, you can also choose increasing monthly income instead of fixed, which will help the family, beat inflation in the long run.

2. Premium Waiver

There are situations in life which may not be as bad as ultimate death, but they are nonetheless financially devastating. For example, disabilities, temporary long-term disabilities are damaging enough for your earnings. But permanent total disabilities, like loss of both legs or hands or other limbs, can change your life forever.

However, in this situation, you would want your life cover to continue as is and not compromise your family’s financial safety. The premium waiver is one such feature, which helps you continue the life cover in case of permanent total disability, without paying premiums.

The iSelect Smart360 Term Plan from Canara HSBC Life Insurance offers this feature as an add-on benefit.

3. Increasing Life Cover

Much like any other needs, lifestyle and income, your life cover needs also grow, at least so far as your family and lifestyle keep growing. There are only two ways to keep your life cover adequate for your family over time:

- Buy a new life cover each time there’s a significant change in the need

- Increase the life cover in your existing life insurance policy

If you have bought a term life cover previously, you know how tedious it could be to get a new policy. It is an exercise you would not like to repeat every few years. Obviously, for the second option to happen, your policy should have the feature to allow you the same. Canara HSBC Life Insurance Company’s flexible term insurance plan has two options to help you match your life cover with your growing needs:

- Life-stage increments

- Increasing life cover at 5% simple annual rate: Life-stage increments allow you to increase your cover at crucial life moments like marriage and childbirth. Both the events mark a significant increase in your financial responsibilities, giving you the chance to keep up your life cover without having to go through the entire application and underwriting process again.

Otherwise, you can opt to increase your life cover by 5% every year. The increments will continue until the sum assured has doubled or you reach 60 years of age. This option would be more useful if you are buying term insurance when you already have a family with children.

4. Insurance Against Terminal Diseases & Disabilities

We have discussed in the second point above about disabilities which can affect your income. But disabilities are just one of the risks you can insure against, life-threatening diseases, accidental death are others.

All three risks not only affect your income but also increase your expenses:

- Treatment cost for life-threatening diseases like cancer, heart or kidney failure

- Hospital expenses and medical bills during recovery after an accident

- Modifications to life, home and vehicle after a disability

The insurance covering you and your family from these costs will help you sail through such difficult times, at least without financial worries.

5. Child Support Benefit

With all-inclusive plans like the iSelect Smart360 Term Plan, you don’t have to worry about your child’s future too. Child support benefit is an added sum assured for the benefit of your child. The amount is separate from the life cover or any other benefit added to the plan. The policy pays this amount under death or critical illness claims.

Child support benefit amount can be directly invested towards children’s goal, and it takes away another challenge of investment. Your child’s goals will be safe with this addition in place, regardless of what happens with the other benefit payouts.

6. Cover for the Homemaker

The spouse who brings order to your home and looks after the family, at times sacrificing her own needs and wishes, has immense financial value. If she goes away and can no longer look after the house and children, you will need additional support to look after growing children and their needs.

Then why not have a life cover for her as well. Since the cover for a homemaker is based on a portion of household and other costs, it is significantly lower than your life cover. Still, large enough to have either a separate term life cover or jointly with you.

7. Whole Life Cover to Leave a Legacy

The need for life cover happens to grow in the first half of your earning life, while it falls rapidly in the later stage of the second half. But unless you have opted for return of the premium at the expiry, all the premiums go down the drain if you survive the term.

But you can do more than just receive your premiums back at the expiry of term life cover. The iSelect Smart360 Term Plan from Canara HSBC Life provides the option to receive the premiums back at 60 and continue the cover until the age of 99.

Basically, allowing you to gift a financial estate to your grandchildren, and leave a legacy for them.

The right insurance policy can be aligned with your financial needs and it will allow you to design your financial safety nets. Consider the financial needs of your family and factor inflation. It will ensure that your loved ones lead their life in comfort without any financial worries.

The iSelect Smart360 Term Plan is a highly flexible plan with all the features you need to ensure sufficient financial safety and ease of life for your family. You can also enjoy a discount on premiums for a higher sum assured and adding a few of these benefits to your policy.

Life Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs

Popular Searches

- Term Life Insurance

- Whole Life Insurance

- Critical Illness Insurance

- Accidental Death Benefit Rider

- Compare Life Insurance Quotes

- Best Life Insurance Companies In India

- Factors Affecting Life Insurance Premiums

- Insurance For Tax Savings

- Life Insurance For Children

- Life Insurance Rider

- Life Insurance Plans

- Types of Life Insurance

- Term Life Insurance Tax Benefit

- What is Insurance?

- Life Insurance Premium