Buying a term insurance policy helps you protect your family against financial instability if something happens to you. You can opt for a significant amount of coverage (or Sum Assured) under a term plan by paying lesser premium than other life insurance plans. The availability of coverage and associated premium amount, however, depends upon various factors such as your age, annual income, and most importantly, your lifestyle and health status.

Insurance companies require applicants to take a complete body medical examination for term insurance before issuing a term insurance policy with a high sum assured. This is applicable for both traditional term insurance plans and term insurance for spouse cover. Here is why undergoing a medical test can be necessary while buying term insurance.

When is term insurance medical test mandatory?

Undergoing a medical test for term insurance coverage is mandatory, in either or both of the cases mentioned below –

- Your age is above 35 years

- You have chosen a sum assured of Rs 10 lakhs and above

There are some term insurance policies, which do not require you to undergo a medical examination for term insurance, up to the age of 40 or 45 years. Insurance companies may similarly provide relaxation for term insurance medical test requirements for applicants aging less than 45 years and for coverages up to Rs 20 or 25 lakhs.

However, if you have any pre-existing illness, family history of health or hereditary conditions, the insurers would require you to take a medical test for term insurance, irrespective of your age and opted sum assured. Overall, the requirement of term insurance medical tests is subject to the underwriting policies of the insurer. You should, therefore, go through the medical grid of the insurance company to determine the age and sum assured for which a term insurance medical test is mandatory.

What is the need for medical tests for purchasing term insurance?

Insurance companies assess your health status to determine whether you have any existing health condition or history of medical issues, which might later increase the probability of a claim. In case you have any health issues that may increase your chances of premature demise, the insurance company may increase the premium payable, put restrictions on the sum assured, or even reject your term insurance proposal, based on your medical test results.

On the other hand, if your health is normal, the insurance company may offer insurance coverage without additional terms and conditions. Term insurance plans require medical test reports to verify the information provided in the application. These reports help the insurance company estimate your risk profile before deciding the available coverage and the applicable premium.

Which tests are included in the medical examination for term insurance?

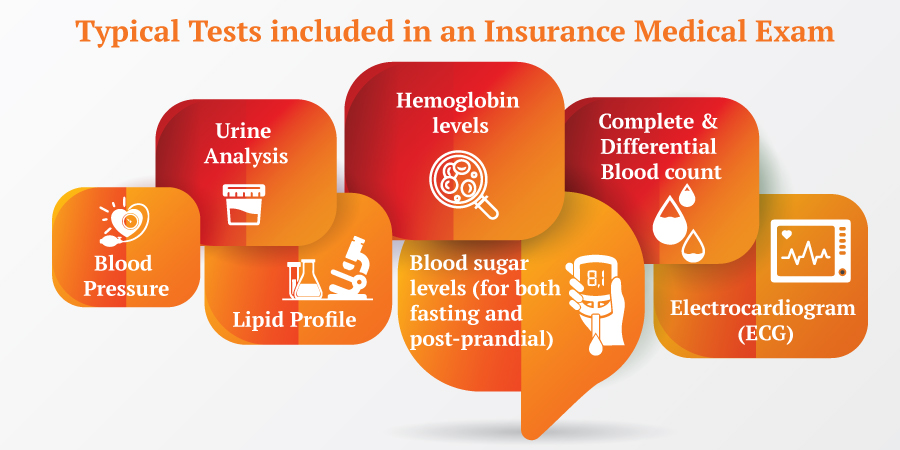

The applicability of medical tests at the time of purchasing term life insurance varies from one case to another – depending upon the declarations you have made in the insurance application. The routine medical examination comprises basis measurements of body weight, height, and body mass index (or BMI), along with the following –

Subsequently, as the age of the applicant and the sum assured increases, the medical examination required may comprise additional tests such as the treadmill test, Electroencephalography (EEG), HIV I & II, hormonal and cholesterol assays. Further tests may be required in case you have a medical history of health ailments such as diabetes and hypertension, or if you have any addictions.

Click here to Use - Online BMI Calculator

What are the benefits of having medical tests for term insurance done?

Undergoing medical tests before buying a term insurance plan comes with the following benefits –

1. No claim rejection

Term life insurance claims are usually rejected because of the discrepancies found in the personal information provided when buying the policy. When you undergo a medical test before purchasing a term life insurance policy, you are absolved of this potential rejection. The medical test reports serve as proof of your fitness and support any claim approval that might arise later.

2. Affordable premiums

Term insurance policies, which do not require a medical test, usually come with heftier premiums to cover the risk of the unknown. The primary purpose of the insurance company here is to determine the amount of premium payable based on risk perception and for the desired term plan coverage. If your health is normal, you will be eligible to lower rates of premium. In case you have any pre-existing health conditions, you may have to pay a higher amount of premium than a healthier individual.

3. Higher Sum Assured

Traditionally, term insurance plans that require you to undergo a medical examination offer higher assured and coverage to healthy individuals. The sum assured is the guaranteed term insurance benefit paid to your family in case of your unfortunate demise within the term plan coverage period.

At Canara HSBC Life Insurance, our requirement for medical tests varies from case to case. If you are looking to opt for comprehensive term insurance coverage and wonder if you would need to undergo a medical examination, feel free to connect with our team of life insurance specialists and discuss your queries.

Term Insurance - Top Selling Plans

Canara HSBC Life Insurance offers online term insurance plans to secure your family financially in your absence.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Family Shield: Enhanced Protection

- Affordable prices

- Multiple premium payment option

- Get Tax benefits

- Hassle-free purchase process

Recent Blogs

Popular Searches

- Types of Term Insurance

- iSelect Smart360 Term Plan

- Term Insurance Plan

- 1 Crore Term Insurance

- 2 Crore Term Insurance

- 5 Crore Term Insurance

- Single Premium Term Plan

- Term Insurance Calculator

- Canara HSBC Life Insurance Young Term Plan

- Term Insurance Tax Benefit

- Term Life Insurance Vs Life Insurance

- Term Insurance For 50 Lakhs

- Zero Cost Term Insurance