Vaibhav was an avid investor. He was very good at planning and was very serious with his financial goals. While he was single and started his job, he planned and started investing for his wedding goal. After marriage, he planned and started investing for the family’s future goals.

However, from the risk management side, he was not very confident with the options available to him. He understood that he can always save and build financial assets for the future, but it takes time and in case anything happens to him in that period, his family could suffer despite his best efforts.

During the early days his accumulated wealth will not be enough for the family to survive in case of his early demise. Therefore, he chose to go the life insurance way. It was difficult for Vaibhav to think about death and disability but planning for it was also important. He wanted to build enough corpus so that his family can survive and fulfill all their goals even if he wasn’t around to do the same. This is when he came across the concept of insurance.

Life Insurance to Build an Emergency Cushion

He could see that life insurance, or more specifically the term insurance, can build the kind of corpus he was looking for his family. He noticed that he can buy adequate life insurance cover for his family at a pocket-friendly price with the help of a term insurance plan.

For instance, if he were to replace his income for the family for the next 30 to 40 years, he needed at least 10-15 times of his annual income in the bank account. 15 times of his annual take-home income came about Rs. 1.5 Crores. He could secure a term insurance plan with a life cover of Rs. 1.5 Crore for just Rs. 15,000 a year. And the cover will continue till his retirement.

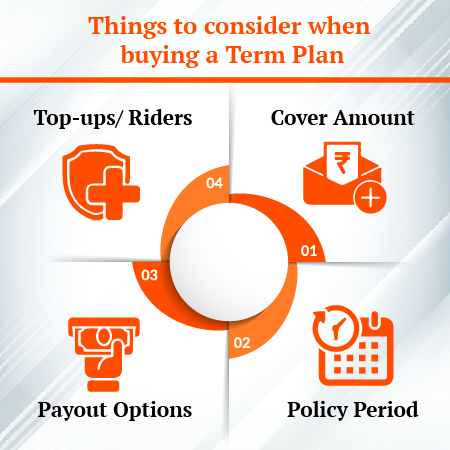

But Vaibhav wanted more than just a basic life cover; after all, it was about his family secure future!

Finally, Vaibhav decided to buy a term life insurance policy. However, he was still worried about how his family will handle the large corpus after his demise. Will they be able to invest and use it wisely? While enquiring, he came across different payout option which life insurance companies are offering these days.

He listed down some of his major concerns about the term insurance coverage and why he felt that a basic life cover wasn’t enough:

- Physical and mental disability due to an accident can be as financially devastating for the family as untimely demise

- What if he falls ill with cancer or suffers heart failure or other life-threatening illnesses? He will not only need a large sum for treatment but may lose income for the time being. Additionally, many such illnesses may leave him incapacitated partially.

- How will his family know how much of the claim money to convert to income and how much to save for a long-term goal?

- How quickly can his family receive the claim payout?

So, do life insurance policies in India offer any solutions to his concerns? Yes, they do!

Extra Protection with Term Life Insurance Plans

He quickly found that some of the best life insurance policies like the iSelect Smart360 Term Plan try to resolve these issues with additional features and benefits. Some of the added benefits he found to answer his concerns were:

- Accidental Death & Disability Benefit: This added benefit increases the death benefit in case of death due to accident. However, death is not the only hazard in an accident. Disability total or partial can affect the income. Hence, the cover also pays a lump-sum to the family in case of disability as well.

- Critical Illness Benefit: This benefit provides assistance upon diagnosis of any critical illness it covers. Similar to the accidental rider, this benefit also, pays out the benefit sum to the family. However, this payment is regardless of the treatment result. This rider can help the family in managing the high cost of illness without disturbing their other savings.

- Premium Waiver Option: An additional feature can be activated with critical illness and accidental benefits. Premium waiver benefit ensures that in case of your survival with a disability or after critical illness, your life continues without you having to pay any premiums.

What About the Income Need of the

One of the major concerns Vaibhav raised was about his family trying to build an income stream from the life insurance corpus. Term plans like Canara HSBC Life’s iSelect Smart360 Term Plan have a ready solution for this problem.

While lump-sum Payout is the default option available in all term plans, iSelect Smart360 Term Plan allows you to divide the lump sum benefit into (a) Corpus for regular income payment and (b) Corpus for Lump sum payment.

The insurer will use the corpus for regular income to provide the family with a monthly income at the time of claim. You can also estimate how much income they can receive based on the factors provided in the policy document.

So, divide the corpus accordingly and make sure your family can have adequate monthly income along with a large corpus for their future financial goals.

How Long Does the Income Last?

You can choose the duration at the time of buying the policy. In the case of iSelect Smart360 Term Plan, the plan allows for a minimum of 10 years and can continue paying the income for up to 40 years. If you feel this may not be enough, you need to ensure that the lump sum payment is large enough to allow a retirement corpus for your spouse.

Life Insurance for Peace of Mind

Regular monthly income or part lump-sum and part monthly income options are few which can provide peace of mind to the insured and family members as well. While regular income offers the comfort of running the household, lump-sum payment helps the family’s bigger goals.

Thus, the family can maintain the same lifestyle and does not compromise on education or other necessary expenses. Having a life insurance plan with enough cover and riders is always recommended. If planned properly, the riders and features of the plan can make life a lot easier for your family. So, make sure to foolproof your life insurance plan with different riders which can help an insured in case of any illness or disability.

Life Insurance - Top Selling Plans

We bring you a collection of popular Canara HSBC life insurance plans. Forget the dusty brochures and endless offline visits! Dive into the features of our top-selling online insurance plans and buy the one that meets your goals and requirements. You and your wallet will be thankful in the future as we brighten up your financial future with these plans.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Fixed Returns, Zero Risks & Worries

- 4 Plan options

- Life cover + Guaranteed benefits

- Accidental death benefit

- Premium protection cover

Recent Blogs

Popular Searches

- Term Life Insurance

- Whole Life Insurance

- Critical Illness Insurance

- Accidental Death Benefit Rider

- Compare Life Insurance Quotes

- Best Life Insurance Companies In India

- Factors Affecting Life Insurance Premiums

- Insurance For Tax Savings

- Life Insurance For Children

- Life Insurance Rider

- Life Insurance Plans

- Types of Life Insurance

- Term Life Insurance Tax Benefit

- What is Insurance?

- Life Insurance Premium