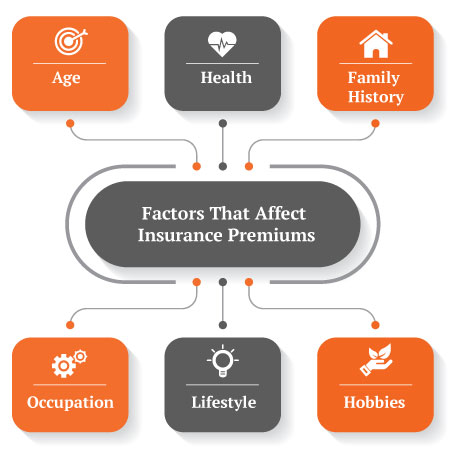

nsurance premium refers to a specific amount to be paid periodically by the insured individual to maintain their insurance coverage, as calculated by the insurance company. For deciding the premium amount, an insurance company examines the type of life insurance coverage being opted, the policyholder lifestyle and health conditions, and the likelihood of a claim being made, among other factors.

For the purpose of accurate analysis of a person’s life and premium calculation, insurance companies employ actuaries. They are responsible for analyzing the risks associated with an event or claim, and then greater the risk, higher will be the insurance premium.

The sooner you buy a term insurance, the better it is

The usual age bracket for buying a term insurance is minimum 18 years and a maximum age of 65 years. It is a well known fact that buying insurance earlier yields several benefits, including lower premiums and better coverage. This is because, with time and increasing age the risk of falling prey to illnesses increase, so does the premium amount.

Nevertheless, higher premiums do not necessarily mean you should not buy a term plan at all. When you buy a term plan, there may be times when your premiums are revised after your medical examination is done. The insurance company may ask you to pay an extra premium, according to your health conditions or the risks involved, but you should understand that this is a decision made after expert analysis of your profile and health conditions. Therefore, paying higher premium only means that you are closer to securing your family’s financial future.

Take this increase in premiums in a positive manner because it will help you prepare better for the risks to your health, due to conditions that may include smoking, alcohol or a high-risk lifestyle. A little extra premium can therefore go a long way in securing your loved ones, and relieving you from the stress.

Paying insurance premiums

There are several options offered in terms of premium payment against your policy. Policyholders can usually pay the insurance premium in installments on a monthly, quarterly, half-yearly or annually. This premium payment frequency is called the Premium Payment Mode.

Then there is a Premium Payment Term, which determines the duration for which the premium needs to be paid, or number of installments. For the iSelect Smart360 Term Plan, besides payment throughout the duration of the policy, you can choose a single bullet payment for entire policy duration or opt to pay for a limited duration of 5/10/15/20/25 years.

In addition, the plan also lets you choose a Limited Premium Payment Term Option, wherein you pay only during your working years, that is, till you turn 60 years old, while the insurance cover continues to run even after that.

What happens when you fail to pay the premiums? When the policyholder fails to pay a premium by its due date, it causes the life insurance policy to go into a grace period. Grace period is the extra time given to your after a missed premium payment, before the policy finally goes into a lapse. If no premium is payed even during the grace period, the life insurance policy will lapse, causing the policy benefits to discontinue.

Therefore, a term life insurance premiums must always be made by the due date or the policy may lapse.

What happens to the paid premiums if you don’t make a claim?

In case of a term insurance, you cannot ask for a return of your insurance premiums if you don’t make a claim during the policy term. That is the part which makes it even more important to understand your premium. However, if you ever require making the claim, all your premiums will be worthwhile. However, in term insurance with Return of Premium option, the company returns the total premiums paid by you at maturity, in case you outlive the policy term.

Term Insurance - Top Selling Plans

Canara HSBC Life Insurance offers online term insurance plans to secure your family financially in your absence.

Family Shield: Enhanced Protection

- 3 Plan options

- Life cover till 99 years

- Steady income benefit

- Block your premium at inception

Start Young, Pay Less, Stay Secured

- Life cover till 99 years

- Coverage for spouse

- Block your premium rate

- Covers 40 critical illness

Family Shield: Enhanced Protection

- Affordable prices

- Multiple premium payment option

- Get Tax benefits

- Hassle-free purchase process

Recent Blogs

Popular Searches

- Types of Term Insurance

- iSelect Smart360 Term Plan

- Term Insurance Plan

- 1 Crore Term Insurance

- 2 Crore Term Insurance

- 5 Crore Term Insurance

- Single Premium Term Plan

- Term Insurance Calculator

- Canara HSBC Life Insurance Young Term Plan

- Term Insurance Tax Benefit

- Term Life Insurance Vs Life Insurance

- Term Insurance For 50 Lakhs

- Zero Cost Term Insurance